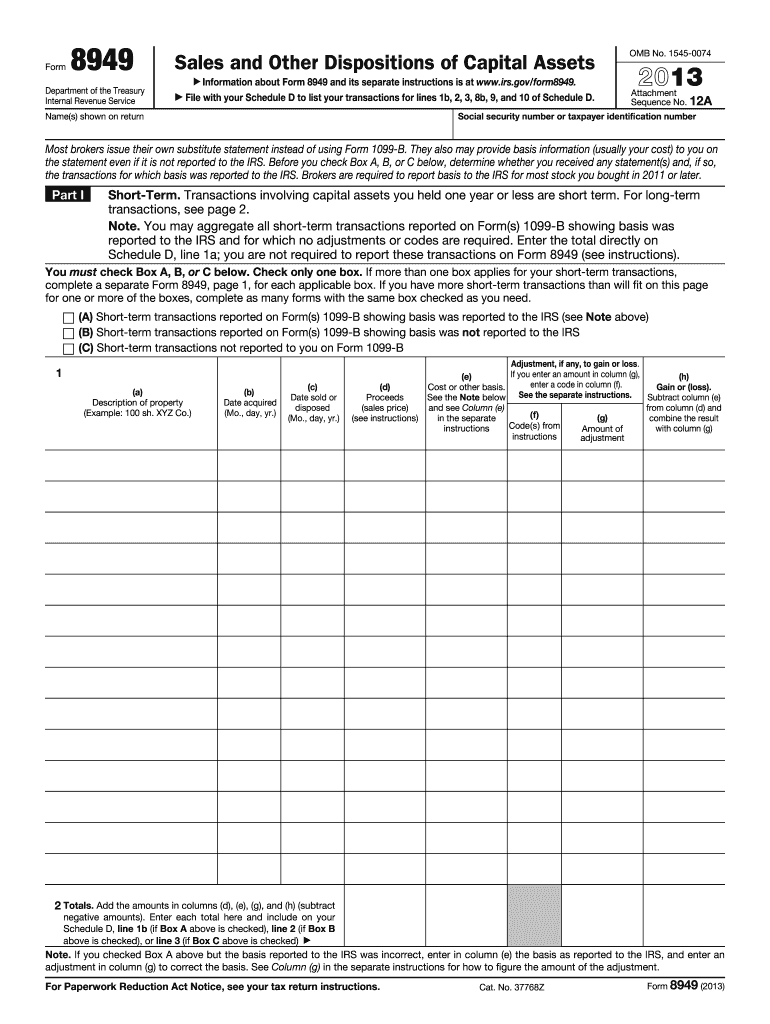

Definition and Purpose of Form 8949

Form 8949, utilized by the Internal Revenue Service (IRS), serves to report sales and other dispositions of capital assets. This tax form is essential for documenting short-term and long-term capital transactions, providing detailed information about each asset's sale or exchange, including acquisition and sale dates, sales proceeds, and cost basis. The correct completion of Form 8949 ensures accurate calculation of capital gains or losses, which are then reported on Schedule D of the tax return. By detailing these transactions, taxpayers can verify and substantiate their income and ensure compliance with federal tax regulations.

Steps to Complete Form 8949

Collect Necessary Documentation

- Gain Access to Financial Records: Gather all relevant documents reflecting capital transactions, such as 1099-B forms from brokers, transaction reports, and supplementary records of basis adjustments.

- Organize by Transaction Type: Segregate short-term transactions, held for one year or less, from long-term transactions, held for more than one year.

Execution of Form 8949

- Input Transaction Details: For each sale or exchange, enter a description, acquisition date, sale date, sales proceeds, cost basis, and any necessary adjustments.

- Selection of Appropriate Box: Identify whether the basis information was reported to the IRS and tick the suitable box on the form to denote this.

- Calculate Totals: Compile the figures into aggregated totals that will be transferred to Schedule D, differentiating between short-term and long-term categories.

Obtaining the 2013 IRS Form 8949

Taxpayers can obtain Form 8949 from several sources to ensure they have everything necessary for an accurate filing. The IRS website offers digital downloads for individual use, saving the need for acquiring physical copies. Local IRS offices provide printed copies by request, a useful approach for individuals without steady internet access. In addition, professional tax preparation software often includes integrated versions of Form 8949 within their platforms, facilitating both the completion and electronic filing processes.

Important Terms and Concepts Related to Form 8949

Capital Assets

- Definition: Include stocks, bonds, real estate, and other properties held for investment or personal use.

- Implications: Sale of any capital asset potentially triggers a taxable event, requiring compliance with basis calculation and gain or loss reporting.

Adjusted Basis

- Adjustments: Include costs related to improvements, depreciation, and purchase expenses to determine the asset's true cost for accurate gain or loss computation.

Proceeds

- Clarification: Refers to the gross amount received from the sale or exchange of a capital asset, pivotal for calculating taxable gains or losses.

IRS Guidelines for Proper Use

Adhering to IRS guidelines while completing Form 8949 ensures compliance and accuracy in tax filing. The instructions emphasize precise record-keeping, accurate segregation of transaction types, and full disclosure of necessary information. Following these rudimentary instructions not only secures compliance with tax laws but can also mitigate the likelihood of audits or necessary amendments resulting from errors in reporting. Consistent documentation practice is paramount for reconciling reported figures with actual market transactions.

Required Documentation for Form 8949

Filing Form 8949 necessitates thorough preparation, relying on various types of documentation. Taxpayers should collect:

- Form 1099-B: Received from a broker or barter exchange reporting annual proceeds from sales.

- Personal Records: These may include receipts and sale confirmations to support the reported figures on Form 8949.

- Broker and Financial Statements: Contain monthly or quarterly transaction summaries often utilized for verifying assets' acquisitions and sales.

Penalties for Non-Compliance

Filing inaccuracies or failure to submit Form 8949 may result in penalties ranging from late payment fees to more severe consequences like interest charges or potential audits. The IRS enforces these measures to uphold filing consistency and accuracy among taxpayers. Awareness and adherence to deadlines mitigate these risks significantly.

Eligibility Criteria and Who Uses Form 8949

Form 8949 is predominantly used by U.S.-based taxpayers who have disposed of capital assets and must report capital gains or losses. This includes:

- Individual Investors: Engaged in stock trades or real estate sales.

- Business Entities: Including corporations and partnerships that have transactions affecting capital assets.

- Estate Trustees: Responsible for managing and reporting sales from inherited assets.

Taxpayers involved in any capacity with capital asset disposition throughout the tax year are required to use Form 8949 to comply with filing directives.