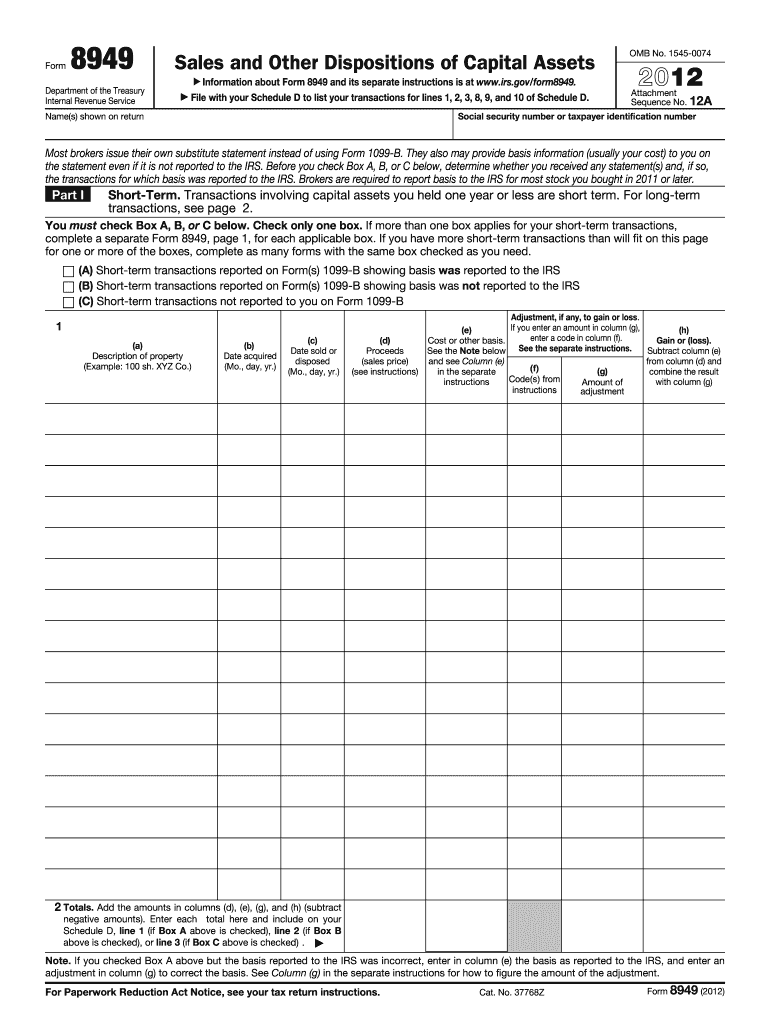

Definition and Purpose of the 2 Form

Form 8949 is used by the IRS for reporting sales and dispositions of capital assets, such as stocks and real estate. The 2012 version continues this function by requiring taxpayers to categorize transactions based on the holding period of assets, distinguishing between short-term and long-term gains and losses. This differentiation is crucial since it influences tax rates applied to capital gains. The form captures detailed information about each transaction, including the description of the asset, acquisition date, sale date, proceeds received, and any necessary adjustments.

Steps to Complete the 2 Form

-

Categorize Transactions: Start by determining whether each asset's holding period falls under short-term (held for one year or less) or long-term (held for more than one year). This categorization will decide the relevant section on Form 8949 you need to complete.

-

Provide Transaction Details: Fill out descriptions for each asset, including acquisition date, sale date, amount realized, and the cost or other basis. Adjustments, if needed, should be clearly noted and justified.

-

Check Appropriate Boxes: The form includes boxes to indicate whether the basis was reported to the IRS and whether adjustments have been made. Selecting the right options is crucial for accurate reporting.

-

Calculate Totals: For both short-term and long-term transactions, aggregate the proceeds, basis, and adjustments. The totals should then be transferred to Schedule D of your tax return for final computation of capital gains tax.

Important Terms Related to the 2 Form

- Short-Term Capital Gains: Assets held for one year or less; typically taxed at higher ordinary income rates.

- Long-Term Capital Gains: Assets held for more than one year; benefit from lower tax rates.

- Basis: The purchase price or initial investment in the asset, which is used to calculate capital gain or loss.

- Adjustment Codes: Indicate specific circumstances requiring a change to the calculated gain or loss, such as a wash sale.

How to Obtain the 2 Form

The form can be downloaded directly from the IRS website, ensuring you have the most accurate and up-to-date version. Alternatively, it may be included in the tax-filing software packages like TurboTax or QuickBooks, which facilitate the preparation of this form through guided processes.

Why Should You File the 2 Form

Filing Form 8949 accurately is essential for ensuring your capital gains and losses are properly reported to the IRS, thereby avoiding potential penalties or reassessments. The form helps in calculating the correct amount of tax due on such transactions, leading to compliance with federal tax laws.

Legal Use and Compliance

The 8949 form is a legal document required by the IRS for certain taxpayers. Failure to file it accurately and on time can result in penalties. Understanding its role within the broader context of tax reporting helps maintain compliance and avoid legal consequences.

IRS Guidelines for Completing the Form

The IRS provides specific instructions for the 8949 form to ensure clarity and reduce errors. Taxpayers must adhere to these guidelines, including accurate classification of transactions and correct use of adjustment codes when applicable. The instructions help in aligning the form submission with tax regulations, facilitating smoother processing and evaluation by the IRS.

Filing Deadlines and Important Dates

Form 8949 must be included with your annual tax return, which is due by April 15th of the year following the tax year in question, unless an extension has been filed. Staying aware of this deadline is crucial for timely submission and avoiding penalties associated with late filing.

Form Submission Methods

Forms can be submitted electronically via e-file systems provided by the IRS, through compatible tax software, or by mailing paper forms directly to IRS addresses as specified in the filing instructions. Electronic submission is strongly recommended for faster processing and confirmation of receipt.