Definition & Meaning

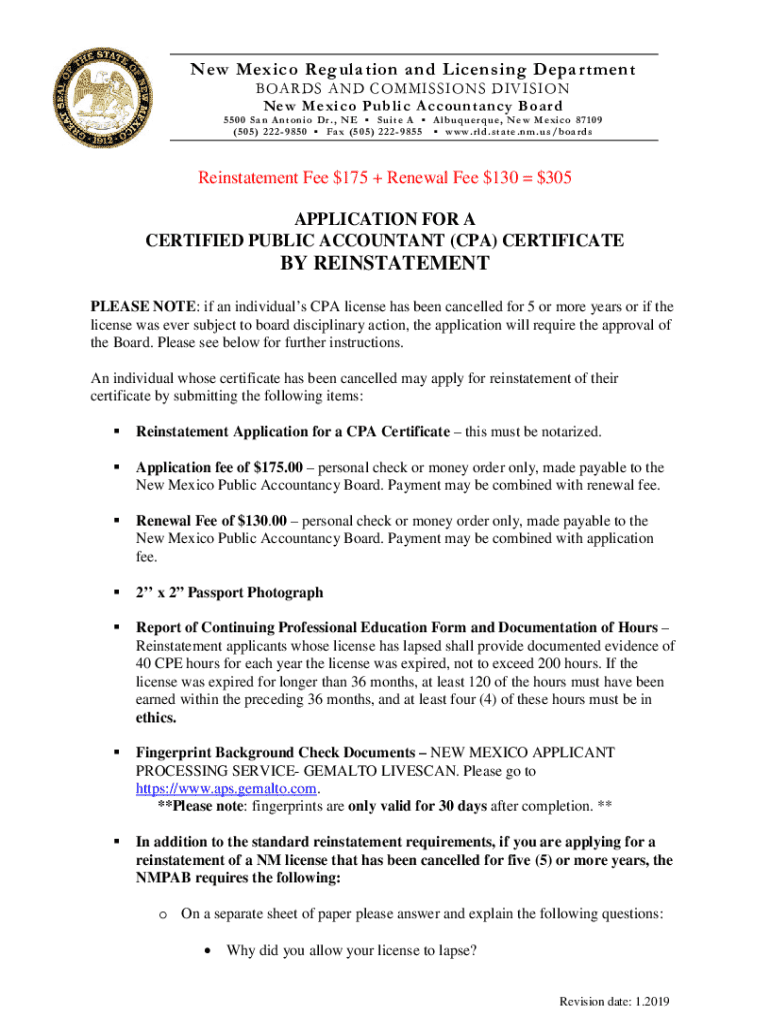

An "Application for a Certified Public Accountant (CPA) Certificate by Reinstatement" is a formal request submitted by individuals seeking to reactivate their CPA credentials after a period of inactivity or lapse. This application is essential for professionals who have previously held a CPA certificate but lost their active status due to non-compliance with ongoing educational or professional requirements. Successfully reinstating a CPA certificate allows accountants to legally practice and offer their services within their jurisdiction once again.

Steps to Complete the Application for a Certified Public Accountant (CPA) Certificate by Reinstatement

-

Review Eligibility Requirements: Ensure you meet all the conditions required for reinstatement in your state. These often include fulfilling continuing education credits that were missed during the inactive period.

-

Gather Required Documents: Collect documentation that demonstrates compliance with educational and ethical standards, such as proof of completed continuing education courses, professional experience, and any other state-specific requisites.

-

Complete the Application Form: Fill out the application thoroughly. This includes personal information, details about previous licensure, and sections pertaining to the fulfillment of reinstatement prerequisites.

-

Pay Applicable Fees: Submit the necessary payment to cover application processing costs. This fee varies by state and may be non-refundable.

-

Submit the Application: Use state-specified methods to send in your completed application along with supporting documents and the fee. This could be done online, by mail, or in person, depending on state regulations.

-

Await Approval: The approval process time frame varies; prepare for possible requests for additional information or documentation.

Required Documents

-

Proof of Continuing Education: Certificates or official transcripts demonstrating completion of necessary credits since your license lapsed.

-

Personal Identification: Government-issued identification, such as a driver’s license or passport, to verify personal data.

-

Previous CPA License Details: Information about your prior CPA certificate, including any disciplinary actions taken during the inactive period.

-

Professional Experience Verification: Letters or statements from employers confirming your work experience during the inactive period.

State-Specific Rules for the Application

Since CPA governance is state-controlled, the specific requirements and processes for reinstating a CPA certificate vary. Each state board of accountancy stipulates unique criteria concerning continuing education credits, inactive periods, and reexamination necessities. Research and adhere to the specific regulations applicable in your jurisdiction to ensure a successful application.

Application Process & Approval Time

The reinstatement process includes reviewing documentation, evaluating continuing education, processing fees, and assessing any outstanding ethical issues or complaints. Approval times differ, generally ranging from a few weeks to several months, based on the state’s workload and the complexity of the individual’s application.

Key Elements of the Application for a Certified Public Accountant (CPA) Certificate by Reinstatement

-

Identification of Applicant: Personal and professional details.

-

Education and Experience: Required educational background and professional experiences.

-

Continuing Education Requirements: Verification of educational courses completed during the inactive period to meet state requirements.

-

Fee Payment Details: Information related to submitted fees for processing the application.

Eligibility Criteria

-

Prior CPA Certification: Must have previously held a CPA certificate.

-

Fulfilled Educational Requirements: Completion of required continuing education credits.

-

Good Standing: Application must be devoid of pending disciplinary actions from the accountancy board.

Penalties for Non-Compliance

Failure to maintain an active CPA license without seeking reinstatement may lead to penalties such as prohibitive fines, extended inactive periods, and the potential inability to practice certain financial services. Depending on jurisdiction, ignoring state accountancy board regulations can impede professional reputation and legal standing.

Who Typically Uses the Application for a Certified Public Accountant (CPA) Certificate by Reinstatement

This application is principally used by certified accountants who have had a lapse in their active certification status. It serves those aiming to revive their practice after an involuntary period of inactivity, such as following a career break, or after failing to meet specific continuing education requirements on time.