Definition & Meaning

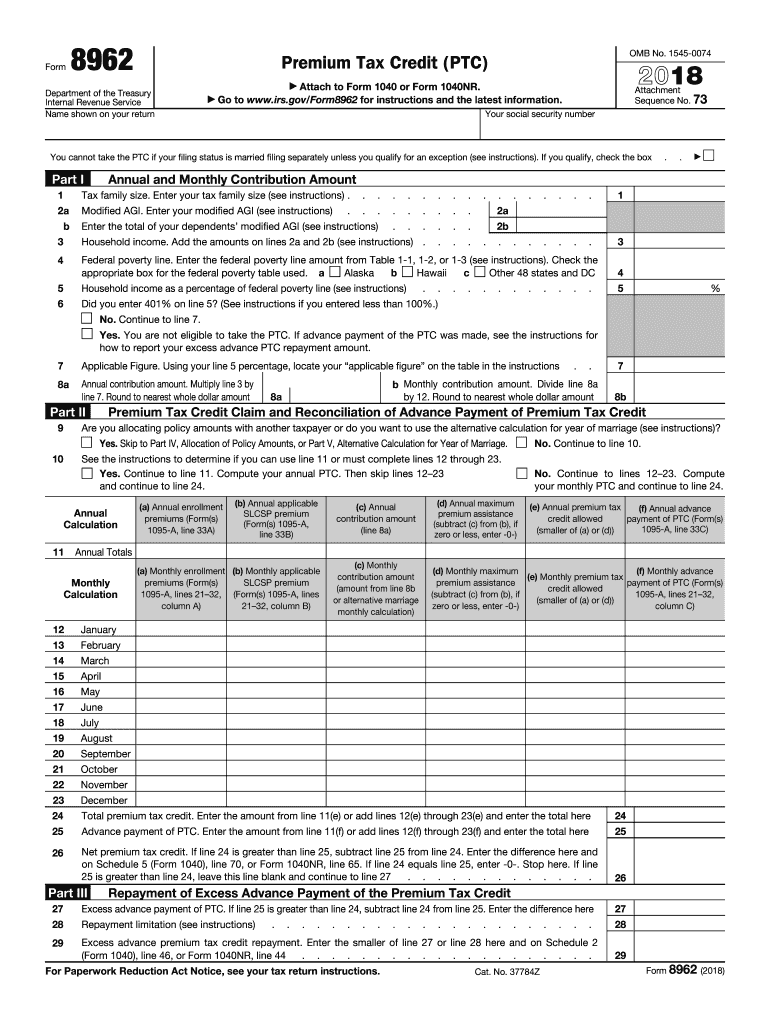

IRS ACA Form 8962, officially known as the Premium Tax Credit form, is used by taxpayers in the United States to claim the Premium Tax Credit (PTC) and reconcile any advance credit payments for individuals who have been receiving subsidies for health insurance purchased through the Health Insurance Marketplace. The form plays a crucial role in confirming the accuracy of tax credit claims based on household income and other determining factors related to healthcare coverage under the Affordable Care Act.

How to Use the IRS ACA Form 8962

Using Form 8962 involves a series of steps to ensure that the Premium Tax Credit is accurately calculated and claimed. Taxpayers need to first gather pertinent financial details such as their household income and family size. These inputs are necessary to fill out sections of the form that address annual and monthly credit calculations. The form guides users through reconciling advance premium tax credits received during the year with the actual allowed tax credits based on final income and family circumstances.

Steps to Complete the IRS ACA Form 8962

- Gather Required Documents: Collect your Form 1095-A and any other relevant financial documents.

- Provide Household Information: Input the size of your household and annualized income to determine eligibility.

- Complete the Premium Tax Credit Calculation: Use the form to compute both annual and monthly credits.

- Reconcile Advance Payments: If you received advance payments, compare them against the calculated PTC.

- Complete Allocation Sections: In situations involving shared policy payments, accurately divide the premium among responsible parties.

- Submit the Form: Attach the completed Form 8962 to your federal tax return.

Important Terms Related to IRS ACA Form 8962

- Premium Tax Credit (PTC): A subsidy that lowers the cost of health insurance premiums for individuals with certain income levels.

- Advance Payments of the Premium Tax Credit (APTC): Payments made to insurance providers to lower monthly premiums.

- Household Income: The total income of all individuals in a household, which determines eligibility for the PTC.

- Form 1095-A: A form from the Health Insurance Marketplace recording coverage details, necessary for completing Form 8962.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for the use and filing of Form 8962, ensuring taxpayers understand components such as how to calculate credits and the reconciliation process. These guidelines emphasize accuracy, urging taxpayers to strictly follow instructions to avoid errors that might affect their tax situations. The IRS also offers assistance through its website and customer service for complex issues related to the form.

Filing Deadlines / Important Dates

- Annual Tax Filing Deadline: Typically, Form 8962 must be filed by April 15, the common deadline for individual tax returns. Adjustments to this date are made if it falls on a weekend or holiday.

- Extension Opportunities: Extensions can be filed, often extending the deadline to October 15, providing extra time to ensure all documents, including Form 8962, are accurately completed.

Required Documents

Filing Form 8962 requires supporting documentation to ensure all entries are substantiated. Essential documents include:

- Form 1095-A: Lists details of insurance coverage received, which is essential for completing the form accurately.

- Proof of Income: Taxpayers need documentation like pay stubs or W-2 forms to confirm household income levels.

Form Submission Methods (Online / Mail / In-Person)

- Online Submission: Taxpayers can file Form 8962 electronically through the IRS e-file system, which is integrated with many tax preparation software platforms.

- Mail Submission: The form can also be printed and mailed alongside the taxpayer's paper tax return to the IRS.

- In-Person Assistance: Although less common, some individuals may seek assistance at IRS service centers for help with their submission.

Digital vs. Paper Version

Taxpayers are given the flexibility to choose between submitting a digital or paper version of Form 8962. The digital format, popular with e-filing services, streamlines the process and provides automated calculations for accuracy. This contrasts with the paper version, where individuals manually complete calculations, which may be preferable for those who prefer physical copies or lack digital access.