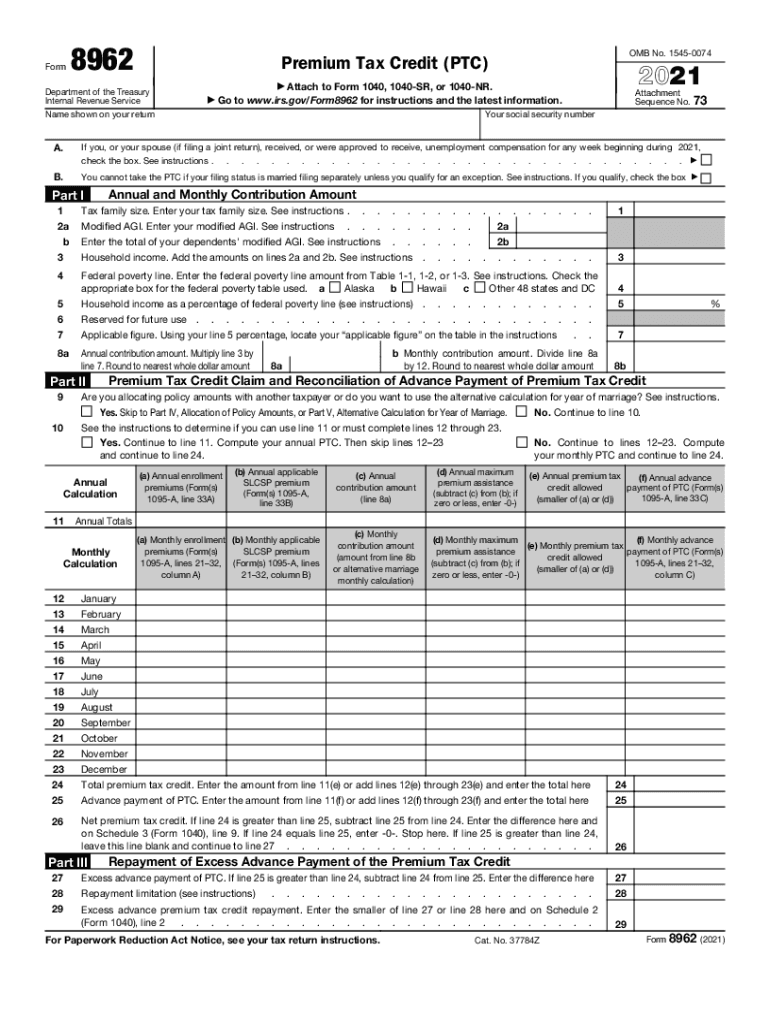

Definition and Purpose of Form 8962

Form 8962, part of the U.S. tax filing system, is integral for calculating the Premium Tax Credit (PTC). This form is used by taxpayers who obtained health coverage through the Health Insurance Marketplace. The primary objective is to reconcile any Advance Premium Tax Credit (APTC) received against the actual PTC a taxpayer is eligible for based on their annual income and household size.

Key Elements of Form 8962

Form 8962 contains critical sections designed to gather specific data for accurate PTC calculations:

- Household Income: Total annual income from all family members, crucial for determining PTC eligibility.

- Tax Family Size: The number of individuals on a tax return impacts the calculation of eligible credits.

- Premiums: The cost of health premiums paid during the tax year.

- Reconciliation: Aligns any APTC received with the actual credit due, possibly resulting in tax credits or liabilities.

Practical application involves reporting these elements accurately to either claim additional credits or repay excess credits received.

How to Obtain Form 8962

Form 8962 can be acquired in several ways to accommodate different taxpayer preferences:

- IRS Website: The most direct and up-to-date resource for downloading the form in PDF format.

- Tax Software: Many programs like TurboTax and QuickBooks automatically incorporate Form 8962.

- Tax Professionals: Accountants or tax advisors typically provide necessary forms during tax preparation.

- Local IRS Office: Physical copies can be obtained by visiting IRS offices.

Regardless of the acquisition method, ensuring the form version aligns with the current tax year is important.

Steps to Complete Form 8962

Completing Form 8962 involves a systematic approach to gather and enter the correct data:

- Gather Documents: Collect Form 1095-A, showing your Marketplace coverage information.

- Calculate Annual Household Income: Sum total income from all applicable sources.

- Enter Data: Fill in the sections based on Form 1095-A information.

- Compute PTC: Use the form to calculate the potential tax credit against received APTC.

- Reconcile Credits: Ensure all calculations are accurate to determine if additional payments or refunds are necessary.

It's advisable to cross-reference each calculation with available documentation to prevent mistakes.

Why Use Form 8962

Form 8962 is vital for taxpayers for several reasons:

- Accurate Credit Reconciliation: Ensures taxpayers pay the correct amount of taxes by reconciling APTC with eligible PTC.

- Avoid Penalties: Prevents fines from underpayment due to incorrect credit claims.

- Financial Management: Helps manage health-related expenses and taxes effectively.

- Legal Requirement: Essential for all who received APTC, adhering to IRS obligations.

Ensuring correct completion protects taxpayers from financial and legal repercussions.

Who Typically Uses Form 8962

Form 8962 is predominantly used by individuals and families who:

- Obtained Health Insurance Through the Marketplace: Specifically for those who received APTC.

- Varied Income Taxpayers: With monthly or annually fluctuating incomes affecting credit eligibility.

- Divorced or Separated Parents: In cases where children are covered under one parent, but tax filings differ.

- ETO Users: Earners with temporary or fluctuating incomes from sources like gig work.

Broad applicability across various income brackets demonstrates the form’s versatile role in tax filing.

Important Terms Related to Form 8962

Understanding terminology within Form 8962 ensures accurate compliance:

- APTC: Initial credits given based on projected annual income.

- PTC: The actual eligible credits determined after taxation.

- Marketplace: The platform through which health insurance under the Affordable Care Act is procured.

- Reconciliation: Process of aligning the APTC with the PTC to correct over or underpayments.

Familiarity with these terms streamlines the form completion process.

IRS Guidelines for Form 8962

The IRS provides specific guidelines for completing Form 8962 effectively:

- Timeliness: Submit the form with your IRS tax return by the typical April 15th deadline.

- Documentation: Maintain supporting documents, like Form 1095-A, for at least three years for potential audits.

- Form Updates: Adhere to annual updates in requirements and figures.

- Accuracy: Double-check all entries to prevent number transpositions and data errors.

Adhering to IRS protocols prevents compliance issues and potential audits.

Filing Deadlines and Important Dates for Form 8962

Key dates associated with Form 8962 ensure timely filing and reconciliation:

- January 31: Deadline for receiving Form 1095-A from the Marketplace.

- April 15: Standard due date for tax forms, including 8962, aligning with the federal tax deadline.

- Extensions: File Form 4868 for an additional six months if more time is required.

While extensions are available, they may delay any potential refunds owed once the reconciliation is complete.