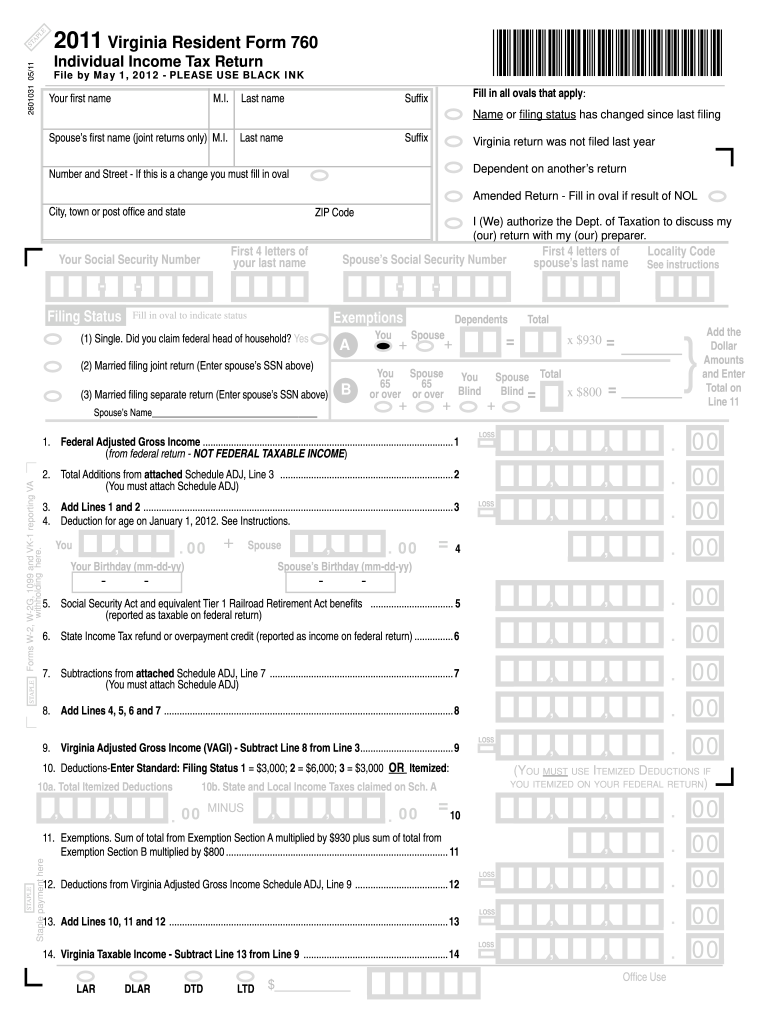

Overview and Significance of the 2011 Virginia Form 760

The 2011 Virginia Individual Income Tax Return Form 760 is a critical document for residents of Virginia to accurately report their income, deductions, and tax liabilities. This form is a primary means for individuals to fulfill their annual state tax obligations. Understanding its importance helps taxpayers navigate the complexities of state taxation and avoid potential penalties.

- Taxpayer Responsibility: Filing the form is a mandatory requirement for all Virginia residents with income that meets certain thresholds. This form ensures taxpayers comply with state tax laws.

- Personalization: The form allows for the individual's financial situation to be presented uniquely, including various exemptions, deductions, and credits applicable to the taxpayer.

- Legal Standing: Form 760 is legally binding once submitted, meaning all provided information must be accurate and truthful.

Understanding the overall significance of this document gives taxpayers insight into not only their responsibilities but also the potential benefits derived from accurately reporting their financial information.

How to Obtain the 2011 Virginia Form 760

Acquiring the 2011 Virginia Form 760 is straightforward. It is available through multiple channels, ensuring all taxpayers have access.

- Online Availability: The Virginia Department of Taxation website typically hosts downloadable PDF versions of Form 760, making it easy to access at any time.

- Local Tax Offices: Taxpayers can also obtain physical copies of the form at local tax offices throughout Virginia. This is helpful for individuals who may prefer paper forms over digital options.

- Public Libraries: Many public libraries provide copies of tax forms, including Form 760, especially during tax season.

Using these methods, taxpayers can ensure they have the correct version of the form available for their submission.

Steps to Complete the 2011 Virginia Form 760

Completing Form 760 requires careful attention to detail. Each section is designed to capture specific information necessary for accurate tax calculations.

- Personal Information: Include your name, address, Social Security number, and filing status. Accurate personal information is crucial for processing your tax return.

- Income Reporting: List all sources of income. This can include wages, self-employment income, interest, and dividends. It is important to report total income accurately to avoid penalties.

- Deductions and Exemptions: Identify potential deductions and exemptions which can lower taxable income. This may involve itemizing deductions or taking advantage of personal exemptions.

- Calculating Tax Obligation: Utilize the provided tax tables to determine the amount owed based on your taxable income. This step requires careful calculation to ensure accuracy.

- Review and File: Double-check all entries for completeness and accuracy before submitting the form. Errors can lead to delays or corrections that may incur penalties.

Taking the time to follow these steps meticulously will help taxpayers prepare their returns accurately, reducing the risk of issues arising post-filing.

Important Deadlines for the 2011 Virginia Form 760

Taxpayers must be aware of important deadlines associated with the filing of Form 760 to prevent penalties and interest charges.

- Filing Deadline: Form 760 must be filed by May 1, 2012. Taxpayers should not wait until the last minute to ensure all information is accurate and complete.

- Extensions: If additional time is needed, taxpayers may request an extension, but this does not extend the payment deadline. It is crucial to estimate and pay any owed taxes by the original due date to mitigate penalties.

- Amendments: If errors are discovered post-filing, an amended return should be submitted as soon as possible. This demonstrates a commitment to compliance and can prevent further issues.

Staying mindful of these deadlines is essential for all taxpayers to promote legal compliance and financial accuracy.

Key Elements of the 2011 Virginia Form 760

A comprehensive understanding of the key elements within the 2011 Virginia Form 760 aids in accurate completion and submission.

- Filing Status: This section determines the taxpayer's category (single, married filing jointly, etc.), which influences tax liabilities.

- Income Calculation: Taxpayers must provide total income from various sources and calculate adjusted gross income accordingly.

- Deductions and Credits: Various state-specific deductions and tax credits are available, aimed at diminishing taxable income or tax owed.

- Signature and Date: The form must be signed and dated by the taxpayer or their representative, indicating the validity of the provided information.

Each of these elements plays a crucial role in determining the overall tax liability and must be carefully addressed in the completion of Form 760.

Legal Use and Compliance with the 2011 Virginia Form 760

Understanding the legal implications of using the 2011 Form 760 ensures compliance with state laws and regulations.

- Accuracy and Honesty: All information submitted must be truthful and accurate. Misrepresentation of income or other details can lead to severe penalties.

- Retention of Records: Taxpayers are advised to retain copies of submitted forms and associated documents for at least three years. This enables proper record keeping in the event of an audit or discrepancy.

- Compliance with State Laws: Filing this form signifies agreement to comply with Virginia tax laws. Non-compliance can result in fines, interest on unpaid taxes, and potential legal action.

Understanding these legal facets of Form 760 helps to reinforce the importance of accuracy and compliance in tax reporting.