Definition & Meaning

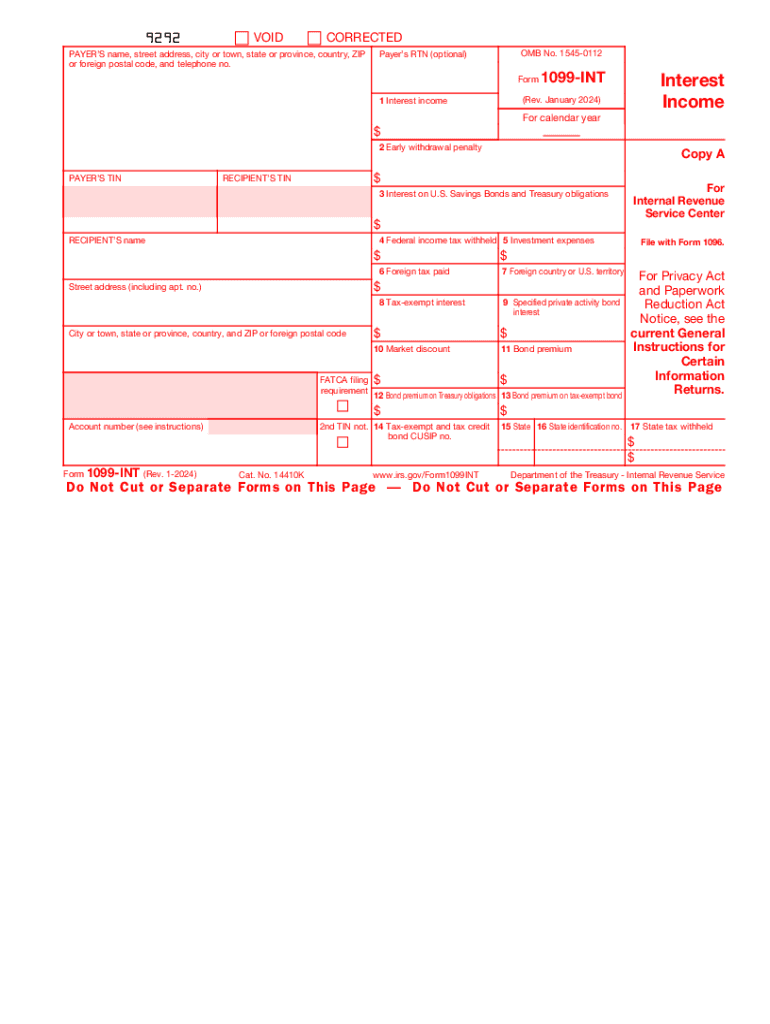

Form 1099-INT (Rev January 2024) Interest Income is an IRS tax document used by payers to report interest income paid to individuals and entities within a given tax year. Interest income may include amounts earned from savings bonds, tax-exempt bonds, interest-bearing accounts such as savings or checking accounts, and other sources. The form reflects the total interest income received by the taxpayer, which must be reported on their income tax return. Understanding this form is critical for ensuring the accurate reporting of taxable income and staying compliant with federal tax regulation.

How to Use the Form 1099-INT (Rev January 2024) Interest Income

The primary use of Form 1099-INT is to report interest income to the IRS and the taxpayer. Banks and financial institutions issue these forms to any recipients who have earned at least $10 in interest during the tax year. Taxpayers must include this information when preparing their federal income tax return. The form includes various boxes denoting different types of interest income, penalties, and federal tax withholdings, among others. By using this form, taxpayers can accurately calculate their gross interest income and ensure they are meeting all applicable tax obligations.

Understanding Box Descriptions

- Box 1: Total interest paid on savings and other interest-bearing accounts.

- Box 2: Interest penalties for early withdrawal.

- Box 3: Interest on U.S. savings bonds and other tax-exempt securities.

- Box 4: Federal income tax withheld (if any was withheld under backup withholding regulations).

Scenarios for Use

- Individuals with savings account interest

- Investors in municipal or U.S. savings bonds

- Recipients of interest from domestic and foreign accounts

Steps to Complete the Form 1099-INT (Rev January 2024) Interest Income

Completing Form 1099-INT involves a detailed understanding of the various sections and boxes. Properly filling out this form is essential to ensure compliance and avoid penalties.

- Collect Necessary Information: Gather details about the recipient, including full name, address, and taxpayer identification number (TIN).

- Record Total Interest Income: Enter the total interest earned by the recipient during the tax year in Box 1.

- Calculate Penalties (If Applicable): Use Box 2 for any applicable early withdrawal penalties.

- Include Other Interest Types: Fill in Box 3 with interest from U.S. savings bonds or other tax-exempt income.

- Document Withholding: If applicable, record any federal tax withheld in Box 4, the backup withholding amount.

Example

A bank that paid a customer $500 in interest on a savings account during the year must issue a Form 1099-INT reflecting this payment.

IRS Guidelines for Form 1099-INT

The IRS has a comprehensive set of guidelines for issuing and filing Form 1099-INT, ensuring clear communication and accurate reporting of interest income.

- Threshold for Issuance: Not required for interest amounts less than $10 unless federal tax was withheld under backup withholding mandates.

- Recordkeeping Requirements: Retain a copy of every issued form for at least three years, as it is an essential part of financial records.

- Electronic Filing: Required if more than 250 forms are submitted. Can be voluntarily filed electronically if fewer forms are filed.

Filing Deadlines / Important Dates

Adhering to specific deadlines is vital for compliance with IRS requirements.

- Recipient Deadline: Issued by January 31 following the reporting year.

- IRS Filing Deadline: Paper forms must be submitted by February 28, while electronic submissions are due by March 31.

Penalties for Non-Compliance

Failure to comply with requirements for Form 1099-INT can lead to significant penalties for the payer.

- Late Submission: Penalties may range depending on the degree of lateness and size of the business.

- Incorrect Filing: Includes errors like missing TINs or incorrect amounts, resulting in fines per incorrect form.

- Failure to Provide Form to Recipient: Additional penalties may apply if the form is not issued to the payee by the deadline.

Digital vs. Paper Version

Taxpayers and businesses may choose between digital and paper versions of the form. Digitally filed forms offer convenience and speed, while paper versions may be kept for official records.

- Paper Forms: Ideal for smaller businesses with fewer filings.

- Digital Forms: Efficient for larger enterprises required to process many forms electronically.

Benefits of Digital Forms

- Faster processing and confirmation of submitted forms.

- Reduced risk of errors and omissions through digital validation tools.

Key Takeaways for Form 1099-INT (Rev January 2024) Interest Income

Understanding and properly managing Form 1099-INT filings are vital for compliance and accuracy in tax reporting. Businesses and individuals must be vigilant about gathering proper data, meeting deadlines, and adhering to IRS guidelines to avoid potentially costly penalties. By recognizing the importance and application of this form, taxpayers can better manage their financial reporting responsibilities.