Definition & Meaning

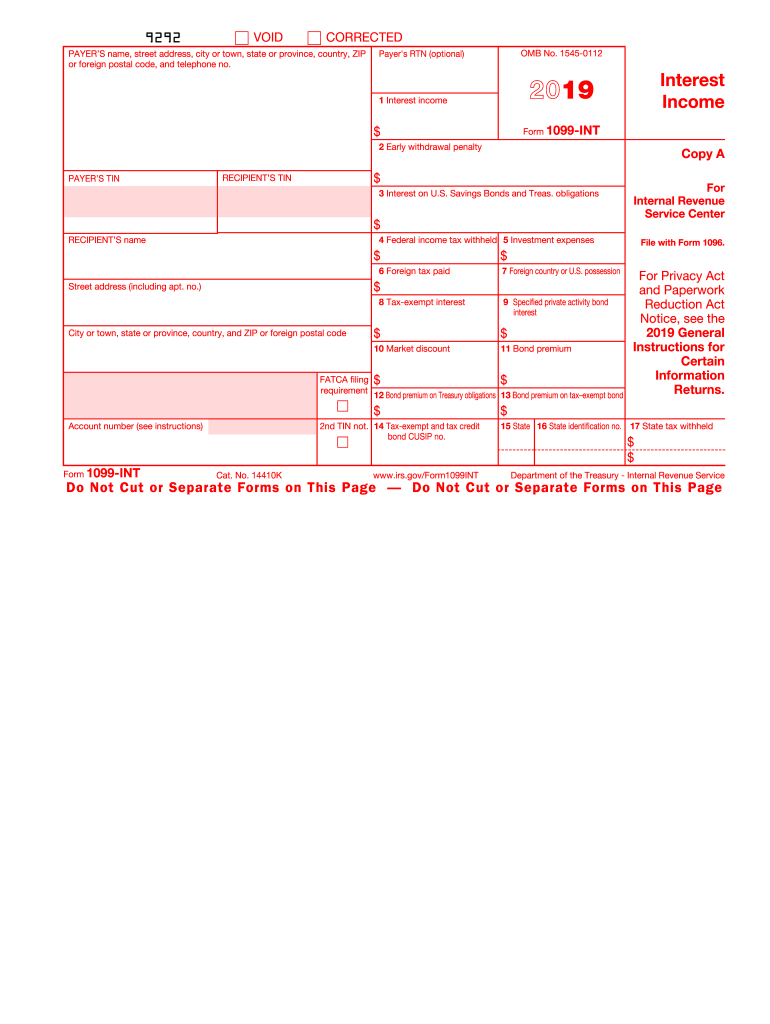

The 2020 Form 1099-INT is an IRS tax document used to report interest income. If you received interest from bank accounts, bonds, or other similar investments, this form summarizes the interest income you earned during the 2020 tax year. Financial institutions or entities that paid you interest must send you and the IRS Form 1099-INT, detailing income such as interest paid on savings accounts, certificates of deposit, or mutual funds. Correctly understanding and reporting this information is crucial for accurate tax filing and compliance.

How to Use the 2020 Form 1099-INT

You need Form 1099-INT for filing your annual federal income tax return. Here's how to use it effectively:

- Verify Information: Ensure all details are accurate, including your name, address, and taxpayer identification number. Mistakes can delay tax processing.

- Calculate Total Interest Income: Sum up all interest reported on multiple 1099-INT forms.

- Report on Tax Return: Transfer this total to your tax return, specifically on the forms recommended by the IRS, such as Schedule B if necessary.

Understanding each section of the form helps prevent errors that could lead to a revision of your return or adjustments in your tax due or refund.

Steps to Complete the 2020 Form 1099-INT

Completing your tax file with a Form 1099-INT involves a systematic process:

- Gather All Forms: Collect all 1099-INT forms received from different payers.

- Review Payer Information: Confirm each payer's name and address, which impacts the legitimacy of the reported data.

- Check the Interest Income Sections:

- Includes interest on U.S. Savings Bonds or Treasury obligations.

- Interest not fully taxable is reported in a separate section.

- Add Other Income: Factor in bond premiums, acquisition premiums, and other adjustments on the form.

- Report to IRS: Use the data while filing your tax return. Fill out any additional schedules that apply to your tax situation.

Following these steps ensures the accuracy of your tax filings and avoids potential audits or IRS inquiries.

IRS Guidelines for the 2020 Form 1099-INT

Adherence to IRS guidelines when dealing with Form 1099-INT is critical:

- Accuracy: The IRS requires that all information, especially in Box 1 (Interest Income), is accurately reflected.

- Thresholds: If interest income is less than $10, a form is generally not issued.

- Deadlines: You must report interest earnings when filing taxes by the April deadline. The deadline for companies to send this form is usually January 31st.

Awareness of such guidelines helps in timely filing and ensuring compliance with federal tax laws.

Filing Deadlines / Important Dates

Knowing the critical deadlines and dates ensures compliance:

- IRS Filing Deadline: April 15 (or the next business day if it falls on a weekend or holiday).

- Issuance of Form: Typically, forms must be mailed to recipients by January 31.

Timely filing prevents penalties or interest from accruing due to late submission of taxes.

Required Documents

To file taxes with a Form 1099-INT, prepare the following documents:

- All Received 1099-INT Forms: Gather each form from payers.

- Previous Tax Returns: Useful for comparison and verification.

- Identification Documents: Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Any Correspondence from Payers: Helps resolve discrepancies.

Having these documents at hand ensures a smooth filing process and accurate reporting.

Penalties for Non-Compliance

Failing to comply with Form 1099-INT reporting requirements can incur significant penalties:

- Late Filing: Fines accrue if forms are not submitted on time.

- Incorrect Information: Submitting incorrect information can result in additional penalties.

- Failure to Furnish Forms: Companies that neglect to provide this form to the IRS or recipient face fines.

Understanding these penalties motivates timely and accurate reporting of interest income.

Digital vs. Paper Version

Receiving and handling a 2020 Form 1099-INT can be accomplished in both digital and paper formats:

- Digital Versions: Often provided via secure online access. Advantages include ease of use, storage, and eco-friendliness.

- Paper Versions: Traditional method, mailed directly to you. Some prefer hard copies for record-keeping.

Decide based on personal preference and accessibility, while understanding that both versions serve the same reporting purpose.