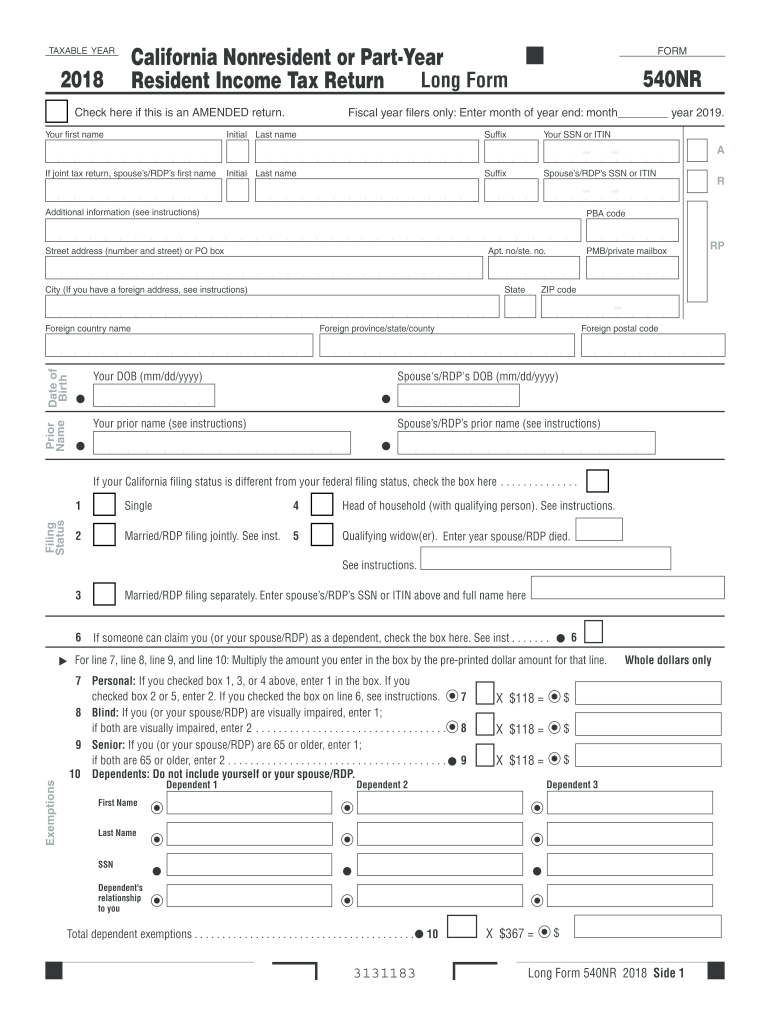

Definition and Purpose of Form 540NR

The California Nonresident or Part-Year Resident Income Tax Return, commonly referred to as Form 540NR, is designed for individuals who do not reside in California for the whole year but earn income sourced from California. This form is crucial for ensuring that nonresidents pay the appropriate taxes on income they earned while in the state. The primary objective of Form 540NR is to report income, calculate tax liability, and facilitate the accurate payment of taxes for those who qualify as nonresidents or part-year residents within California.

Understanding the definitions associated with this form is essential. A nonresident is someone who did not live in California during the tax year. In contrast, a part-year resident is someone who lived in California for a segment of the year. Both categories must report California-source income to comply with state tax regulations. By correctly utilizing Form 540NR, individuals fulfill their legal obligations while ensuring accurate tax assessments.

Who Typically Uses Form 540NR?

Form 540NR is primarily utilized by several categories of taxpayers, reflecting the diverse situations from which income can be sourced in California. Understanding these groups is key for accurately identifying whether you need to file this form:

-

Nonresidents Earning California Income: Individuals who live outside California but earn income within the state—for instance, through work, rental properties, or investment incomes—must file Form 540NR to report their California-source earnings.

-

Part-Year Residents: Individuals who moved in or out of California during the year also fall under this category. They must report all income earned while they were residents, alongside any California-sourced income earned while residing elsewhere.

-

Students and Temporary Workers: Many students attending colleges in California or temporary workers on shorter contracts may not establish residency but earn income that necessitates the use of Form 540NR.

Recognizing the varying circumstances that require filing Form 540NR ensures adherence to tax laws and avoids potential penalties for non-compliance.

Steps to Complete the Form 540NR

Completing Form 540NR demands careful attention to detail, ensuring that all necessary information is correctly documented. The process can be streamlined by following these steps:

-

Gather Your Documents: Collect all income-related documents, including W-2s, 1099s, and documentation of any income earned in California.

-

Determine Your Filing Status: Identify whether you are a nonresident or a part-year resident and choose the appropriate sections of the form.

-

Complete Personal Information: Fill in your name, address, and other requested personal details at the top of the form.

-

Report Income:

- Line A: Enter your total income (both California-sourced and any out-of-state income).

- Line B: Specify your California-source income.

-

Calculate Deductions and Credits: Utilize applicable deductions or tax credits specific to nonresidents or part-year residents as guided by the form instructions.

-

Determine Tax Liability: Follow the instruction manual to calculate your tax based on your income and applicable rates.

-

Review and Sign: Before submitting, ensure all sections are complete and accurate. Sign and date the form.

-

Submit the Form: Choose your method of submitting the form, either electronically or via mail.

By following these structured steps, you can ensure an accurate and timely filing of Form 540NR.

Important Terms Related to Form 540NR

Understanding various terms associated with Form 540NR is imperative for correctly navigating tax responsibilities. Key terms include:

-

California-source Income: This term is crucial since it refers to all income derived from California sources, such as jobs, real estate, and businesses conducted within the state.

-

Adjusted Gross Income (AGI): A critical concept in taxation, AGI is your total income after certain adjustments. For nonresidents, it is vital for tax calculation on Form 540NR.

-

Deductions: These are expenses allowed by the IRS to reduce taxable income. Nonresidents may have different deductions than residents.

-

Tax Credits: Credits directly reduce the amount of tax owed. Knowing which credits are applicable can significantly affect your tax liability.

Familiarity with these terms helps clarify filing requirements and identifies potential deductions or credits that could benefit your tax situation.

Filing Deadlines and Important Dates

Adhering to filing deadlines is essential to avoid penalties. Key deadlines related to Form 540NR include:

-

Tax Return Filing Deadline: Typically, the deadline to file Form 540NR is April 15 of the following year. For example, for the tax year 2023, the deadline is April 15, 2024.

-

Extension Requests: If additional time is needed, taxpayers may request an extension, typically allowing up to six months. However, any taxes owed must still be paid by the original deadline to avoid interest or penalties.

-

Estimated Tax Payments: Nonresidents or part-year residents earning income that is not subject to withholding may need to make estimated tax payments throughout the year. These payments are usually due on April 15, June 15, September 15, and January 15 of the following year.

Being aware of these dates is fundamental for fiscal compliance and for managing avoidance of unnecessary penalties.

Methods of Submitting Form 540NR

Form 540NR can be submitted through various methods, providing flexibility for taxpayers. The options include:

-

Electronic Filing: This method is encouraged for its speed and efficiency. Tax preparation software often includes options for completing and submitting Form 540NR electronically. Electronic filers receive confirmation of submission, making it a reliable choice.

-

Mail Submission: Taxpayers may also opt to print and mail their completed form. It is advisable to use certified mail or another tracking method to ensure that documentation has been received by the California Franchise Tax Board.

-

In-Person Submission: While less common, some individuals may choose to submit their forms in person at a local tax office. This format allows for immediate interaction with tax personnel for any last-minute questions or clarifications.

By understanding these submission methods, you can choose the best approach that fits your preferences or circumstances.

Key Elements of Form 540NR

Understanding the fundamental components of Form 540NR is essential for navigating the filing process smoothly. Key elements include:

-

Personal Information Section: This initial area requires basic details such as the taxpayer's name, Social Security number, and address.

-

Income Reporting Section: Here, all income, including adjustments and California-source income, is detailed. Attention should be given to accurately report all sources as this affects tax calculations.

-

Deductions and Credits Section: Appropriate deductions and tax credits must be accounted for to lower taxable income. Familiarizing yourself with options available specifically for nonresidents is crucial.

-

Signature and Declaration Section: The final part of the form demands a signature, affirming the accuracy of the provided information before submission.

Familiarizing yourself with these key elements helps streamline the completion of Form 540NR and reduces the risk of errors.