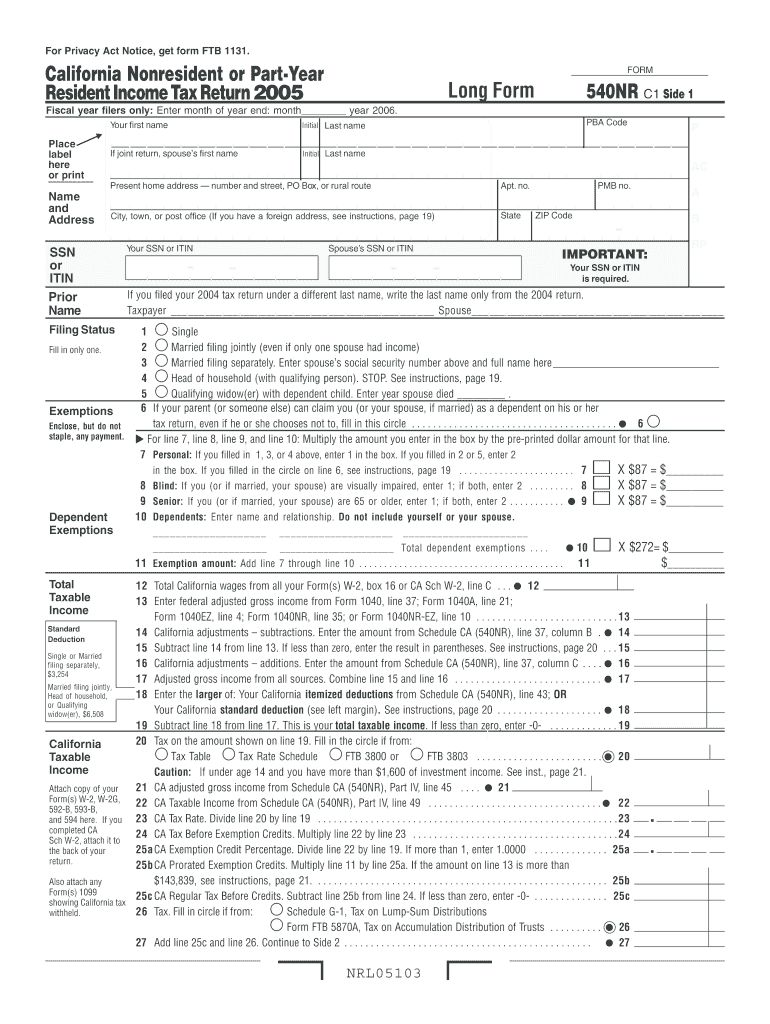

Understanding the 2005 California Nonresident or Part-Year Resident Income Tax Return (Long Form 540NR)

The 2005 California Nonresident or Part-Year Resident Income Tax Return, also known as Long Form 540NR, is essential for individuals who have earned income in California but maintain residency in another state or only lived in California for part of the year. This form is critical for accurately reporting income and calculating tax obligations to ensure compliance with California's tax laws.

Key Definitions and Terms

- Nonresident: An individual who does not maintain a permanent residence in California and spends less than nine months in the state.

- Part-Year Resident: An individual who lived in California for part of the tax year, generally encompassing those who moved into or out of the state.

- Taxable Income: Income that is subject to California state income tax, which nonresidents are required to report only from California sources.

- Form 540NR: The official tax form used to file California income tax for nonresidents and part-year residents.

Understanding these key terms can help clarify the filing process and ensure that individuals are aware of their responsibilities when it comes to state taxation.

Steps to Complete the 2005 California Nonresident or Part-Year Resident Income Tax Return

Completing the Long Form 540NR involves several steps to ensure thoroughness and compliance. The process can be broken down into manageable parts:

-

Gather Required Documents:

- W-2 forms from all employers.

- 1099 forms for any additional incomes.

- Documents supporting the claim for credits or deductions, such as receipts for deductible expenses.

-

Fill Out Personal Information:

- Enter your name, address, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and filing status (e.g., single, married filing jointly).

-

Report Income:

- Report all income earned from California sources. This includes wages, salaries, and any other earnings sourced in California.

- Part-year residents should also report income earned during their time in the state.

-

Adjustments to Income:

- Complete Schedule CA (540NR) to make necessary adjustments to your total income for the California portion.

-

Claim Deductions and Credits:

- Determine eligibility for any available deductions or credits. This can include standard deductions, personal exemptions, or credits for taxes paid to other jurisdictions.

-

Calculate Tax Liability:

- Use the tax tables provided within the form instructions to calculate your tax based on the taxable income reported.

-

Fill Out Payment Details:

- Specify how any tax owed will be paid. Options may include payment by check, electronic payment methods, or asserting eligibility for a refund.

-

Review and Sign:

- Thoroughly review all entries to ensure accuracy. Sign and date the return before submission.

-

Submit the Form:

- Choose the method of submission: electronically through specific software or by mailing to the designated address included in the instruction booklet.

Why Use the 2005 California Nonresident or Part-Year Resident Income Tax Return?

Utilizing the Long Form 540NR is crucial for fulfilling legal obligations as a taxpayer with connections to California. Failing to file can lead to audits, penalties, and interest on unpaid taxes. It becomes especially essential to complete this form to avoid overpayment and ensure that any credits or refunds due are properly accounted.

Important Dates and Deadlines for Filing

Adherence to filing deadlines is paramount to avoid penalties. For the 2005 tax year, the typical deadline to file the Long Form 540NR is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can request an extension, but an extension to file does not extend the time to pay any taxes owed.

Required Documents to File the Long Form 540NR

Before starting the filing process, ensure that the following documents are readily available:

- Income Documentation: Including W-2s, 1099s, and any other income verification forms.

- Identification: A valid SSN or ITIN for both the taxpayer and any dependents.

- Proof of Residency: Documentation that substantiates the period of residency, such as lease agreements or utility bills.

- Supporting Documents for Deductions/Credits: Receipts and records that validate any deductions or credits claimed on the tax return.

Collecting these documents beforehand can simplify the process and reduce the likelihood of errors.

Examples of Scenarios for Using the 2005 California Nonresident or Part-Year Resident Income Tax Return

Several scenarios illustrate when an individual would need to file the Long Form 540NR:

- Scenario 1: A student who resides in another state but worked a summer job in California would use this form to report income earned during that period.

- Scenario 2: An individual who moved to California for part of the year and received Californian rental income must report this income while detailing periods of residency.

- Scenario 3: A business professional who travels for work and earns income related to their job while in California would need to report their activities on the Long Form 540NR for the time spent within state lines.

These examples highlight the variety of situations in which nonresidents and part-year residents may find themselves required to file state taxes.