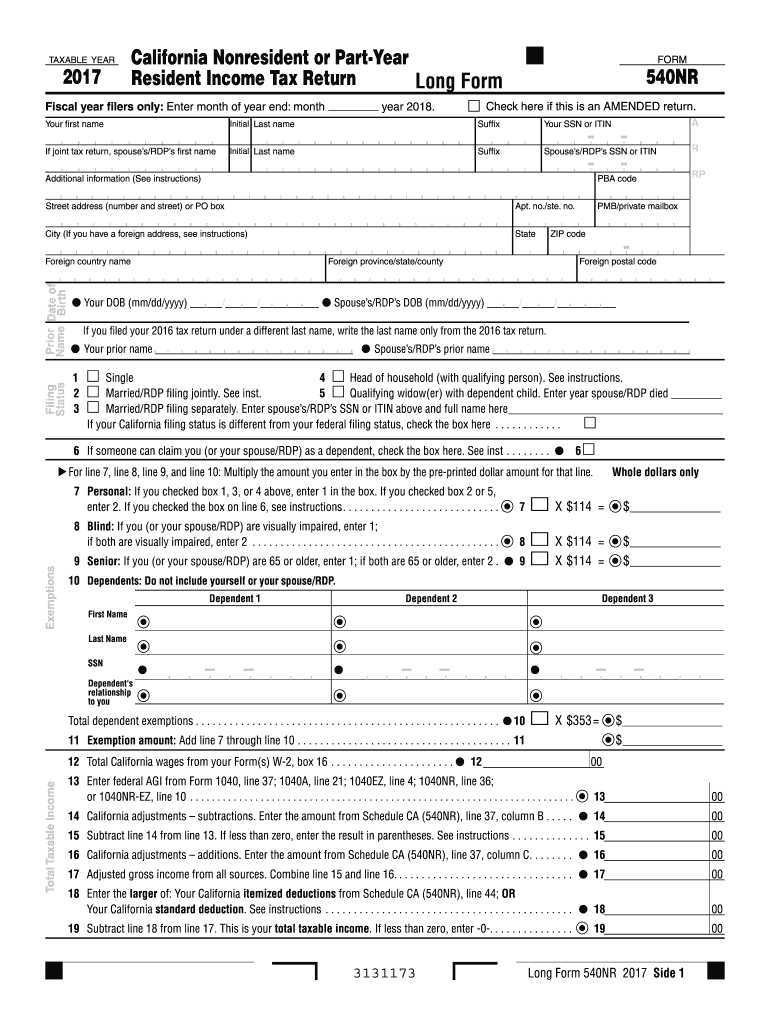

Understanding the 2017 Form 540NR for California Tax Returns

Definition and Purpose of the 2017 Form 540NR

The 2017 Form 540NR, or the California Nonresident or Part-Year Resident Income Tax Return, is specifically designed for individuals who do not reside in California for the full tax year but have income sourced from California. This form is crucial for accurately reporting income earned in California by non-residents or those who have moved in or out of the state during the tax year. The form captures personal information, filing status, exemptions, and total taxable income, thus ensuring compliance with California tax laws.

Steps to Complete the 2017 Form 540NR

Completing the 2017 Form 540NR involves a series of essential steps:

- Gather Required Information: Collect all necessary documents, including W-2 forms, 1099s, and any other relevant income reports.

- Determine Filing Status: Identify whether you are filing as a single, married filing jointly, married filing separately, or head of household.

- Fill in Personal Information: Input your name, address, and Social Security number in the designated sections.

- Calculate Total Income: Use the provided lines to report all income, including wages, business income, and any other sources.

- Claim Deductions and Exemptions: Follow the instructions to list recorded deductions and exemptions that pertain to your financial situation.

- Calculate Tax Owed or Refund: Use the tax tables provided in the Form 540NR instructions to ascertain the amount of tax owed or refund due.

This structured approach helps ensure that all necessary information is accurately included, minimizing errors during submission.

Important Terms Related to the 2017 Form 540NR

There are notable terms associated with the 2017 Form 540NR:

- Nonresident: An individual who does not live in California but may earn income there.

- Part-Year Resident: Someone who lived in California for part of the year and meets certain income thresholds.

- Adjusted Gross Income (AGI): Total income after specific exclusions or deductions have been applied, used as a baseline for tax calculations.

- Deductions: Specific amounts that can be subtracted from total income to lower tax liability, including standard and itemized deductions.

- Credits: Tax reductions provided by the state that directly decrease the amount owed to the government.

Understanding these terms is essential for accurately filling out the form and navigating California's tax system.

Legal Use of the 2017 Form 540NR

The 2017 Form 540NR serves a critical legal function under California tax law. It is used to ensure that nonresidents and part-year residents report their California source income accurately and pay the appropriate amount of taxes. Filing this form is a legal obligation for eligible individuals to avoid penalties and interest on unpaid taxes. Noncompliance can result in legal repercussions, including fines and enforcement actions by the California Franchise Tax Board.

Filing Deadlines and Important Dates for the 2017 Form 540NR

Deadline awareness is crucial for timely submission:

- Filing Deadline: The tax return must be filed by April 15, 2018, for the tax year 2017 unless an extension is obtained.

- Extension Requests: If unable to meet the deadline, a six-month extension can be requested, pushing the filing due date to October 15, 2018.

- Payment Due Dates: Taxes owed are generally due on the original return date, even if an extension to file is granted.

Adherence to these dates is necessary to avoid interest and penalties, ensuring compliance with state tax obligations.

Digital vs. Paper Version of the 2017 Form 540NR

The 2017 Form 540NR is available in both digital and paper formats, allowing flexibility for users:

- Digital: Online filling may be done through state-approved tax filing software, which often provides instant calculations and streamline submission.

- Paper: The physical form can be completed manually and submitted through the mail. Ensure it is sent to the appropriate address based on your location to avoid delays.

Choosing the format depends on personal preference and resource availability, with digital methods generally offering a faster processing time.

Required Documents for Filing the 2017 Form 540NR

To correctly complete the 2017 Form 540NR, gather the following documents:

- W-2 Forms: Essential for income reporting.

- 1099 Forms: For reporting various types of income, such as freelance work or interest earnings.

- Proof of Deductions: Receipts or documentation for expenses that can be deducted.

- Tax Credits Documentation: Any forms related to credits you wish to claim, such as dependent care costs or education credits.

Having these documents ready will facilitate the completion of the form and ensure accuracy in the reported figures.

Taxpayer Scenarios Using the 2017 Form 540NR

Different taxpayers may have unique situations that impact their use of the 2017 Form 540NR:

- Self-Employed Individuals: Individuals with income from self-employment must ensure accurate reporting of business income along with personal income.

- Students: Part-year residents who earned money during the school year while living in California should file to properly report their income.

- Retirees: Retirees who receive pension income sourced from California should utilize this form to report that income accordingly.

Each scenario underscores the importance of correctly filing the 2017 Form 540NR to ensure compliance with tax laws while accurately reporting income.