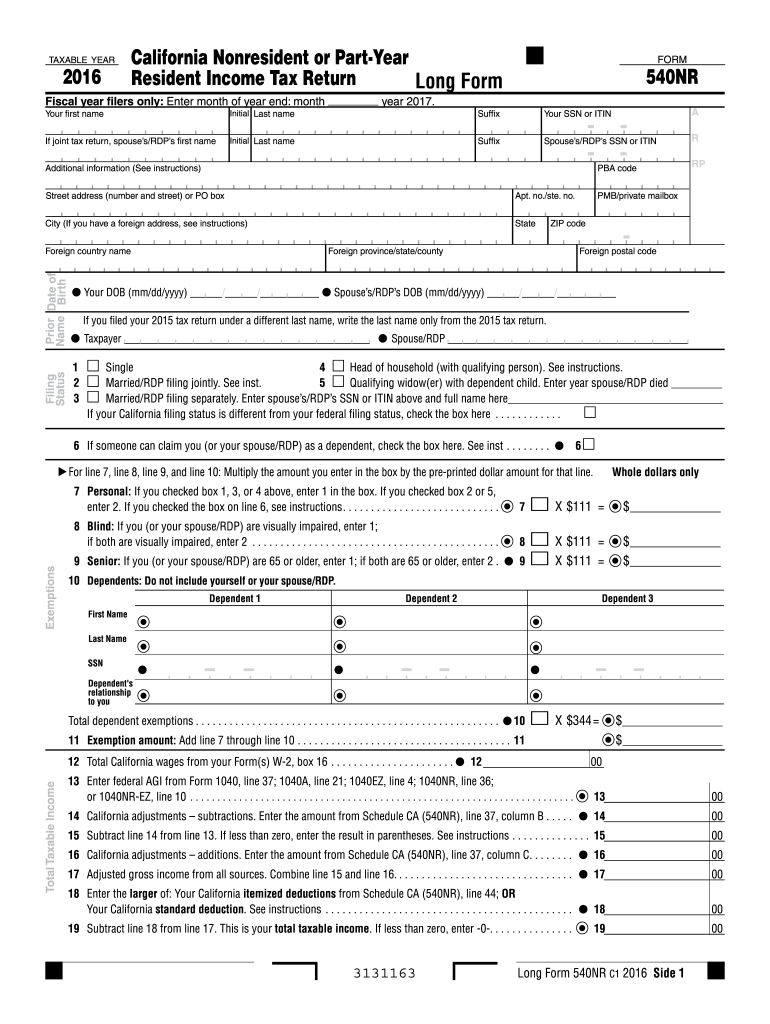

Understanding the 2016 Form 540NR

The 2016 Form 540NR, officially known as the California Nonresident or Part-Year Resident Income Tax Return, is essential for individuals who did not reside in California for the entire year yet earned income sourced from the state. This form helps determine the tax liability based on income earned within California.

Key Elements of the Form

- Personal Information: Basic personal details such as name, address, and social security number.

- Filing Status: Options include single, married filing jointly, head of household, etc.

- Exemptions: Information on dependents and personal exemptions affecting taxable income.

Steps to Complete the 2016 Form 540NR

- Gather Required Documents: Have all relevant income forms like W-2s and 1099s.

- Fill Out Personal Information: Start with your name, address, and social security number.

- Select Your Filing Status: Choose from the available filing statuses.

- Declare Income: Enter your California-sourced and worldwide income.

- Calculate Deductions: List applicable deductions to reduce taxable income.

- Determine Taxable Income: Calculate total income and apply deductions to find taxable income.

- Complete Tax Calculation Section: Determine your tax based on the state tax table.

- Account for Credits and Payments: Apply any tax credits and account for taxes already paid.

- Finalize with Signatures: Ensure the form is signed before submission.

Filing Deadlines and Important Dates

- Deadline: The deadline for submitting Form 540NR is usually April 15 annually.

- Extension Filing: If unable to file by the deadline, apply for an extension which typically grants until October 15.

How to Obtain the 2016 Form 540NR

- Online: Access the form through the California Franchise Tax Board's website.

- Tax Software: Software solutions like TurboTax often include the form.

- Tax Agencies: Visit local offices of the California Franchise Tax Board.

Software Compatibility for Filing

The 2016 Form 540NR works with various tax preparation software:

- TurboTax: Offers step-by-step guidance in filling out the form.

- H&R Block: Provides resources for tax calculations and e-filing.

- QuickBooks: Useful for businesses, syncs financial data for accuracy.

Legal Use and Compliance

It is crucial to ensure accurate reporting on the 2016 Form 540NR as per legal guidelines. The form must reflect accurate income data, deductions, and credits to comply with California tax laws. Penalties for non-compliance may include fines and interest on omitted taxes.

Who Typically Uses the 2016 Form 540NR

Typically, the form is used by:

- Nonresidents with California Income: Individuals residing outside California but earning within the state.

- Part-Year Residents: Those who moved in or out of California during the year.

- Temporary Workers: Employees on a temporary assignment in California.

Important Terms Related to the 2016 Form 540NR

- Nonresident: An individual who resides outside California but earns income in the state.

- Part-Year Resident: A tax filer who has lived in California for only part of the tax year.

- California-Sourced Income: Earnings that originate from work or investments in California.

State-Specific Rules for the 2016 Form 540NR

- Apportionment of Income: Only California-sourced income is subject to state tax.

- Credits and Deductions: Must conform to California-specific rules, separate from federal.

Document Submission Methods

- Online: Submit electronically via the California Franchise Tax Board’s official site for faster processing.

- Mail: Send a paper return to the specified address on the form.

- In-Person: Rarely used, but available at certain tax agency locations.

Accurately completing and filing the 2016 Form 540NR ensures compliance with California tax regulations for nonresidents and part-year residents with income in the state.