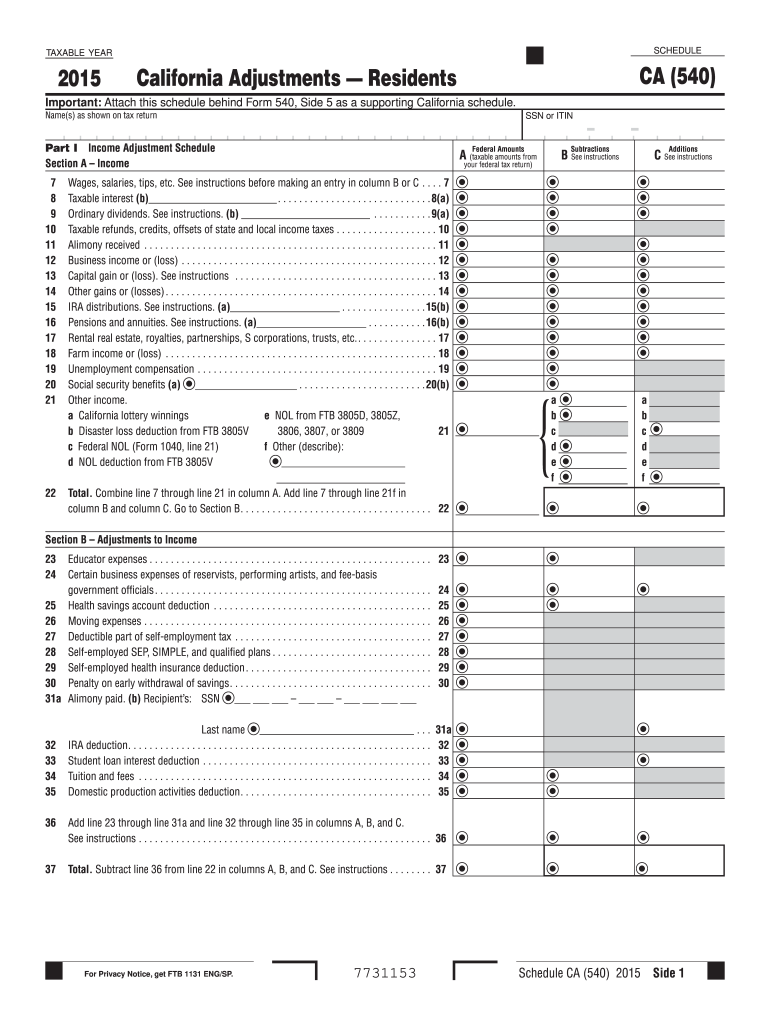

Definition and Meaning of the 2015 Schedule CA (540) Form

The 2015 Schedule CA (540) is a critical document used by California residents to identify adjustments to their federal income for state tax purposes. This form outlines modifications related to income types, federal amounts, subtractions, and additions, ensuring that taxpayers accurately report income according to California's tax regulations. By detailing state-specific adjustments, it helps residents determine their taxable income in California, separate from their federal taxable income. This is essential for aligning with California's unique tax requirements.

How to Use the 2015 Schedule CA (540) Form

Taxpayers should start by gathering relevant federal tax return information, particularly the Form 1040. The 2015 Schedule CA (540) requires you to adjust figures listed in your federal return for state tax calculations. Follow these steps:

-

Identify Adjustments:

- Locate applicable sections on income, deductions, and credits from your Form 1040.

- Compare these with California’s guidelines to identify discrepancies.

-

Attach Supporting Documents:

- Ensure all referenced schedules and forms are attached during submission.

-

Ensure Consistency:

- Confirm that figures reported match across all relevant forms to avoid discrepancies.

Completing this form carefully ensures accurate reporting and compliance with California’s tax laws.

How to Obtain the 2015 Schedule CA (540) Form

The 2015 Schedule CA (540) form is accessible through several official channels:

-

California Franchise Tax Board (FTB) Website:

- The primary source for downloading the form in PDF format.

-

Local Public Libraries and Tax Offices:

- Hard copies may be available for individuals without online access.

Ensure you are using the correct version (2015) to avoid processing issues. It is advisable to check for the most recent updates or additional instructions related to the form when visiting the FTB website.

Steps to Complete the 2015 Schedule CA (540) Form

Completing the Schedule CA (540) involves several detailed steps:

-

Income Adjustments Section:

- Input federal amount, California subtractions, and additions for different types of income (e.g., wages, retirement distributions).

-

Deduction Adjustments:

- Differentiate between itemized deductions and standard deductions, and adjust them according to California laws.

-

Review State-Specific Adjustments:

- Account for any California-specific tax credits or differences.

-

Final Verification:

- Double-check all inputs and calculations for accuracy before submission.

Ensuring detailed attention at every step minimizes errors and helps achieve compliance.

Key Elements of the 2015 Schedule CA (540) Form

The form comprises several critical sections:

-

Part I: Income Adjustments:

- Lists various income types requiring adjustments.

-

Part II: Adjustments for Itemized Deductions:

- Details adjustments related to federal itemized deductions.

Each section is essential for reporting differences between federal and state taxable income accurately.

State-Specific Rules for the 2015 Schedule CA (540) Form

Certain state-specific considerations are critical:

-

Community Property State:

- Unique rules apply if you are married and filing taxes separately.

-

Residency:

- Adjustments differ for part-year and non-residents.

Understanding these nuances ensures accurate completion and avoids compliance issues.

Penalties for Non-Compliance

Failing to submit or incorrectly completing the Schedule CA (540) can result in penalties:

-

Late Filing Penalties:

- Imposed if forms and payments are not made by the deadline.

-

Error Penalties:

- Incorrect declaration or omission of income might lead to additional fines.

-

Interest:

- Accrues on unpaid taxes if deadlines are not met.

Accurate and timely completion of this form is crucial to avoid financial penalties and interest charges.

Examples of Using the 2015 Schedule CA (540) Form

Practical scenarios highlight the form's application:

-

Self-Employed Individuals:

- Personal business income must be reconciled between federal and state tax obligations.

-

Retired Taxpayers:

- Adjustments for pension and Social Security income are particularly significant in determining taxable income in California.

-

Students:

- Scholarships or grants may require adjustments depending on their taxable status in California.

These examples demonstrate how various taxpayer groups utilize this form for accurate state tax reporting.