Definition and Purpose of the 1041 QFT 2014 Form

The Form 1041-QFT, a U.S. Income Tax Return for Qualified Funeral Trusts, is specifically designed for trustees to report the earnings, deductions, gains, losses, and tax obligations for qualified funeral trusts (QFTs) for the calendar year of 2014. This form is critical for ensuring that the trust complies with IRS regulations, allowing it to maintain its tax-exempt status under certain conditions.

Qualified funeral trusts are defined by specific criteria set forth by the IRS. The primary purpose of these trusts is to hold funds for funeral expenses, ensuring that funds are available at the time of need to help ease the financial burden on families during difficult times. Utilizing the 1041-QFT form enables the trustee to accurately report these financial activities and ensure compliance with applicable tax regulations.

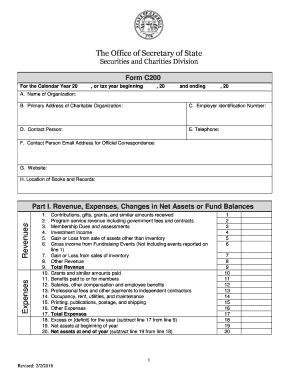

Key Features of the 1041-QFT Form

- Income Reporting: Document all sources of income the trust receives during the year.

- Deductions: Detail any allowable deductions related to the management of the trust.

- Tax Liabilities: Calculate and report the tax owed by the trust on any taxable income.

- Penalties for Non-Compliance: Provide explicit instructions on the repercussions for failing to submit the form on time.

How to Obtain the 1041 QFT 2014 Form

To acquire the 1041-QFT form, trustees have several options. The form can be accessed through the IRS website or obtained directly from tax preparation offices or libraries that provide tax documents. It is crucial for trustees to ensure they are using the correct version of the form for the 2014 tax year to avoid errors that could lead to compliance issues.

Steps to Access the Form

- Visit the IRS Website: Navigate to the forms section where various tax forms are listed.

- Search for Form 1041-QFT: Use the search function to locate the specific form.

- Download or Print: Forms are available in PDF format, which can be downloaded and printed for manual completion.

- Contact Local Tax Offices: If help is needed, local IRS branches or tax professionals can provide copies of the form as well.

Steps to Complete the 1041 QFT 2014 Form

Completing the Form 1041-QFT requires careful attention to detail to ensure all information is accurate and complete. Each part of the form plays a specific role in reporting the financial activity of the trust.

Detailed Steps for Completion

-

Identify the Trust: Start by entering the name, address, and Employer Identification Number (EIN) of the trust.

-

Report Income:

- Indicate total income in the relevant sections.

- Include details from all sources, such as interest and dividends.

-

Claim Deductions:

- Itemize any deductible expenses related to the administration of the trust.

- This may include trustee fees, legal fees, or other necessary expenses.

-

Calculate Tax Liability:

- Use the IRS tax tables to determine the tax rate applicable to the trust's income.

- Fill out the appropriate section with the computed tax amount.

-

Signature and Dates: Ensure that an authorized individual signs the return and indicates the date of signing.

Importance of the 1041 QFT 2014 Form

Using the 1041-QFT form is essential for trustees managing funeral trusts as it ensures compliance with federal tax rules and provides a clear record of the trust’s financial activity. Failure to file the form or inaccuracies can result in penalties, so it is vital that trustees understand their responsibilities regarding tax obligations.

Benefits of Proper Filing

- Maintains Compliance: Regular use of the 1041-QFT form ensures that the trust remains compliant with IRS regulations.

- Avoids Penalties: Accurate and timely submissions help prevent fines associated with late filing or incorrect reporting.

- Simplifies Future Filings: Keeping organized records and proper filing helps streamline future tax preparations.

Who Typically Uses the 1041 QFT 2014 Form

This form is specifically utilized by trustees of qualified funeral trusts, which may include individuals or entities responsible for managing the trust assets. Typical users can include:

- Scholes and funeral directors who set up funeral trusts for clients,

- Family members designated as trustee, or

- Financial professionals managing these assets on behalf of a beneficiary.

Context for Use

-

Family Trusts: Families may set up a QFT to ensure funds are available for future funeral costs, minimizing stress at the time of need.

-

Funeral Home Operators: They may assist clients in establishing these trusts as a method for pre-funding services.

Important Terms Related to the 1041 QFT 2014 Form

Understanding key terms associated with the 1041-QFT form is vital for accurate completion and compliance. Here are some fundamental terms:

- Qualified Funeral Trust (QFT): A trust that meets specific IRS criteria and is designed to pay for funeral services.

- Trustee: The individual or entity responsible for managing the trust and ensuring compliance with legal obligations.

- EIN (Employer Identification Number): A unique identifier assigned to the trust for tax purposes, necessary for completing the form.

- Taxable Income: The portion of the trust's income that is subject to tax, which must be recorded on the form.

IRS Guidelines and Filing Deadlines

Each form must be filed according to the guidelines set forth by the IRS to ensure compliance. For the 2014 tax year, the Form 1041-QFT must be filed by April 15, 2015. Adhering to deadlines is essential to avoid penalties.

Recommendations for Timely Filing

- Prepare Early: Gather documentation and start completing the form well before the deadline.

- Consult Professionals: If questions arise, consulting with a tax professional can provide clarity and ensure correct filing.

- Track Submission: Keep records of the filing date and method of submission for future reference.

Potential Penalties for Non-Compliance

Failure to file the 1041-QFT form by the deadline or incorrectly completing it can lead to significant penalties. The IRS may impose fines for incomplete information, missed deadlines, and inaccurate reporting.

Common Penalties Include

- Late Filing Fees: Typically assessed based on the length of the delay in filing.

- Accuracy-Related Penalties: Additional fines for misreporting income or deductions.

- Increased Scrutiny: Non-compliance can lead to audits or heightened scrutiny from the IRS, complicating future filings.

By understanding the importance of the 1041-QFT form and its specific requirements, trustees can effectively manage their responsibilities and ensure compliance with U.S. tax regulations.