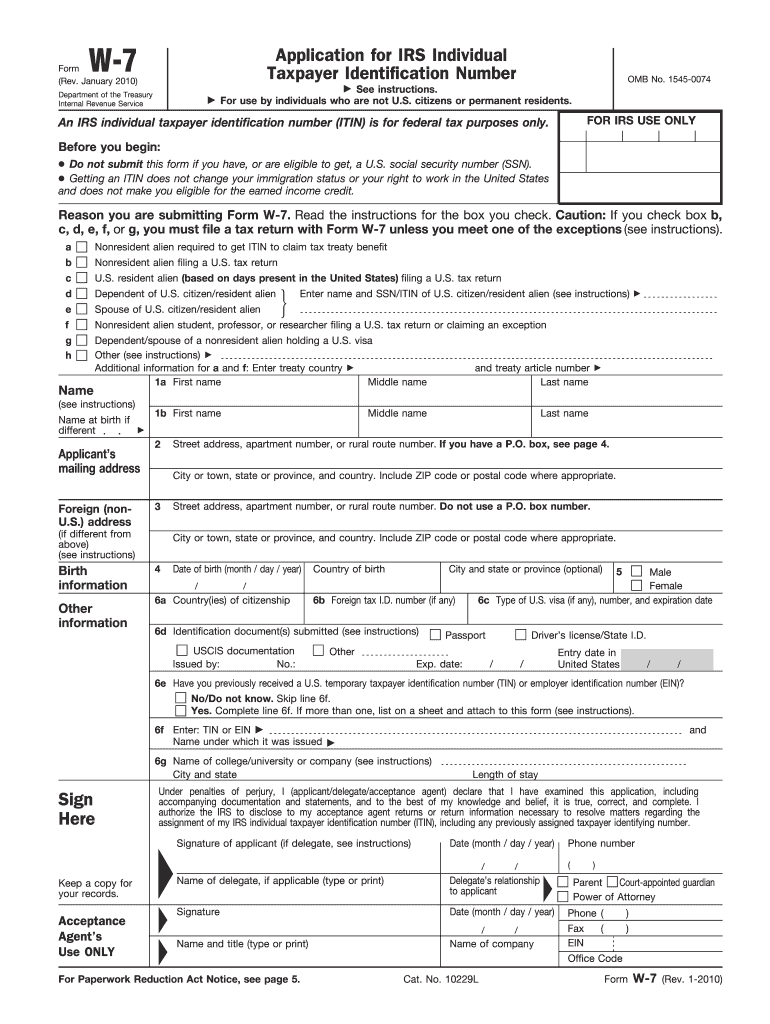

Definition and Meaning of 2010 Form W-7

The 2010 Form W-7 is an application used by individuals who are not U.S. citizens or permanent residents to obtain an IRS Individual Taxpayer Identification Number (ITIN). This form is essential for those who need to comply with U.S. tax laws but are not eligible for a Social Security Number (SSN). The ITIN helps in the identification of taxpayers who do not qualify for an SSN, allowing them to fulfill their tax obligations without affecting their immigration status or eligibility for certain tax credits.

How to Obtain the 2010 Form W-7

The 2010 Form W-7 can be obtained through various channels. It is available for download from the official IRS website, ensuring that individuals have easy access to the most current version. Additionally, the form can be requested by mail from the IRS or collected in person from a local IRS office. Taxpayers should ensure they have the correct version of the form corresponding to the year they are filing for. It’s crucial to follow IRS guidelines for submitting supporting documents along with the form to prevent any processing delays.

Steps to Complete the 2010 Form W-7

-

Applicant Information: Enter your name, address, and birth information accurately. This section establishes your identity, so double-check all entries.

-

Foreign Status Documentation: Include relevant documentation to verify your foreign status and identity, such as a passport or national ID card. These documents must be originals or certified copies.

-

Reason for Submitting Form W-7: Indicate the reason for requesting an ITIN, which could range from filing a U.S. tax return to fulfilling treaty benefits requirements.

-

Supporting documents: List any additional documents you are providing to support your application.

Important Considerations:

- Ensure accuracy and completeness to avoid rejections or delays.

- Follow up with IRS guidelines regarding acceptable identification and supporting documents.

Key Elements of the 2010 Form W-7

- Identification Information: Essential details like full legal name, date of birth, and country of citizenship.

- Reason for Application: Specific rationale for ITIN request which must be aligned with IRS accepted reasons.

- Supporting Documentation: Requirements include submission of legitimate IDs and potentially other evidence of legal presence or tax status.

- Signatures: Ensure the form is signed and dated to validate the application.

Who Typically Uses the 2010 Form W-7

The Form W-7 is typically used by non-U.S. residents who are required to file a tax return in the United States, individuals who are dependents or spouses of a U.S. citizen/resident, and some foreign national students or scholars who need an ITIN. These individuals often involve in activities that require compliance with U.S. tax laws without possessing a Social Security Number.

Legal Use of the 2010 Form W-7

The use of the 2010 Form W-7 is strictly for tax purposes. The issuance of an ITIN through this form does not alter an individual's immigration status and cannot be used as evidence of authorization to work in the United States. It is specifically intended to assist individuals in meeting their federal tax responsibilities.

Penalties for Non-Compliance

Failing to submit the 2010 Form W-7, if required, can lead to challenges in accurately reporting income and tax liabilities. Non-compliance could potentially result in fines or penalties imposed by the IRS. It could also complicate legal financial activities in the U.S., as an ITIN is crucial for fulfilling tax reporting obligations.

Filing Deadlines and Important Dates

Adhering to IRS deadlines is crucial when submitting Form W-7, typically accompanying a valid tax return. While there is no specific filing deadline for Form W-7 itself, it should be submitted as early as possible within the tax year to avoid delays in processing the tax return that it accompanies. Be sure to check for any changes in filing deadlines, especially in unusual circumstances or tax years, to ensure compliance.

Form Submission Methods (Online, Mail, In-Person)

Individuals can submit the 2010 Form W-7 by mail or in-person at designated IRS Taxpayer Assistance Centers. It must be submitted along with the tax return it supports, using original or certified copies of required identification documents. As of the latest guidelines, online submission is not available for this form due to the need for original verification of identity documents.

Mail Submission

- Mail the form and documentation to the address specified in the W-7 instructions.

- Make sure all documents are secured and sent through a reliable courier service if needed.

In-Person Submission

- Schedule an appointment at an IRS Taxpayer Assistance Center.

- Bring all necessary documents for verification during the visit.