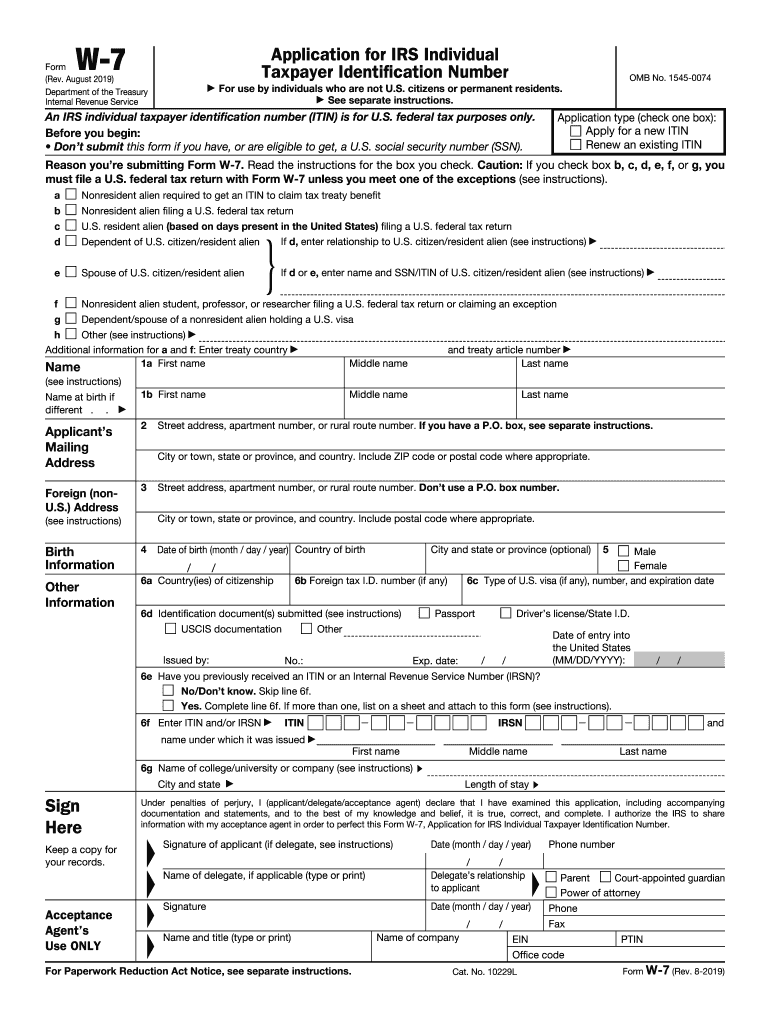

Definition and Meaning of the W-7 Form

The W-7 Form is an application document used to obtain an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS) in the United States. It is mainly intended for individuals who are not eligible to receive a Social Security Number (SSN), such as non-resident aliens, U.S. resident aliens, dependents, or spouses of U.S. citizens or resident aliens. The ITIN allows these individuals to comply with U.S. tax laws by reporting income and filing tax returns, even if they do not qualify for a SSN. Understanding the meaning and purpose of this form is crucial for ensuring compliance with federal tax regulations.

Importance of Using the W-7 Form

The W-7 Form is vital for several reasons. Firstly, it allows individuals without an SSN to fulfill their tax obligations, thereby avoiding legal complications and potential penalties. For non-resident aliens conducting business or earning income in the U.S., obtaining an ITIN through the W-7 Form facilitates the correct filing of U.S. tax returns. It is also essential for claiming certain tax treaty benefits or exemptions. Dependents or spouses of foreign nationals who are subject to taxation may also need an ITIN to be listed on a U.S. tax return, emphasizing the form's importance for comprehensive tax reporting.

Eligibility Criteria for the W-7 Form

Eligibility for the W-7 Form includes a range of individuals who do not have, and are not eligible to obtain, an SSN. This includes:

- Non-resident aliens needing to fulfill tax reporting obligations.

- U.S. resident aliens under the Substantial Presence Test who must report income.

- Dependents or spouses of U.S. citizens or resident aliens who require an ITIN for tax return purposes.

- Students or researchers from countries with tax treaty benefits who need an ITIN to claim treaty exemptions.

- Foreign investors and entrepreneurs engaged in business activities within the U.S.

Meeting eligibility criteria ensures the proper issuance of an ITIN.

Steps to Complete the W-7 Form

Successfully completing the W-7 Form involves several crucial steps:

-

Determine the Reason for Filing: Identify the reason for needing an ITIN, such as being a non-resident alien or a dependent of a U.S. citizen.

-

Gather Required Documents: Collect supporting documentation, such as a passport, visa, or other forms of identification that verify identity and foreign status.

-

Complete the Form: Fill out each section of the W-7 Form meticulously, ensuring accuracy and completeness, especially personal details and the reason for applying.

-

Attach Supporting Documentation: Include certified or notarized copies of identification documents as required by the form instructions.

-

Submit the Form: Mail the completed form and documents to the IRS office specified in the instructions. Alternatively, apply through an IRS Acceptance Agent or at designated IRS Taxpayer Assistance Centers.

Following the correct process helps prevent delays or rejections.

Required Documents for the W-7 Form

Submitting the W-7 Form necessitates certain documentation for verification purposes. The required documents include:

- A current passport or two other forms of identification, such as a national ID and a birth certificate.

- A visa or immigration documents, if applicable.

- Copies of recent tax returns, if the ITIN is required for filing.

These documents must be certified by the issuing agency or accompanied by a notarized copy to ensure validity and acceptance by the IRS.

How to Obtain the W-7 Form

Obtaining the W-7 Form is a straightforward process:

-

Online Download: Visit the official IRS website to download a PDF version of the W-7 Form, along with instructions for completion.

-

In-Person Pickup: Obtain the form at select IRS offices or through IRS Acceptance Agents.

-

Request by Mail: Contact the IRS to receive a physical copy of the form by mail.

Ensuring access to the correct form version is crucial for successful processing.

Examples and Scenarios for Using the W-7 Form

The W-7 Form is applicable in numerous scenarios, including:

-

International Students: Students from abroad in the U.S. on scholarships may need an ITIN to claim treaty benefits.

-

Non-resident Alien Specialists: Professionals such as engineers or scientists temporarily working in the U.S. may require an ITIN for income reporting.

-

Foreign Property Owners: Non-U.S. persons earning rental income from U.S. property may need an ITIN to file a tax return.

These examples highlight the diverse applications of the W-7 Form across different circumstances.

IRS Guidelines for the W-7 Form

The IRS provides comprehensive guidelines to aid applicants in the W-7 Form process, including:

- Submission Instructions: Clear steps on how to fill out and submit the form accurately.

- Documentation Requirements: Detailed descriptions of acceptable verification documents.

- Application of Tax Laws: Information on how the ITIN aligns with U.S. tax laws and obligations.

Adhering to IRS guidelines ensures proper compliance and reduces the risk of application rejection.