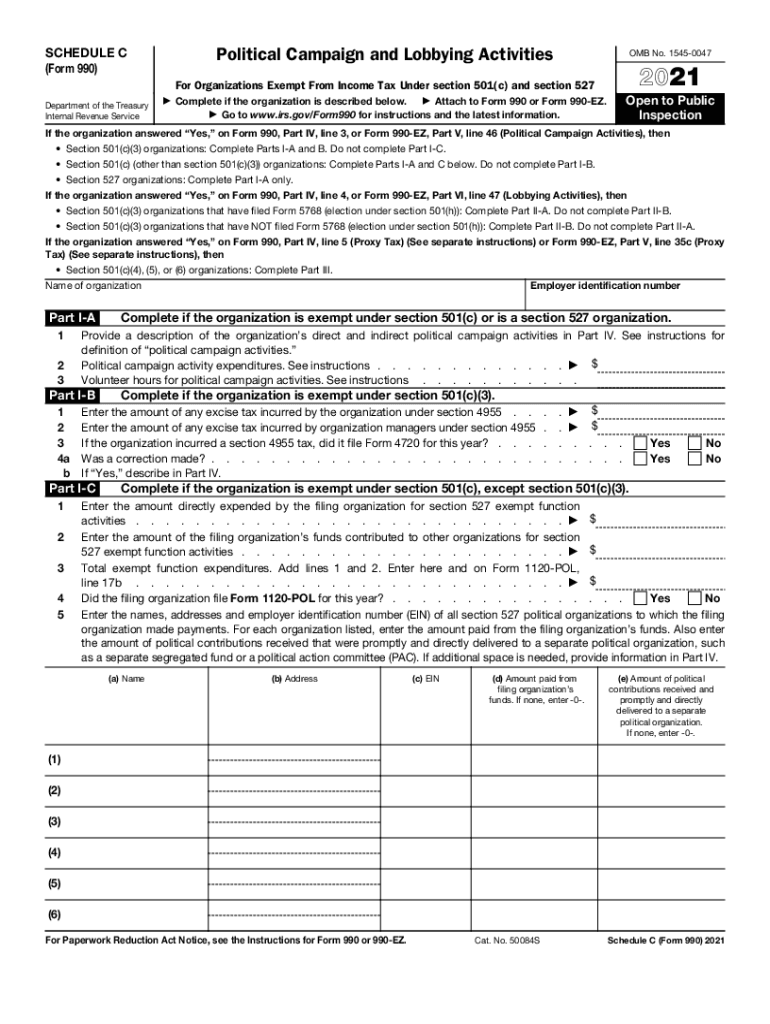

Definition and Purpose of Form 990 Schedule C

Form 990 Schedule C, officially referred to as the Political Campaign and Lobbying Activities Schedule, is used by organizations exempt from federal income tax under sections 501(c)(3), 501(c)(4), and 501(a) of the Internal Revenue Code. This form serves to report significant political campaign and lobbying activities conducted by these organizations.

Organizations must disclose any political expenditures made, detailing direct and indirect campaign activities, lobbying expenditures, and efforts to influence legislation. The necessity of this transparency is rooted in compliance with IRS regulations, which offer guidelines on how tax-exempt entities can engage in political activity without jeopardizing their tax-exempt status.

Importance of Completing Schedule C

Completing Form 990 Schedule C accurately is essential for several reasons:

- Regulatory Compliance: Filing Schedule C ensures that organizations adhere to IRS requirements concerning political and lobbying activities.

- Transparency: Detailed reporting promotes accountability and transparency to the public and oversight bodies.

- Tax-exempt Status Safeguarding: Proper completion can prevent potential risks to an organization’s exempt status resulting from unauthorized political engagement.

How to Use the 990 Schedule C

Using Form 990 Schedule C involves understanding the key sections and how they correspond to an organization's political and lobbying activities. Here's a step-by-step approach to effectively using this form:

- Determine Necessity: Assess whether your organization engages in political activities or lobbying that exceeds specified thresholds requiring you to file Schedule C.

- Gather Information: Collect data on political expenditures, including contributions to political campaigns, costs related to advertisements, and any payments made for lobbying services.

- Complete the Form: Fill out each relevant section of Schedule C, providing detailed information regarding your political and lobbying activities.

- Section A: Report any political campaign activities.

- Section B: Detail lobbying expenditures, including both direct and indirect costs.

- Review Requirements: Ensure that you meet all IRS requirements for disclosure related to your specific type of organization.

- File Along with Form 990: Submit Schedule C along with your organization's main Form 990 by the applicable deadline.

Additional Points to Remember

- Organizations using public funding must adhere to stricter reporting guidelines and may have additional disclosure requirements.

- Be mindful of state-specific regulations regarding political and lobbying activities, which may also necessitate additional reporting.

Steps to Complete Form 990 Schedule C

Completing Form 990 Schedule C can be methodical. Here’s a concise guide to the necessary steps:

- Understand Eligibility: Determine if your organization fits the criteria for filing this schedule, typically based on the extent of political activity and lobbying that exceeds the IRS specified limits.

- Collect Necessary Documentation: Secure all relevant receipts, invoices, and records of expenditures related to political activities or lobbying efforts.

- Fill Out the Sections:

- List all direct expenditures associated with political campaigns in Section A.

- In Section B, disclose any lobbying-related expenditures, separating costs into direct and indirect categories.

- Include Necessary Narratives: Provide explanations for your activities as needed. The IRS appreciates clarity that encompasses the intention behind expenditures and the context of lobbying efforts.

- Finalize and Review: Once completed, review the form for accuracy and completeness before submission.

Key Elements of Form 990 Schedule C

When completing Schedule C, it is critical to focus on several key elements that require thorough understanding and accurate reporting:

- Political Campaign Activities: Any direct involvement in the electoral process, including campaign contributions and expenditures related to advertised political messages.

- Lobbying Activities:

- Direct Lobbying: Efforts directly aimed at influencing legislation, including communication with legislators.

- Grassroots Lobbying: Mobilizing public opinion or action to persuade legislation. This includes costs incurred for advertising campaigns aimed at influencing public opinion on legislation.

Important Financial Disclosure Components

- Expenditure Totals: Aggregate totals for political and lobbying expenses provide insight into the organization's engagement level.

- Personnel and Volunteer Hours: Documenting staff salaries and volunteer contributions dedicated to lobbying efforts can significantly impact financial disclosures.

Filing Deadlines and Important Dates

Awareness of deadlines for Form 990 Schedule C submission is crucial for compliance:

- Filing Deadline for Form 990: Typically the 15th day of the fifth month after the end of your organization’s fiscal year. For organizations operating on a calendar year, the due date is May 15.

- Extension Requests: If more time is needed, organizations may apply for an automatic six-month extension using Form 8868. This will also extend the due date for Schedule C.

Consequences of Late Filings

- Organizations failing to meet deadlines may incur considerable penalties and risk losing their tax-exempt status.

Who Typically Uses Form 990 Schedule C

Form 990 Schedule C is primarily utilized by various organizations under the 501(c) classifications in the United States, including:

- 501(c)(3) Organizations: Charitable entities that must adhere strictly to regulations concerning political and lobbying activities.

- 501(c)(4) Organizations: Social welfare organizations that can engage more freely in lobbying efforts but must still report these activities on Schedule C.

- Political Action Committees (PACs): Entities designed to raise and spend money for political campaigns have specific reporting obligations related to expenditures.

Impact on Organization Type

Different types of tax-exempt organizations vary in their latitude concerning political and lobbying activities and will need to approach Schedule C based on their specific operational mandates.

IRS Guidelines for Form 990 Schedule C

Filing Form 990 Schedule C must align with various IRS guidelines. These encompass:

- Clear Disclosure Requirements: The IRS stipulates what constitutes relevant political and lobbying activities requiring disclosure, impacting how organizations categorize their expenditures.

- Regulatory Compliance: Guidelines pertaining to maintaining tax-exempt status directly relate to adherence to the reporting obligations outlined within Schedule C.

Navigating Complexities in Reporting

- Public vs. Private Organizations: Public charities and private foundations may experience different obligations concerning their reporting.

- Updates to IRS Regulations: Staying updated on any changes to these guidelines is essential for organizations as tax laws and compliance requirements can evolve.

By comprehensively understanding the purpose, use, and requirements of Form 990 Schedule C, organizations can ensure compliance and safeguard their tax-exempt status while engaging in lawful political activities.