Definition and Purpose of the 990 Part EZ Form

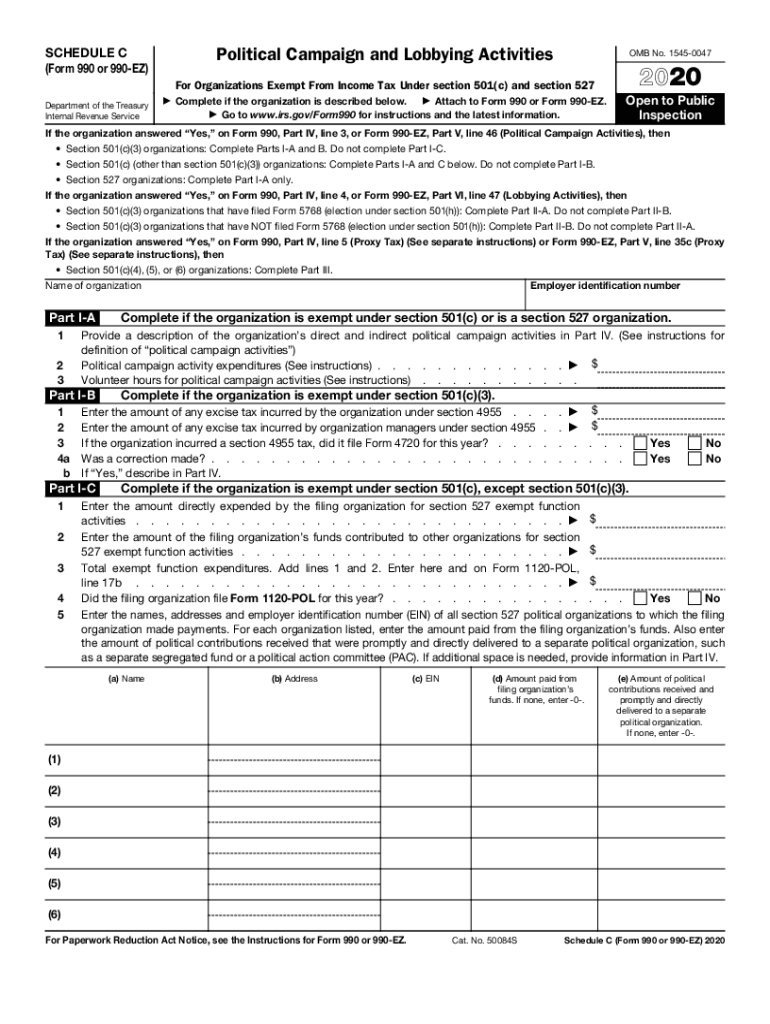

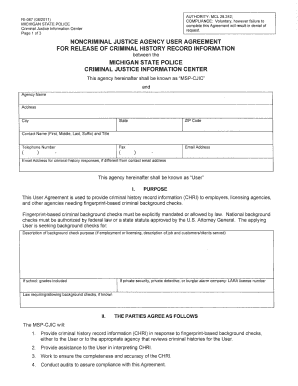

The 990 Part EZ form is a simplified version of the IRS Form 990, which is specifically designed for organizations that are tax-exempt under sections 501(c) and 527. This form is utilized by smaller tax-exempt organizations, such as charities and nonprofits, to report financial information, changes in their operations, and activities related to their exempt status. The primary purpose of the 990 Part EZ form is to fulfill annual reporting requirements while providing a less complex alternative for those organizations with gross receipts under $200,000 and total assets under $500,000.

The form captures essential details about an organization's mission, contributions, expenses, and operational expenditures. By requiring organizations to report on their activities, the IRS can oversee compliance with federal regulations, ensuring the transparency of charities and nonprofits. This helps maintain public trust in charitable organizations, as stakeholders, donors, and the community can assess how funds are used and the effectiveness of specific programs.

How to Use the 990 Part EZ Form

Using the 990 Part EZ form effectively entails understanding its sections and the specific information required. Here’s a general overview of how to approach the form:

-

Gather Necessary Information:

- Organization identification information, including name, address, and Employer Identification Number (EIN).

- Financial data, such as income, expenses, and any assets held.

- Information on activities and programs, summarizing how funds were utilized to accomplish the organization's goals.

-

Complete Each Section:

- Fill out the form sequentially, adhering to the specified guidelines provided in the instructions for Form 990.

- Ensure accurate reporting by cross-referencing with accounting records to verify figures.

-

Review for Accuracy:

- After completing the form, review each section meticulously to identify errors or inconsistencies.

- It may be beneficial to have an accountant or a tax professional double-check the entries to prevent issues during submission.

Steps to Complete the 990 Part EZ Form

Completing the 990 Part EZ form involves several systematic steps to ensure accuracy and compliance:

-

Download the Form: Obtain the latest version of the 990 Part EZ from the IRS website or relevant tax software.

-

Fill Out Identification Information:

- Enter the organization’s legal name, current address, and EIN.

- Indicate the period covered by the form on the top of the first page.

-

Detail Revenue and Expenses:

- Provide a summary of total revenue, including contributions, program service revenue, and investment income.

- List total expenses, breaking them down into categories such as salaries, administrative expenses, and program expenses.

-

Address Specific Questions:

- Respond to questions about governance, including board composition and policies. This may include disclosure of related-party transactions.

-

Finalize and Sign:

- Ensure the form is signed by an authorized individual, typically the president, treasurer, or equivalent officer of the organization.

Important Terms Related to the 990 Part EZ Form

Understanding key terms related to the 990 Part EZ form is crucial for its completion and compliance:

- Tax-Exempt Organization: Any nonprofit organization that has received exemption from federal income tax under the Internal Revenue Code.

- Gross Receipts: The total amount of money received by the organization from all sources within a tax year, excluding refunds and returns.

- Exempt Purpose: The overarching objectives for which the organization was established, typically charitable, educational, or religious purposes.

- Form Schedule: Additional schedules that may be required for organizations engaging in specific activities, such as lobbying or political campaigning.

Examples of Using the 990 Part EZ Form

To illustrate the utility of the 990 Part EZ form, consider a small nonprofit organization dedicated to community development.

Example 1: A local charity focused on poverty alleviation might report on its fundraising efforts in their revenue section, showing income generated through annual events. Their expense section would detail how funds are allocated to various programs, such as food drives and educational workshops.

Example 2: A sports club that provides after-school programs could utilize the 990 Part EZ form to report membership fees received as revenue and document expenses related to coaching staff and equipment purchases.

These examples highlight the importance of accurate reporting related to how various organizations function, demonstrating accountability to the public and the IRS.

Filing Deadlines and Important Dates

Organizations must adhere to specific deadlines when filing the 990 Part EZ form. Generally, the form is due on the 15th day of the fifth month after the end of the organization's fiscal year. Key deadlines include:

- For Fiscal Year Ending December 31: Filing deadline is May 15.

- For Fiscal Year Ending June 30: Filing deadline is November 15.

If an organization fails to file by the deadline, extensions may be available, typically for up to six months, before penalties for late filing take effect. Timely submission is crucial to maintaining compliance and avoiding legal complications or loss of tax-exempt status.