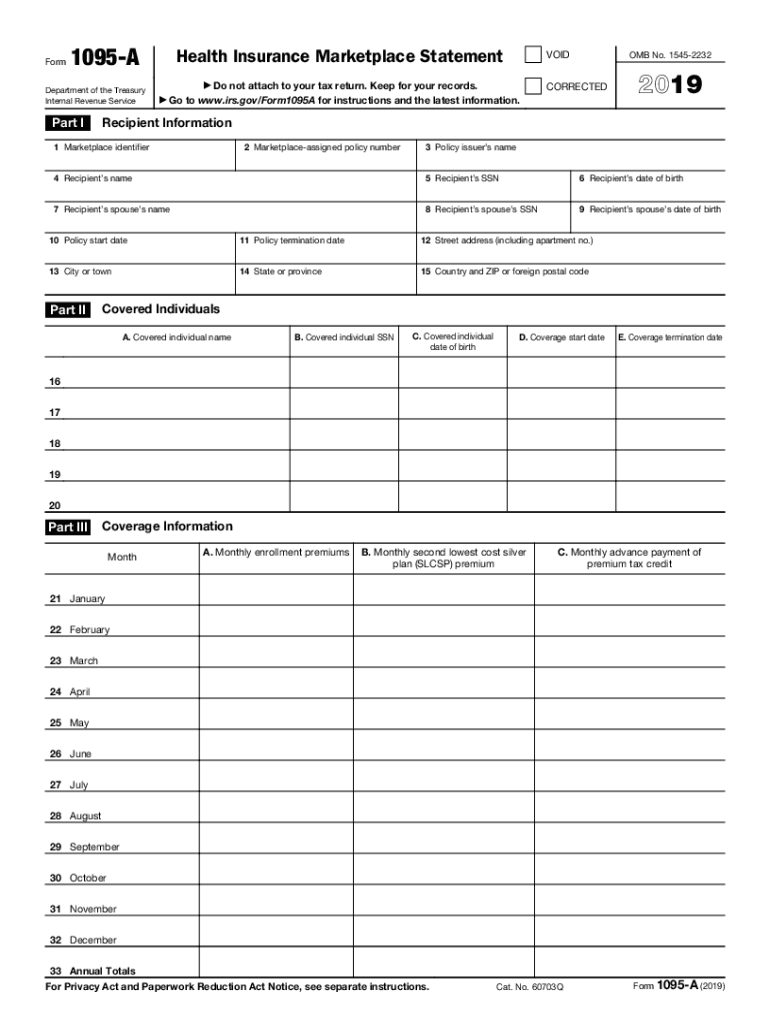

Definition and Purpose of Form 1095-A

Form 1095-A is an essential document issued by Health Insurance Marketplaces in the United States. It provides detailed information about individuals’ health coverage as part of their enrollment in a qualified health plan. Unlike a tax form for filing, Form 1095-A is primarily informational and should be kept with personal records for reference.

This form includes critical data needed to complete Form 8962, which aids in reconciling Premium Tax Credits on tax returns. It is particularly vital for those who received advance payments of the Premium Tax Credit (APTC), as it ensures they report accurate information to the IRS.

How to Obtain Form 1095-A

Individuals typically receive Form 1095-A by mail from the Health Insurance Marketplace where they enrolled in their health plan. It is also possible to access a digital version by logging into the Marketplace account. This approach not only helps to prevent delays associated with mail delivery but also allows for easy retrieval if additional copies are needed.

To ensure receipt of Form 1095-A, one should verify and update their mailing address and contact details within their Marketplace account annually. If not received by early February, contacting the Marketplace is advisable.

Steps to Complete Tax Returns Using Form 1095-A

-

Review the Form: Start by checking all details on Form 1095-A for accuracy, including personal information, details of the insurance policy, and the APTC amounts reported for each month.

-

Use the Information for Form 8962: Transfer the figures from your Form 1095-A onto Form 8962. This form calculates the exact amount of Premium Tax Credit one is eligible to claim, adjusting for any discrepancies between advance payments received and the actual amount based on income.

-

Attach Form 8962 to Tax Return: Upon completing Form 8962, attach it to your individual tax return (Form 1040 or 1040-SR). This final step is crucial, particularly for taxpayers who have received an APTC.

Key Elements of Form 1095-A

-

Recipient Information: Includes the taxpayer's name and the address on file with the Health Insurance Marketplace.

-

Policy Details: Provides the number of individuals covered under the plan, the policy number, and the insurer details.

-

Coverage Months and Premiums: Lists the total premium amount due, advances provided, and the second lowest cost Silver plan premium for each month.

Legal Use and Importance of Form 1095-A

Form 1095-A serves as a legal record of health coverage and is needed to verify eligibility for Premium Tax Credits on tax returns. Failing to accurately report information on Form 1095-A or neglecting to file Form 8962 can result in the need to repay part or all of the APTC received during the coverage year, as well as potential penalties.

IRS Guidelines and Compliance Related to Form 1095-A

IRS guidelines stipulate that individuals must retain Form 1095-A for their records and utilize it to reconcile any APTC received. Taxpayers must accurately complete and submit Form 8962 with their tax return to avoid possible discrepancies or penalties.

Filing Deadlines and Important Dates for Form 1095-A

The IRS requires that Form 1095-A be sent to taxpayers by January 31 each year for the preceding coverage year. Filing of individual tax returns incorporating information from Form 1095-A and Form 8962 must comply with standard IRS deadlines, typically April 15.

Examples of Form 1095-A Use Cases

-

Self-Employed Individuals: Those who bought insurance via the Marketplace as self-employed need Form 1095-A to reconcile the APTC and adjust taxable income effectively.

-

Families with Multiple Insured Members: Households must ensure all family members covered are accurately listed on Form 1095-A to prevent discrepancies in Premium Tax Credits on tax returns.

These comprehensive sections encapsulate various aspects of Form 1095-A, ensuring taxpayers understand both its utility and the importance of handling it correctly for accurate tax reporting.