Definition & Meaning

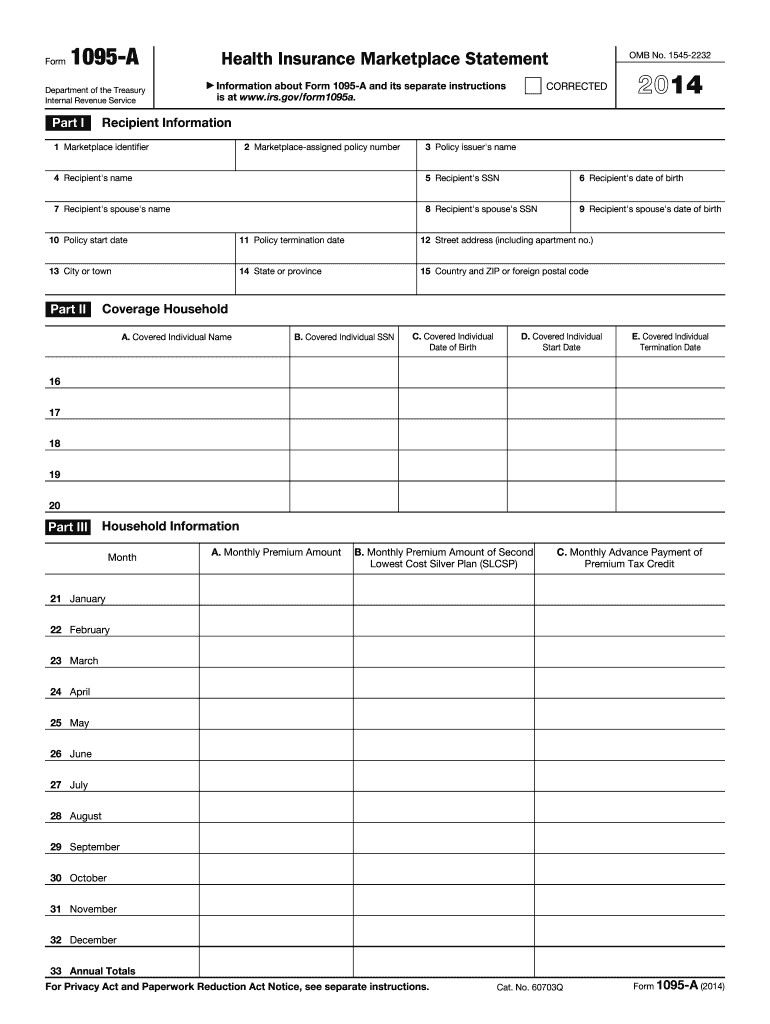

Form 1095-A, formally known as the Health Insurance Marketplace Statement, is an essential document issued by the IRS for individuals who enrolled in a health insurance plan through the Marketplace. It provides critical information required for filing taxes, specifically relating to the Premium Tax Credit. The form includes details about the coverage provided, the individuals covered under the policy, and monthly premium amounts. This information is crucial for completing Form 8962, which is necessary to claim or reconcile premium tax credits.

How to Use the 2-A Form

Using Form 1095-A involves a careful review of its sections to ensure that the data aligns with your insurance coverage. The form is instrumental in completing Form 8962, which reconciles advance payments of the premium tax credit with the actual credit amount to which you are entitled. Key steps include:

- Reviewing Information: Ensure the information matches your records.

- Completing Form 8962: Use the details from Form 1095-A to fill out Form 8962 for claiming the premium tax credit.

- Calculating Premium Tax Credit: Compare the advance payments to the actual credit based on your income and family size.

By following these steps, taxpayers can accurately file their taxes and adjust any discrepancies in advance payments versus credits.

How to Obtain the 2-A Form

Receiving Form 1095-A typically involves waiting for the document to arrive from the Health Insurance Marketplace by mail, usually around January. If you do not receive it, you can:

- Access Your Marketplace Account: Log into your Marketplace account to view and print Form 1095-A.

- Contact the Marketplace Help Desk: If you cannot access the document online, reach out to the customer service team for assistance.

Ensuring you have a copy of this form is vital, as it impacts your ability to complete your tax filing accurately.

Steps to Complete the 2-A Form

Filling out Form 1095-A requires meticulous attention to detail, especially when cross-referencing with Form 8962. Follow these steps to ensure accuracy:

- Review Form Content: Check the accuracy of personal information and coverage data.

- Use for Form 8962: Transfer necessary data (such as premium amounts) to Form 8962.

- File With Tax Return: Include both forms with your tax return, whether filing electronically or via mail.

Maintaining accuracy during this process helps prevent discrepancies and the potential need for amendments.

Key Elements of the 2-A Form

Form 1095-A is structured into multiple sections, each providing vital information about your Marketplace health coverage:

- Part I – Recipient Information: Details about the individual or household receiving the form.

- Part II – Coverage Household: Information regarding each person covered under the plan.

- Part III – Covered Individuals and Premiums: Monthly premium amounts, essential for calculating the premium tax credit.

Understanding each section ensures the form is used correctly during tax preparation.

IRS Guidelines

The IRS provides explicit guidance on how to handle Form 1095-A, especially regarding the filing of Form 8962. The guidelines include:

- Ensuring each month’s premium is accurately reported.

- Using Form 1095-A for the premium tax credit, a key component of the Affordable Care Act.

- Aligning reported income with the Healthcare Marketplace to avoid discrepancies.

Following these guidelines is vital to ensure compliance with federal tax regulations and to reduce the likelihood of tax filing errors.

Filing Deadlines / Important Dates

Meeting deadlines is crucial to avoid penalties and ensure timely filing. Important dates related to Form 1095-A include:

- January: Form 1095-A is typically issued by the Marketplace.

- April 15: Tax filing deadline (unless extended).

Being aware of these dates helps taxpayers stay organized and compliant with filing requirements.

Penalties for Non-Compliance

Failure to properly use Form 1095-A can result in penalties. Non-compliance issues include:

- Failure to reconcile advance premium credits: This can lead to repayment of excess credits.

- Missing or incorrect form submission: Can result in delays, additional taxes owed, or penalties.

To avoid these penalties, ensure accurate completion and timely submission of both Form 1095-A and your tax return.