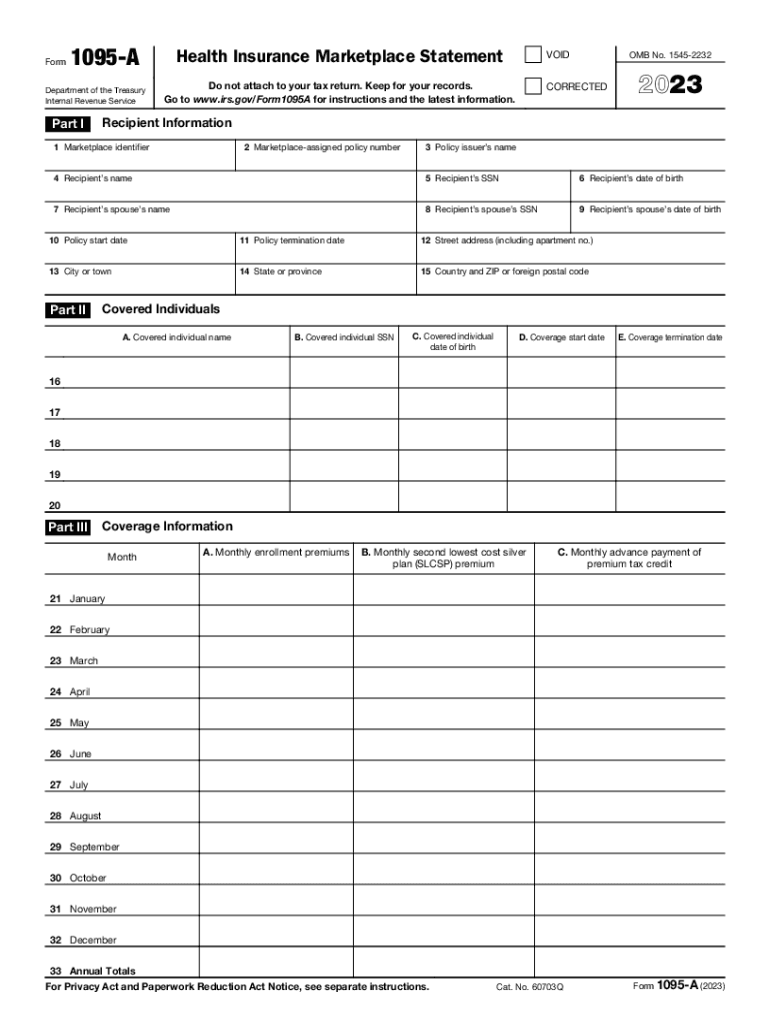

Definition and Meaning of 2023 Form 1095-A

Form 1095-A is an informational tax document provided by Health Insurance Marketplaces in the United States. It details enrollment information for individuals who have health insurance through these Marketplaces. This form is essential for taxpayers who need to reconcile their premium tax credits when filing their tax returns. It includes particulars about coverage and premium amounts, offering insight into what the taxpayer has received or paid throughout the year. The form is not filed with the IRS directly but serves as a reference for completing Form 8962.

How to Use the 2023 Form 1095-A

To accurately use Form 1095-A, individuals need to ensure that all the information provided is correct. The form aids in completing the IRS Form 8962, which reconciles advance payments of the premium tax credit. The taxpayer should verify details such as the premium amounts and ensure that they're accurately depicted in relation to the coverage they received. If discrepancies are found, it's vital to contact the Health Insurance Marketplace promptly to correct any errors before filing taxes.

Obtaining the 2023 Form 1095-A

Taxpayers can obtain Form 1095-A from the Health Insurance Marketplace. It is typically mailed to individuals by January 31 each year but can also be accessed online by logging into the user's account on their respective state or federal marketplace website. If the form is not received by mid-February, reaching out to the Marketplace to request a copy is recommended to avoid delays in their tax filing process.

Steps to Complete the 2023 Form 1095-A

Though Form 1095-A itself is not completed by taxpayers, here is a breakdown on how to utilize it effectively:

- Review each section of the form for accuracy.

- Confirm coverage dates and premium amounts listed.

- Input this information into IRS Form 8962.

- Use Form 8962 to reconcile service credits on the tax return.

- Retain Form 1095-A for personal record-keeping in case of future IRS inquiries or audits.

Key Elements of the 2023 Form 1095-A

The form consists of several important sections:

- Recipient Information: Basic details such as the policyholder's name and address.

- Covered Individuals: Includes names of all family members covered under the health plan.

- Coverage Period: Lists the months for which the coverage was provided.

- Monthly Premium Amounts: Details of the premiums paid each month and any advance premium tax credits received.

IRS Guidelines for 2023 Form 1095-A

IRS guidelines instruct individuals on utilizing Form 1095-A for tax purposes. This includes its role in reconciling advance payments of the premium tax credit. The IRS provides comprehensive instructions through Publication 974, explaining which figures from Form 1095-A should be transferred to Form 8962 and how to correct or resolve data discrepancies via the Marketplace.

Filing Deadlines and Important Dates

The key date for Form 1095-A is January 31, by which the Health Insurance Marketplaces should have sent out the form to all enrolled individuals. Taxpayers should ensure they have all relevant documents, including Form 1095-A, by early February to accurately complete their tax returns by the April deadline. Timely reconciliation is critical to avoid late filing penalties and ensure any discrepancies are addressed well ahead of tax submission deadlines.

Penalties for Non-Compliance

Failing to properly reconcile advance premium tax credits using Form 1095-A can lead to penalties. If this reconciliation does not occur, individuals might face fines related to improper filing or underpayment of taxes. Additionally, discrepancies that are not resolved can lead to delayed tax refunds until the correct information is processed. It is crucial to ensure all information is accurate and complete to avoid these issues.