Definition and Purpose of Form 941

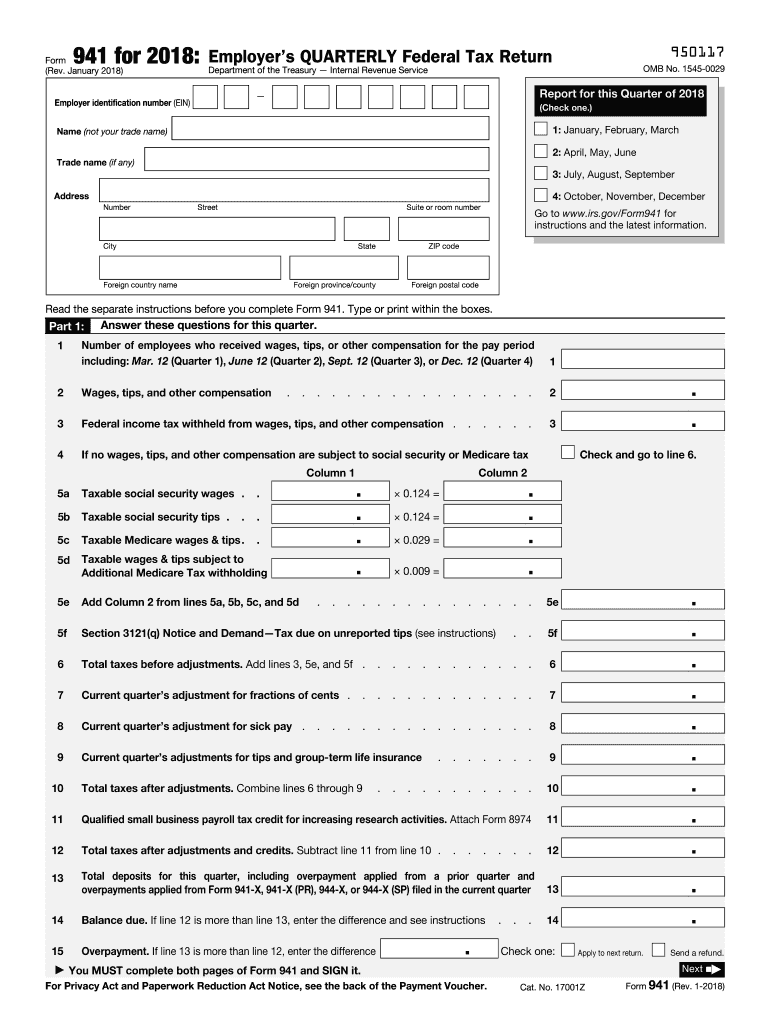

Form 941, also known as the Employer's Quarterly Federal Tax Return, is an essential tax document used by employers in the United States to report employee wages, tips, and other compensation. The form also details federal income tax, social security tax, and Medicare tax withheld from employees' paychecks. Employers are responsible for reporting the amount of these taxes that they have deposited with the Internal Revenue Service (IRS). Accurate completion of Form 941 ensures compliance with federal tax regulations and helps protect businesses from potential penalties.

Key Functions of Form 941

- Report Employee Wages: Employers use the form to declare total compensation paid to employees.

- Tax Withholding Declaration: It specifies the federal tax amounts withheld from employee earnings.

- Employer Contributions: Details employer obligations for social security and Medicare taxes.

- Adjustments and Credits: Allows employers to report adjustments for prior quarters and claim credits, such as for overpaid taxes.

How to Obtain the 941 Form

Employers can access Form 941 through multiple channels, ensuring convenience and accessibility. The IRS website is a primary source, offering a downloadable PDF version, minimizing the need for physical mail. Tax software programs, often used for payroll and business tax accounting, typically include Form 941, streamlining the filing process. Businesses that work with accounting professionals can also receive the form directly from their advisors, facilitating proper submission and ensuring accuracy in reporting.

- Online Access: Form 941 is readily available for download from the IRS official website.

- Tax Software Inclusion: Programs like QuickBooks and TurboTax often embed the form within their system.

- Accounting Professionals: CPAs and tax advisors can provide a copy of the form to businesses.

Steps to Complete Form 941

Filling out Form 941 accurately is vital for compliance. A systematic approach aids in avoiding errors:

- Prepare Necessary Information: Gather all relevant payroll records, including employee wage details and tax withholdings.

- Complete Employer Information: Enter business identification details, such as Employer Identification Number (EIN) and business name.

- Fill in Wages and Tax Data: Provide the total wages, tax withholdings, and FICA contributions.

- Calculate Tax Liabilities: Verify and calculate total liabilities for reported taxes.

- Account for Adjustments: Enter any corrections for previous quarters where necessary.

- Review and Sign: Double-check the completed form for accuracy; sign and date before submission.

Common Mistakes to Avoid

- Miscalculating Taxes: Ensuring precise calculations avoid discrepancies.

- Missing Deadlines: Timely filing is critical to prevent penalties.

Important Terms Related to Form 941

Understanding specific terminology associated with Form 941 ensures accurate completion:

- FICA Taxes: Refers to the combined taxes for social security and Medicare.

- EIN (Employer Identification Number): A unique number assigned to a business for tax purposes.

- Tax Liability: The total amount an employer is responsible for paying in taxes during the reporting period.

- Adjusted Wages: Reflects wages after accounting for any exemptions or adjustment factors.

Examples of Misunderstood Terms

- Adjusted Wages vs. Gross Wages: Confusion often arises; 'gross wages' refers to total earnings before any deductions.

- FICA vs. Federal Income Tax Withholding: Employers need to distinguish between these to allocate tax payments correctly.

Key Elements of the 941 Form

Proper acknowledgment of crucial sections within Form 941 ensures thoroughness in reporting:

- Employee Count: Required to report the number of employees receiving wages and withholdings for the quarter.

- Wages, Tips, and Compensation: A total figure, critical for calculating withholdings and employer contributions.

- Tax Adjustments and Overpayments: Allows for the rectification of previous errors without filing an amended form.

Detailed Section Breakdown

- Part 1: Covers employee count and taxable wages.

- Part 2: Detailed declaration of federal tax liabilities.

- Part 3: Adjustments for additional Medicare tax and prior errors.

Filing Deadlines and Important Dates

Adhering to the prescribed filing schedule for Form 941 is mandatory. The IRS requires that Form 941 be filed quarterly, with distinct deadlines for each period:

- Q1 (January - March): Due by April 30.

- Q2 (April - June): Due by July 31.

- Q3 (July - September): Due by October 31.

- Q4 (October - December): Due by January 31 of the following year.

Employers must ensure timely submission even if no taxes are due for the period. It maintains compliance and prevents late filing penalties.

IRS Guidelines and Compliance

The IRS provides comprehensive guidelines to assist employers in the accurate filing of Form 941. Familiarity with these instructions can reduce errors and ensure completeness:

- Quarterly Deposit Requirements: Specific rules dictate how and when federal taxes should be deposited.

- Using Payment Voucher (Form 941-V): If paying by check or money order, a payment voucher accompanies the form.

- Amendments: Instructions on how to correct errors for previously submitted forms are available.

Compliance and Support

- IRS Helpline: Employers can contact the IRS for clarification and assistance in complex scenarios.

- Publication 15 (Circular E): Employers should consult this comprehensive guide for payroll tax requirements.

Penalties for Non-Compliance

Failure to file Form 941 accurately or timely can result in penalties. The IRS enforces penalties to uphold compliance and maintain revenue integrity:

- Late Filing: Results in incremental penalties based on the number of days late.

- Underpayment of Taxes: Leads to financial penalties and accrued interest.

- Fraud Penalties: Severe consequences, including significant fines and potential legal action.

Avoidance Measures

- Automated Reminders: Utilizing software that sends automatic filing reminders can minimize late submissions.

- Professional Assistance: Hiring tax professionals to manage quarterly filings ensures accuracy.