Definition & Meaning

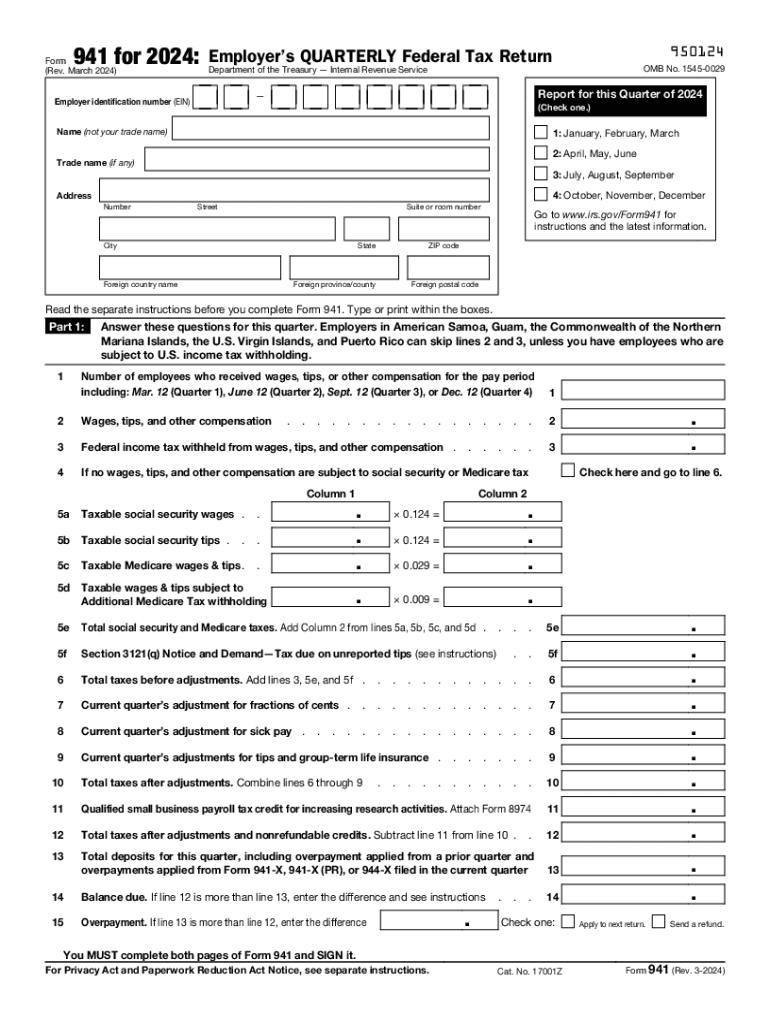

Form 941 (Rev March 2024), or the Employer's Quarterly Federal Tax Return, is a critical document used by businesses within the United States to report essential employment tax information. Primarily, it details wages paid to employees, as well as the federal income taxes withheld. Businesses are required to submit this form quarterly, ensuring that all necessary employer tax contributions, such as Social Security and Medicare taxes, are reported accurately. This form is instrumental in maintaining compliance with federal tax laws and ensuring that employers pay the appropriate employment taxes.

How to use the Form 941 (Rev March 2024)

Employers utilize Form 941 to detail wages, tips, and other compensation paid out to employees throughout the quarter. The process begins by calculating the total taxable wages and tips, followed by reporting withheld federal income taxes. Additionally, the form requires employers to declare both the employer and employee portions of Social Security and Medicare taxes. Employers must also take note of any adjustments or overpayments from previous quarters and make the necessary corrections on the form. Finally, if applicable, employers must use Form 941-V as a payment voucher when submitting any owed taxes.

Steps to complete the Form 941 (Rev March 2024)

- Identify Basic Business Information: Start by entering your business name, employer identification number, and the quarter being reported.

- Report Employee Wages and Tips: Detail the total wages, tips, and other types of compensation paid to employees during the quarter.

- Calculate Federal Income Tax Withholding: Enter the amount of federal income tax withheld from employee wages.

- Record Social Security and Medicare Taxes: Present both employee and employer portions of Social Security and Medicare taxes, taking care to adhere to the current tax rates.

- Adjustments and Credits: If applicable, account for any adjustments, such as sick pay or fringe benefits, and report any tax credits.

- Define Tax Liabilities: Calculate your overall tax liabilities for the quarter and compare them against any deposits made.

- File and Submit: Ensure accurate entries and file the form with the IRS by the due date. If payment is due, accompany the submission with Form 941-V.

Important terms related to Form 941 (Rev March 2024)

- Taxable Wages: Compensation paid to employees that is subject to federal income tax, Social Security, and Medicare taxes.

- Withheld Taxes: The amount of federal income tax withheld from employees' wages, which employers are responsible for reporting.

- Social Security Tax: A payroll tax levied on earnings to fund the Social Security program, shared by employers and employees.

- Medicare Tax: A tax imposed on wages to fund Medicare, shared by employers and employees.

- Overpayment Adjustments: Corrections made when too much tax is paid in previous quarters, which can be used to offset current liabilities.

Filing Deadlines / Important Dates

Employers are required to file Form 941 quarterly with the IRS. The due dates for submission are as follows:

- First Quarter (January - March): April 30

- Second Quarter (April - June): July 31

- Third Quarter (July - September): October 31

- Fourth Quarter (October - December): January 31 of the following year

To avoid penalties, businesses should file on time and ensure any taxes owed are paid by these deadlines. If the due date falls on a legal holiday or a weekend, the deadline extends to the next business day.

Penalties for Non-Compliance

Failure to file Form 941 on time can result in significant penalties. The IRS generally assesses a penalty of five percent of the unpaid tax per month, up to a maximum of 25 percent. Additionally, penalties may be applied for errors or inaccuracies found on the form. Employers who fail to deposit taxes in a timely manner may also face penalties and interest on the unpaid amount. To mitigate these risks, businesses should ensure accurate and timely filings.

Digital vs. Paper Version

Employers have the option to file Form 941 either electronically or via paper submission. Filing electronically through authorized e-file providers offers several benefits, including faster processing times and reduced risk of errors. Electronic submissions also provide automatic confirmation of receipt by the IRS. On the other hand, filing a paper version may be suitable for businesses with simpler tax situations or those who prefer handling their submissions manually.

Who typically uses the Form 941 (Rev March 2024)

Form 941 is used predominantly by U.S.-based businesses that employ workers and are responsible for withholding federal taxes from employee wages. This includes a wide range of entities, such as:

- Corporations

- Partnerships

- Limited Liability Companies (LLCs)

- Non-profit organizations and government entities that have paid employees

These employers must file the form to report their federal tax liability accurately, contribute to Social Security and Medicare systems, and ensure compliance with withholding requirements.