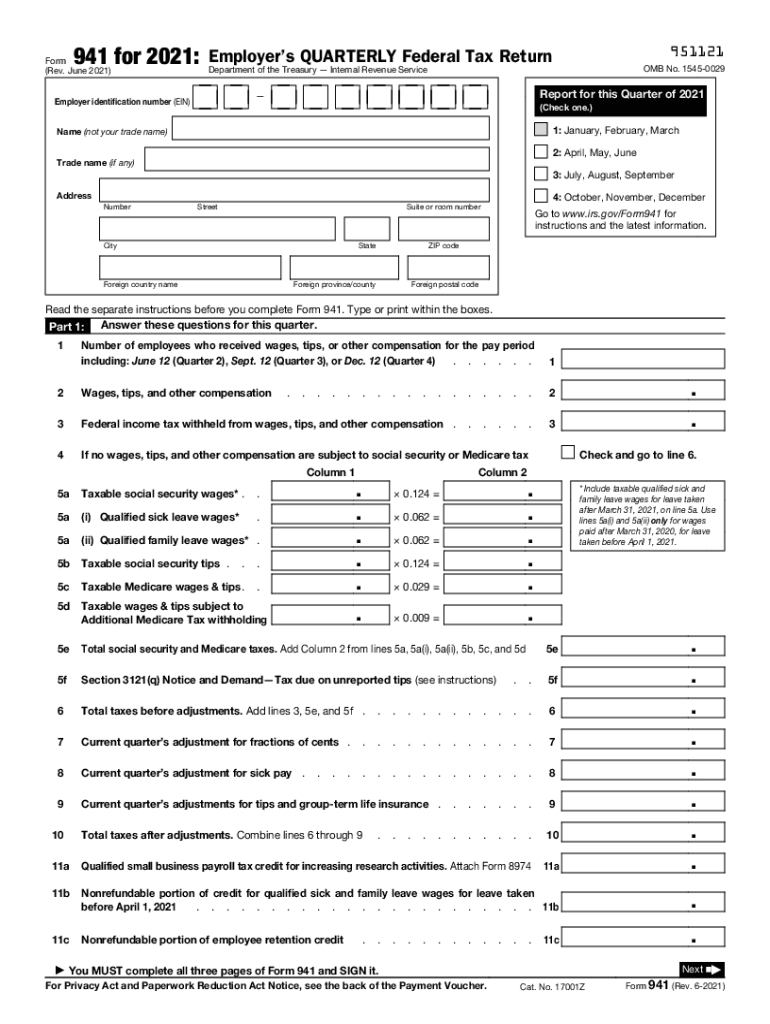

Understanding the 941 Form 2021

The 941 form for 2021, known as the Employer's Quarterly Federal Tax Return, is critical for employers in the United States. It serves as a report to the IRS of wages, tips, and other forms of compensation paid to employees, alongside federal income tax withheld. This form provides a detailed account of payroll expenses, including social security and Medicare taxes, and any applicable adjustments or credits for sick and family leave wages. Accuracy in completing this form is paramount as it needs to be signed by the employer to confirm the declaration of these details.

How to Obtain the 941 Form 2021

Employers can obtain the 941 form for 2021 directly from the IRS website. It is readily available for download in PDF format, making it accessible for printing and manual completion. Alternatively, employers can use tax software solutions such as TurboTax or QuickBooks to streamline the process. These platforms often include the 941 form within their tax management suites, enabling a seamless integration of payroll data for form completion.

Steps to Complete the 941 Form 2021

-

Gather Required Information: Before filling out the form, compile employee wage information, federal income tax withheld, and amounts for social security and Medicare taxes.

-

Complete Part 1: Report the number of employees, total compensation paid, and total federal income taxes withheld during the quarter.

-

Calculate Taxable Wages: Calculate wages subject to social security and Medicare taxes, including additional Medicare tax if applicable.

-

Report Adjustments: In Part 2, report any adjustments to social security and Medicare taxes due to sick pay, group-term life insurance, or tips received.

-

Credits and Payments: Account for any credits, such as those for qualified sick and family leave wages under the Families First Coronavirus Response Act.

-

Sign and Date: Ensure the form is signed by an authorized person within the organization to confirm the accuracy of the reported information.

Filing Deadlines and Important Dates

The 941 form must be filed quarterly. The deadlines are typically:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Employers must adhere to these deadlines to avoid penalties. If the due date falls on a weekend or holiday, the deadline shifts to the next business day.

Key Elements of the 941 Form 2021

Quarterly Reporting

- Line 1: Total number of employees during the pay period including March 12.

- Line 2: Total wages, tips, and other compensation.

- Line 3: Total federal income tax withheld.

Adjustments and Credits

- Adjustments for tips and sick pay provide a mechanism for employers to ensure tax amounts align with actual payments made under specific situations.

Signing and Verification

- The form must be signed by an authorized company official, affirming the accuracy and completeness of the information provided.

Legal Use of the 941 Form 2021

The 941 form is legally required for reporting quarterly payroll and tax information to the IRS. Non-compliance can result in significant penalties and interest charges. Accurate reporting is essential, and companies are encouraged to verify their entries before submission. Misreporting can lead to audits or other legal challenges.

IRS Guidelines for the 941 Form 2021

The IRS provides comprehensive instructions for completing the 941 form. These guidelines cover every section of the form, offering detailed explanations on how to calculate and fill in each part, including tax credits for sick leave and family leave due to COVID-19. Employers are encouraged to consult these resources or work with tax professionals to ensure compliance and accuracy.

Penalties for Non-Compliance

Failing to file the 941 form on time can result in penalties from the IRS. These penalties are calculated based on the amount of tax reported on the form. Additionally, incorrect filings can attract fines. It's vital for employers to submit accurate and timely returns to avoid these consequences.

Digital vs. Paper Version of the 941 Form 2021

While traditional paper filings are still accepted, electronic filing (e-filing) offers several advantages. E-filing can help reduce errors through automatic calculations and immediate verification of the form's submission status. Many employers opt for e-filing to expedite the process and ensure timely compliance with IRS regulations.