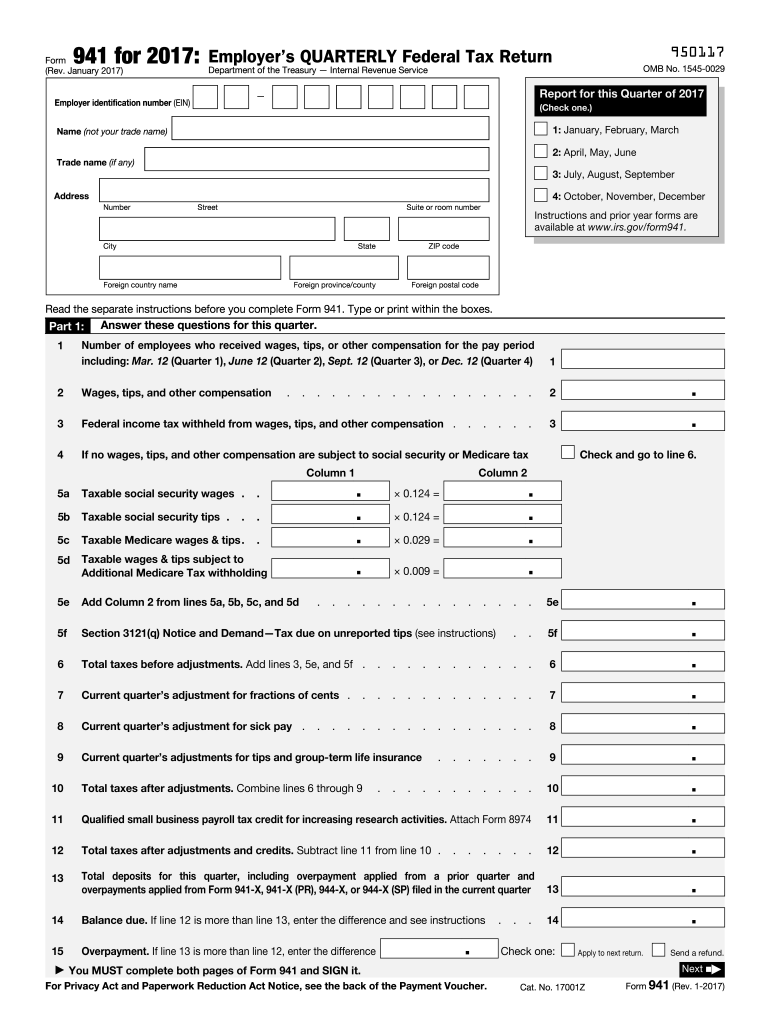

Definition and Importance of Form 941 for 2017

The Employer's Quarterly Federal Tax Return, commonly referred to as Form 941, is a crucial document for employers in the United States. This form is specifically designed for reporting wages, tips, and other compensations paid to employees during a given quarter. Additionally, it serves to report the federal income tax that has been withheld from employee paychecks, along with the employer's share of Social Security and Medicare taxes.

Filing Form 941 for 2017 allows employers to accurately report their tax liabilities to the Internal Revenue Service (IRS). It includes vital sections detailing the number of employees, total taxable wages, tax liabilities, and any necessary adjustments. Accurate completion of this form helps prevent potential penalties for underreporting taxes and maintains compliance with federal tax regulations.

Key Components of Form 941

- Employee Count: Indicates how many employees were paid during the reporting period.

- Taxable Wages: Details the wages subject to social security and Medicare taxes.

- Federal Tax Withholding: Lists the amount withheld from employee paychecks for federal income tax.

- Adjustments: Necessary corrections for prior mistakes or changes in tax credits.

Understanding these components is essential for employers to fulfill their tax obligations to the federal government.

Steps to Complete the File 941 Online 2017 Form

Completing Form 941 online may seem complex, but a structured process can simplify the task significantly. Here’s a step-by-step guide to ensure accurate completion:

- Gather Necessary Documents: Collect all relevant payroll records, employee data, and any previous Forms 941 submitted.

- Access the Form: Visit a platform like DocHub, where you can find a fillable 2017 Form 941. Ensure you are looking at the correct version for the desired quarter.

- Complete Employee Information: Input the total number of employees and any adjustments needed based on prior quarters.

- Enter Taxable Wages: List all taxable wages and tips for the reporting period. Be meticulous to ensure accuracy in the amounts reported.

- Calculate Taxes: Use the provided guidelines to calculate the total tax liability for Social Security, Medicare, and federal tax withheld.

- Review and Submit: Carefully review all entries for accuracy. Once verified, submit the form electronically.

Utilizing platforms that streamline the filing process can facilitate a more straightforward experience and decrease the likelihood of errors.

How to Obtain Form 941 Online for 2017

Obtaining Form 941 for 2017 is a straightforward process due to its availability on various tax filing platforms. Here are the primary steps:

- Visit Tax Forms Websites: Navigate to an official IRS website or authorized forms service provider. These platforms often offer easy access to necessary forms.

- Download Fillable Version: Select the appropriate quarter for the 2017 Form 941. Download the fillable PDF version to your computer or access it through an online service like DocHub, where you can complete it directly.

- Check for Instructions: It's helpful to download or print the accompanying instructions to guide you through the form’s completion.

Using platforms that allow direct and secure access to necessary forms can significantly enhance the filing experience.

Legal Use of Form 941 for 2017

Filing Form 941 is a legal requirement for employers in the United States, governed by the IRS regulations. The legal use of this form ensures compliance with federal tax laws, specifically regarding the withholding and reporting of employee taxes. There are a few crucial points to note:

- Compliance with IRS Standards: Failure to comply with the IRS regulations regarding the timely filing of Form 941 can lead to penalties. This form must be filed quarterly, and adjusting information must be reported accurately.

- Protection from Penalties: Proper filing protects employers from potential audits and penalties associated with incorrect reporting. By accurately completing Form 941, employers demonstrate their commitment to compliance with federal tax laws.

- Audit Trail: The completed Form 941 serves as a crucial document in the event of an IRS audit, providing clear evidence of tax liabilities reported.

Understanding the legal aspects of Form 941 is essential for maintaining compliance as an employer.

Important Dates for Filing Form 941 for 2017

Adhering to the filing deadlines for Form 941 is crucial for avoiding penalties. The key dates for Form 941 for the year 2017 are as follows:

- Quarter 1: Due by April 30, 2017, for wages paid from January 1 to March 31.

- Quarter 2: Due by July 31, 2017, for wages paid from April 1 to June 30.

- Quarter 3: Due by October 31, 2017, for wages paid from July 1 to September 30.

- Quarter 4: Due by January 31, 2018, for wages paid from October 1 to December 31.

Staying aware of these dates helps employers remain compliant and avoids any unnecessary penalties associated with late filings.