Definition and Meaning

The Child Tax Credit is a federal tax benefit designed to assist families with the financial responsibility of raising children. It provides a significant reduction in tax liability, offering financial relief to qualifying taxpayers with dependent children.

- Objective: The credit aims to help parents offset some of the costs associated with raising a family.

- Historical Context: It's a part of evolving tax relief measures, periodically modified by legislation to adjust to economic conditions and family income needs.

- Impact: By reducing the tax burden, this credit helps families to allocate more of their income to essential living expenses.

How to Obtain the Child Tax Credit

To obtain the Child Tax Credit, eligible taxpayers must include it in their annual tax return submission. The process requires:

- Eligibility Verification: Confirming that your child or dependent meets the requirements, such as age, residency, and relationship criteria.

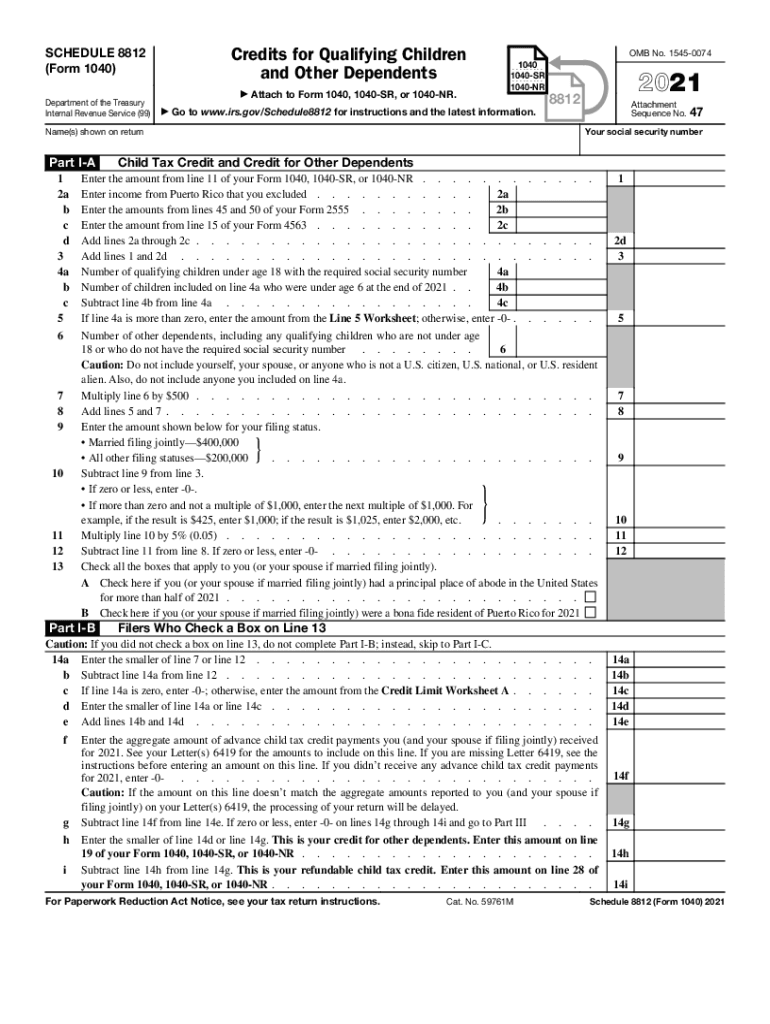

- Form Completion: Accurately completing the relevant sections in Form 1040 and Schedule 8812, where you calculate the credit.

- Supporting Documents: Assembling necessary documents that verify the details of your dependents.

Parents and guardians should ensure that they meet all criteria and complete forms accurately to facilitate smooth processing.

Eligibility Criteria

Eligibility for the Child Tax Credit is determined based on specific qualifications:

- Child's Age: The child must be under a certain age at the end of the tax year.

- Relationship to Taxpayer: The qualifying child must be a son, daughter, stepchild, or eligible foster child.

- Residency Requirements: The child must have lived with the taxpayer for more than half of the tax year.

- Financial Support: The child should not be self-supporting, meaning they did not provide over half of their own support.

- Dependent Status: Each qualifying child must be claimed as a dependent on your tax return.

These criteria are crucial for determining eligibility and maximizing the credit available to eligible families.

Steps to Complete the Child Tax Credit

Completing the Child Tax Credit involves several critical steps:

- Gather Documentation: Collect all necessary personal and dependent information, including Social Security numbers.

- Calculate Income Thresholds: Determine if your adjusted gross income (AGI) falls below the phase-out threshold for the year.

- Complete IRS Form 1040: Enter the credit amount on the tax return, using Schedule 8812 for detailed calculations.

- Verify Information: Double-check entries for accuracy to avoid delays in processing.

- Submit the Return: File either electronically or by mail, ensuring all schedules and attachments are included.

Adhering to this process ensures that taxpayers can claim their full credit in a timely manner.

Important Terms Related to Child Tax Credit

Understanding key terms related to the Child Tax Credit is essential for accurate completion:

- Qualifying Child: A dependent who meets all IRS criteria for the credit.

- Phase-Out Threshold: Income limits beyond which the credit amount starts to decrease.

- Refundability: Some of the credit may be refundable, meaning it can exceed your total tax liability and result in a refund.

- AGI: Adjusted Gross Income used in determining phase-out applicability.

These terms often appear in forms and instruction guides, necessitating a clear understanding to avoid confusion.

IRS Guidelines

The IRS provides detailed guidelines to help taxpayers claim the Child Tax Credit:

- Publications: IRS Publication 972 offers comprehensive instructions on calculating and claiming the credit.

- Online Resources: Information on the IRS website includes FAQs and interactive tools for credit calculation.

- Assistance Programs: IRS Volunteer Income Tax Assistance (VITA) programs aid in credit application for qualifying taxpayers.

Familiarizing yourself with these resources can ease the filing process and enhance compliance.

Filing Deadlines and Important Dates

Staying informed about vital deadlines is crucial for successful tax filing:

- Annual Filing Deadline: Typically April 15, unless extended.

- Form Availability: Forms become available at the start of each tax year for preparation.

- Important Events: IRS may announce extensions or special circumstances due to legislative changes.

Meeting these deadlines ensures timely credit retrieval and avoids penalties.

Application Process and Approval Time

The Child Tax Credit application process often leads into:

- Timelines for Processing: Typically aligned with general tax return processing times.

- Direct Deposits or Refunds: Approved credits usually see reallocation as part of tax refunds.

- Resolution of Discrepancies: Any issues or rejections may cause delays; seeking clarification promptly helps expedite resolution.

Understanding these factors aids taxpayers in managing expectations for credit approval timelines.

Penalties for Non-Compliance

Failing to comply with Child Tax Credit regulations can result in penalties:

- Inaccurate Information: Providing incorrect details can lead to penalties or disallowed credits.

- Missed Deadlines: Late submissions could facilitate penalty fees and interest charges.

- Fraudulent Claims: Intentional misrepresentation for credit acquisition invites severe penalties.

Adherence to IRS rules ensures not only full benefit from the credit but also legal compliance.