Definition & Purpose of Form 8

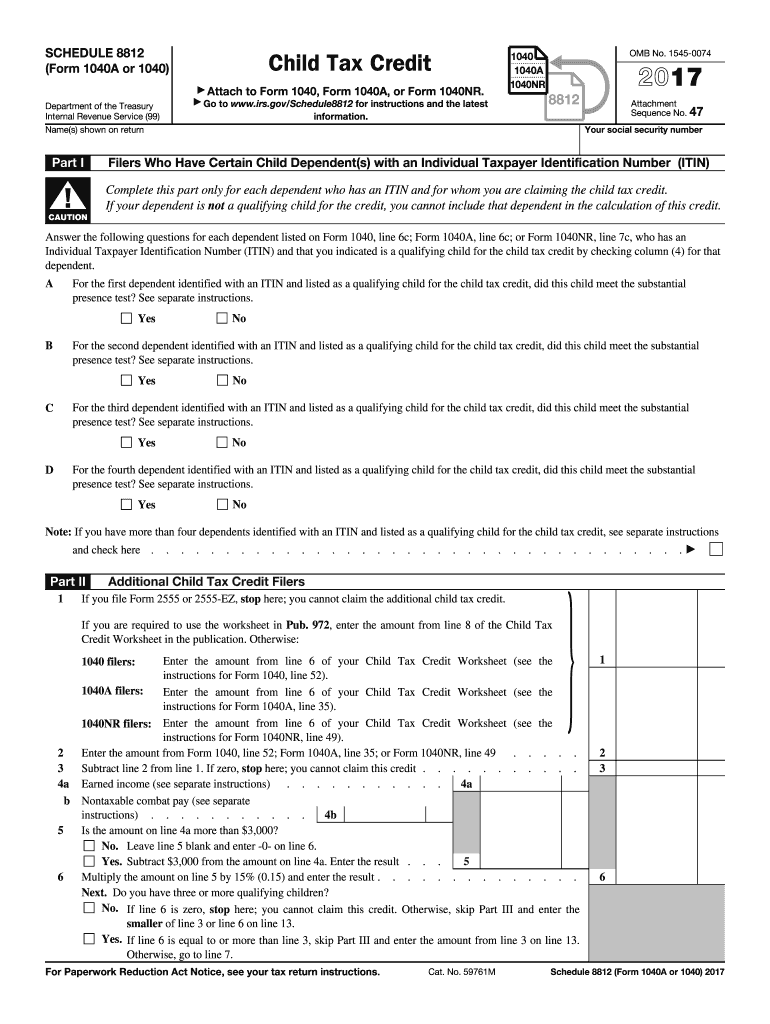

Form 8812, Schedule 8812, is primarily used for claiming the Child Tax Credit and the Additional Child Tax Credit on tax returns. In the 2017 tax year, this form was essential for taxpayers to accurately calculate and claim these credits, which could significantly reduce their federal income tax liabilities. The form helps determine eligibility based on factors such as earned income, the number of qualifying children, and residency status as required by tax laws.

Key Objectives of Form 8812

- Claiming Credits: The main function of the form is to assist in claiming the Child Tax Credit and Additional Child Tax Credit.

- Determining Eligibility: It helps ascertain whether taxpayers meet the criteria for these credits based on their financial and family situation.

- Calculating Credit Amount: It provides a structured method to compute the exact amount of credit owed.

Steps to Complete Form 8

Accurate completion of Form 8812 requires attention to detail and proper documentation. Here's a step-by-step guide to filling out the form:

- Gather Required Information: Collect personal details, social security numbers for each qualifying child, and documentation supporting income and deductions.

- Determine Eligibility: Check if your dependents and your income level qualify for the credits, using the guidelines provided by the IRS.

- Complete Part I: Fill out the portion that deals with the calculation of the Child Tax Credit, ensuring all relevant figures are correctly entered.

- Complete Part II: This section covers the Additional Child Tax Credit. Calculate the additional credit using your earned income.

- Review and Submit: Double-check all entries for accuracy and submit the completed form alongside your Form 1040 or 1040A.

Eligibility Criteria

Eligibility for Form 8812 involves several key requirements. To claim the credits, the taxpayer:

- Must have a qualifying child under the age of 17 at the end of the tax year.

- Needs to meet income thresholds set by the IRS for the respective tax year.

- Must have a valid Social Security Number for the child and themselves.

Certain taxpayers, such as those with high adjusted gross incomes, might face reduced credit eligibility due to phase-out thresholds.

How to Obtain Form 8

Form 8812 can be obtained through various means:

- IRS Website: Download the form directly from the IRS website.

- Tax Software: Use tax preparation software like TurboTax or QuickBooks, which typically include all necessary forms.

- Professional Tax Preparation Services: Tax professionals often provide physical copies of necessary forms during consultations.

IRS Guidelines for Form 8

The IRS provides comprehensive guidelines for taxpayers using Form 8812. These instructions detail how to fill out the form correctly, including definitions of qualifying children and specific income limitations.

- Age Requirement: Explains the age and residency requirements for dependents.

- Income Thresholds: Details income levels that affect eligibility and credit amounts.

- Documentation: Outlines required documentation to support claim applications.

Important Terms Related to Form 8

Understanding key terms is crucial for accurate form completion:

- Qualifying Child: Defined as a child under 17 who meets IRS relationship and residency tests.

- Phase-Out Threshold: The income level beyond which the credit begins to decrease.

- Earned Income: Income received from employment, self-employment, or other active work efforts.

Filing Deadlines / Important Dates

Timely submission of Form 8812 is essential:

- Standard Deadline: Typically aligned with the federal income tax deadline, usually April 15.

- Extensions: Possible through filing an IRS extension request form, usually resulting in a six-month extension.

Required Documents for Form 8

Preparation of Form 8812 necessitates several documents:

- Proof of Income: Pay stubs, W-2s, or 1099 forms to verify earnings.

- Social Security Numbers: For all children claimed under the credits.

- Tax Return: Must accompany the completed Form 8812, generally filed with Form 1040 or 1040A.

Ensuring all documents are gathered and accurate greatly facilitates the completion process and maximizes credit eligibility.