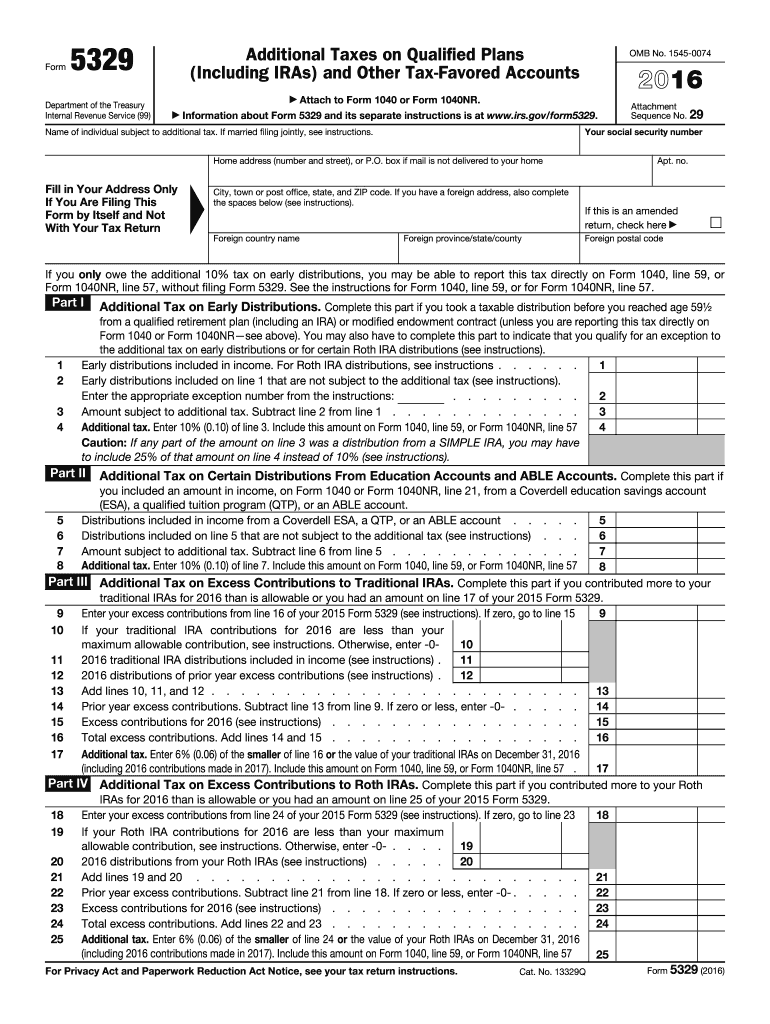

Definition and Purpose of Form 5329

Form 5329, titled "Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts," is utilized by individuals to report and calculate additional taxes related to retirement accounts. This includes taxes on early distributions, excess contributions, and failures to take required minimum distributions. It serves as an essential document for ensuring compliance with specific IRS regulations regarding tax-advantaged accounts.

Sections of Form 5329

Form 5329 consists of multiple sections, each designed to address particular tax situations:

- Part I deals with the additional tax on early distributions from IRAs and other qualified retirement plans.

- Part II addresses the tax on excess contributions to your IRAs, including Roth IRAs.

- Part III covers the tax on excess contributions to other tax-favored accounts, such as health savings accounts (HSAs).

How to Obtain Form 5

Obtaining Form 5329 for the 2016 tax year is straightforward. The IRS website hosts downloadable versions of the form, allowing you to either print it for manual completion or fill it out digitally. Additionally, many tax software programs include Form 5329 within their systems, providing guided assistance for accurate completion.

Steps to Complete Form 5

Completing Form 5329 involves several critical steps:

- Identify Applicable Parts: Determine which sections of the form are relevant to your tax situation, such as early withdrawals or excess contributions.

- Gather Information: Collect all necessary documentation, including your year-end statements from retirement accounts, to report accurate figures.

- Calculate Additional Taxes: Use the instructions provided with the form to correctly compute any additional taxes owed, including exception codes that might apply to reduce these taxes.

- Attach to Tax Return: Attach your completed Form 5329 to your main tax return (Form 1040 or 1040NR) before submission.

IRS Guidelines for Form 5329

The IRS provides comprehensive guidelines to help taxpayers understand how to use Form 5329:

- Early Distributions: An additional 10% tax typically applies to early distributions if the taxpayer is under age 59½, unless exceptions are met.

- Excess Contributions: Taxpayers must rectify excess contributions to avoid penalties and are required to report such excesses.

- Minimum Distributions: Penalties for failure to take required minimum distributions can be significant, typically calculated at 50% of the amount that should have been withdrawn.

Penalties for Non-Compliance

Failing to properly file Form 5329 can lead to hefty penalties. For instance, if early distribution rules are violated without an appropriate exception, taxpayers face a 10% tax on the withdrawn amount. Similarly, neglecting to take required minimum distributions results in a 50% tax on the shortfall. Therefore, precise and timely submission is critical to avoid such penalties.

Who Typically Uses Form 5329

Form 5329 is commonly used by taxpayers who have:

- Made early withdrawals from retirement plans and are not yet 59½ years old.

- Contributed beyond the allowed limits to IRAs or other tax-favored accounts.

- Failed to take required minimum distributions from their accounts.

These scenarios often involve retirees, self-employed individuals, or people undergoing significant financial transitions.

Form Submission Methods

Form 5329 can be submitted through several methods:

- Online Filing: Digital submission is possible through IRS-approved tax software, providing convenience and error checks.

- Mail: Paper forms can be mailed along with Form 1040 or 1040NR to the corresponding IRS service center.

- In-Person: Although less common, in-person submissions are available at local IRS offices.

Required Documents and Accuracy

Accurate completion of Form 5329 is crucial, necessitating the collection of supporting documents:

- Year-end retirement account statements to verify contributions and distributions.

- Documentation for any claimed exceptions to the additional taxes, such as IRS Form 8606 for nondeductible IRA contributions.

Ensuring these documents are prepared will facilitate a smooth filing process and reduce potential for IRS scrutiny.