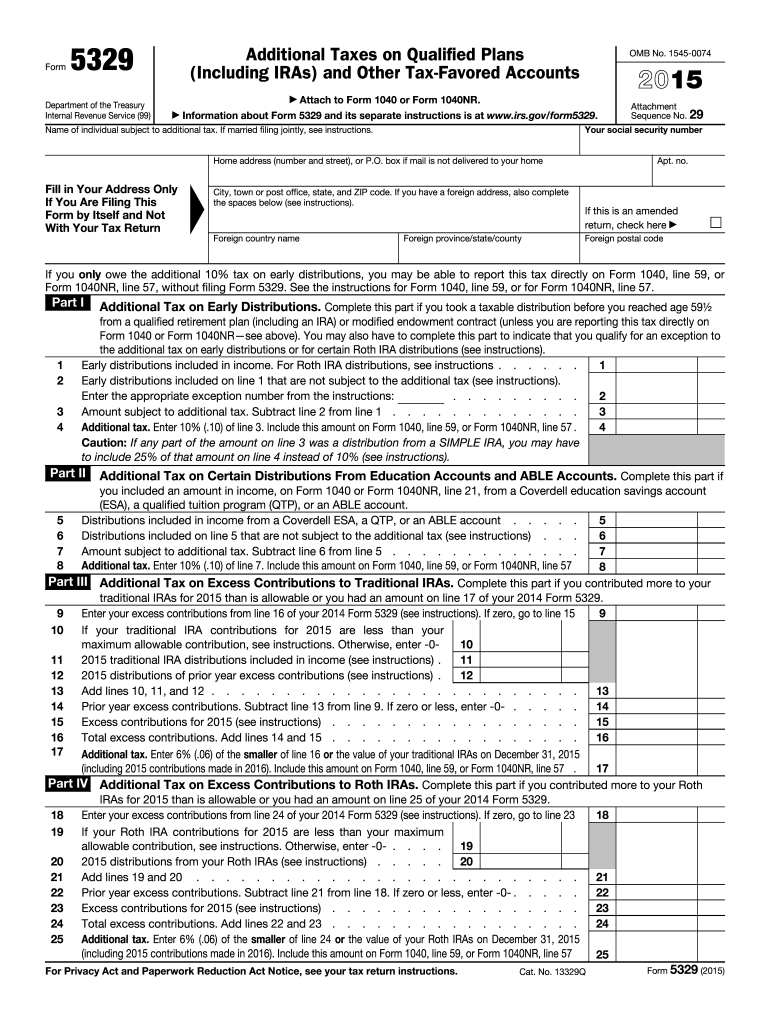

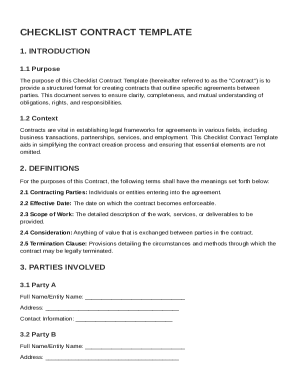

Understanding the 2013 Form 5329

Form 5329 for the year 2013 serves as a pivotal document for taxpayers needing to report additional taxes on qualified plans, including IRAs and other tax-favored accounts. This tax form is essential for individuals who have received early distributions, made excess contributions, or failed to meet required minimum distributions. The form is submitted in conjunction with Form 1040 or 1040NR as part of the individual's annual tax responsibilities.

Steps to Complete the 2013 Form 5329

-

Gather Required Information:

- Collect details of all retirement accounts.

- Have your Form 1040 or 1040NR ready, as it needs to be filed together with Form 5329.

-

Fill in Part I:

- Report any early distributions from IRAs or other qualified plans.

- Obtain and fill out information from your 1099-R form, if applicable.

-

Complete Part II:

- Indicate if you have any excess contributions to traditional IRAs.

- Calculate the applicable penalty.

-

Address Parts III to IX:

- Use these sections to report additional areas such as Roth IRAs, Coverdell ESAs, Archer MSAs, HSAs, and more if the situation applies.

-

Verify Information:

- Double-check all entries for accuracy as errors can lead to misreported taxes and possible penalties.

Detailed Breakdown of Penalties

- Penalties can be hefty, often reaching up to 10% of the early distribution amount.

- For excess contributions not correctly reported, the penalty could be as much as 6% each year until the issue is rectified.

Who Typically Uses the 2013 Form 5329?

The form is commonly used by individuals who encounter situations like:

- Early Withdrawals: Taking money out from retirement accounts before reaching 59½.

- Excess Contributions: Contributions above the allowed limits in retirement or other tax-favored accounts.

- Minimum Distribution Failures: Not withdrawing the required minimum amount from retirement plans after reaching age 70½ for certain plans.

Legal Use of the 2013 Form 5329

Form 5329 must be utilized correctly to avoid legal implications such as improperly managing retirement accounts, which could lead to complications during IRS audits or reviews. The form ensures compliance with federal tax obligations associated with retirement and investment accounts.

IRS Guidelines for the 2013 Form 5329

The IRS provides comprehensive instructions for completing Form 5329, emphasizing:

- Accurate Reporting: Ensure precise reporting of amounts and details as erroneous data can complicate or delay your tax filing.

- Timely Filing: Submit the form by the April 15 deadline, unless a filing extension for Form 1040 or 1040NR has been granted.

Importance of Timely Filing

Filing Form 5329 on time is vital to mitigate penalties and ensure that additional taxes are accurately accounted for within the fiscal year. Missing the deadline without appropriate extensions can result in fines or interest on unpaid taxes.

Penalties for Non-Compliance

- Late Filing: Incurs additional financial penalties and interest on due taxes.

- Incorrect Details: May trigger audits, further fines, or additional charges if discrepancies are found.

Eligibility Criteria for the 2013 Form 5329

Individuals need to file this form if they:

- Took early distributions from retirement accounts.

- Contributed excess amounts that were not otherwise corrected.

- Did not meet required minimum distributions as specified under IRS rulings.

Software Compatibility for Digital Filing

Form 5329 for 2013 can be completed using various tax preparation software, enhancing filing accuracy and efficiency for users. Programs like TurboTax and QuickBooks often support the inclusion and accurate filing of this form alongside other tax documentation.

Taxpayers are encouraged to use digital tools to streamline the process, prevent errors, and ensure compliance with all IRS requirements. This approach bridges the gap between manual errors and digital accuracy, being particularly beneficial for individuals who handle their own tax filings without professional assistance.