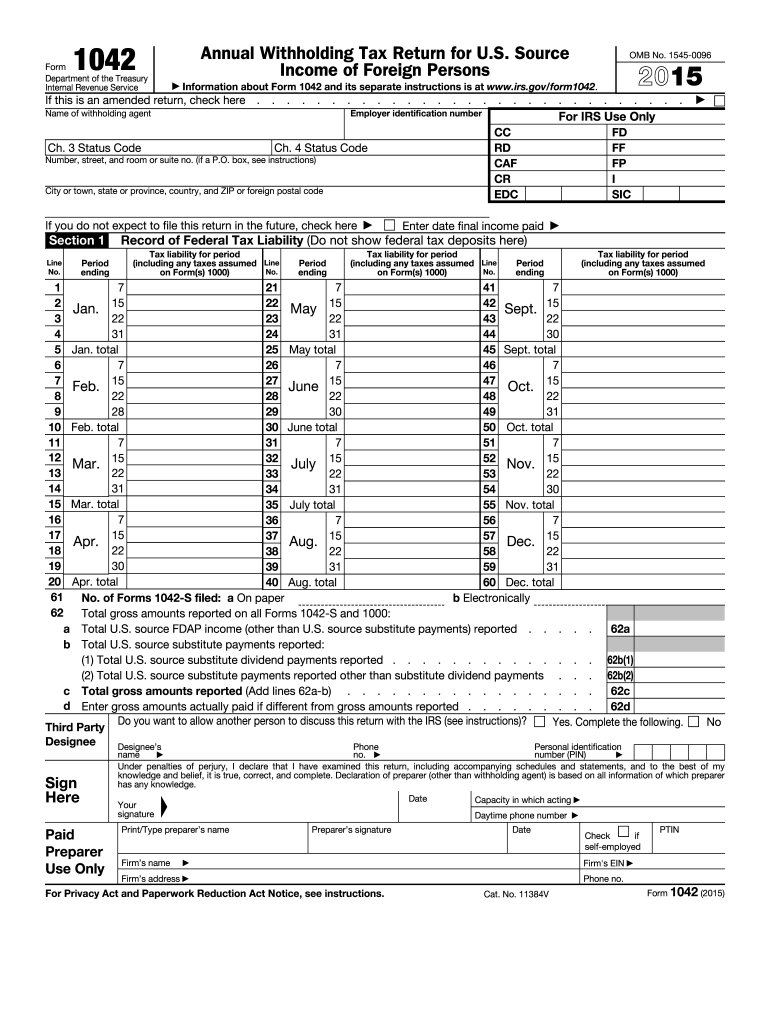

Definition and Purpose of the 2015 Form 1042

The 2015 Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is specifically designed for withholding agents to report and pay taxes on income that is paid to foreign entities or individuals. The income in question typically includes fixed or determinable annual or periodic (FDAP) income sourced in the U.S., such as interest, dividends, rents, and royalties.

Understanding the significance of Form 1042 is essential for compliance with U.S. tax laws. It helps to ensure that the correct taxes are withheld from payments made to foreign recipients, thus preventing potential tax evasion. Filing this form not only assures adherence to IRS regulations but also serves to facilitate international tax treaties that may reduce or eliminate withholding rates for specific countries.

Key Components of Form 1042

- Withholding Tax Liabilities: The form requires reporting of the total amount withheld from U.S. source income along with the corresponding tax liabilities.

- Adjustments and Reconciliations: It allows for reporting adjustments to prior tax years, which may alter the withholding responsibility.

- Instructions for Filing: The form includes guidelines for accurately completing the document to avoid discrepancies and penalties.

Steps to Complete the 2015 Form 1042

Completing the 2015 Form 1042 requires careful attention to detail to ensure compliance and accuracy. Below is a step-by-step breakdown of the necessary process:

-

Gather Necessary Information: Collect all relevant data including income paid to foreign persons, tax withheld amounts, and identifying information about both the payer and recipient.

-

Complete Identification Section: Fill out the withholding agent's details, including name, address, and Employer Identification Number (EIN).

-

Report Income and Withholding Amounts:

- Input the total amounts of U.S. source income.

- Detail the amounts withheld from each type of income.

-

Adjustments Section: If applicable, report any adjustments made in the current tax year concerning withholding from prior years.

-

Review and Verify: Double-check all entries for accuracy before submission. Errors may result in penalties and increased scrutiny from the IRS.

-

Submit the Form: File the completed Form 1042 by the due date, ensuring to use the proper method of submission (online, by mail, or in person).

Tips for Accuracy

- Use tax preparation software to reduce errors.

- Consult IRS guidelines or a tax professional if uncertain about specific entries.

Important Dates and Filing Deadlines for Form 1042

Understanding the key dates associated with the Form 1042 is crucial for maintaining compliance. Here are the important deadlines:

-

March 15: This is typically the deadline for filing the Form 1042 for the previous calendar year. If March 15 falls on a weekend or holiday, the due date is extended to the next business day.

-

30 Days for Correcting Errors: If there are mistakes made in the initial submission, the correction must be filed within 30 days to avoid penalties.

Extensions

-

Automatic Extension: Withholding agents may apply for an automatic 30-day extension by submitting Form 7004.

-

Final Deadlines: Be aware that failure to file by the established extended deadline could result in penalties and interest on unpaid taxes.

Who Uses the 2015 Form 1042?

The 2015 Form 1042 is primarily utilized by withholding agents, which can include various entities:

-

Financial Institutions: Banks and investment firms that pay interest or dividends to foreign account holders or investors.

-

Businesses: Companies that engage in transactions leading to payments classified as U.S. source income for foreign vendors, suppliers, or contractors.

-

Individuals: U.S. taxpayers who make payments to foreign individuals or entities must also act as withholding agents and file this form.

Typical Scenarios for Use

- A U.S. company paying royalties to a foreign entity for the use of its intellectual property.

- A financial institution processing interest payments to non-resident aliens.

Legal Considerations and Compliance for 2015 Form 1042

Compliance with the 2015 Form 1042 is not merely a matter of filing; it incorporates several legal considerations essential for avoiding penalties:

-

IRS Regulations: The IRS mandates accurate reporting of income and taxes withheld. Non-compliance can lead to significant fines.

-

Tax Treaties: U.S. tax treats may alter withholding obligations based on the recipient's country of residence. Awareness and application of these treaties can significantly affect reported tax liabilities.

Consequences of Non-Compliance

- Financial Penalties: Failure to file forms or inaccuracies can result in financial sanctions that compound over time.

- Legal Action: In severe cases, persistent failure to comply may lead to further scrutiny or audits of the withholding agent's tax practices.

Understanding these nuances is essential for effective tax management and compliance within the U.S. tax system, particularly for international transactions.