Definition and Purpose of Form 1042

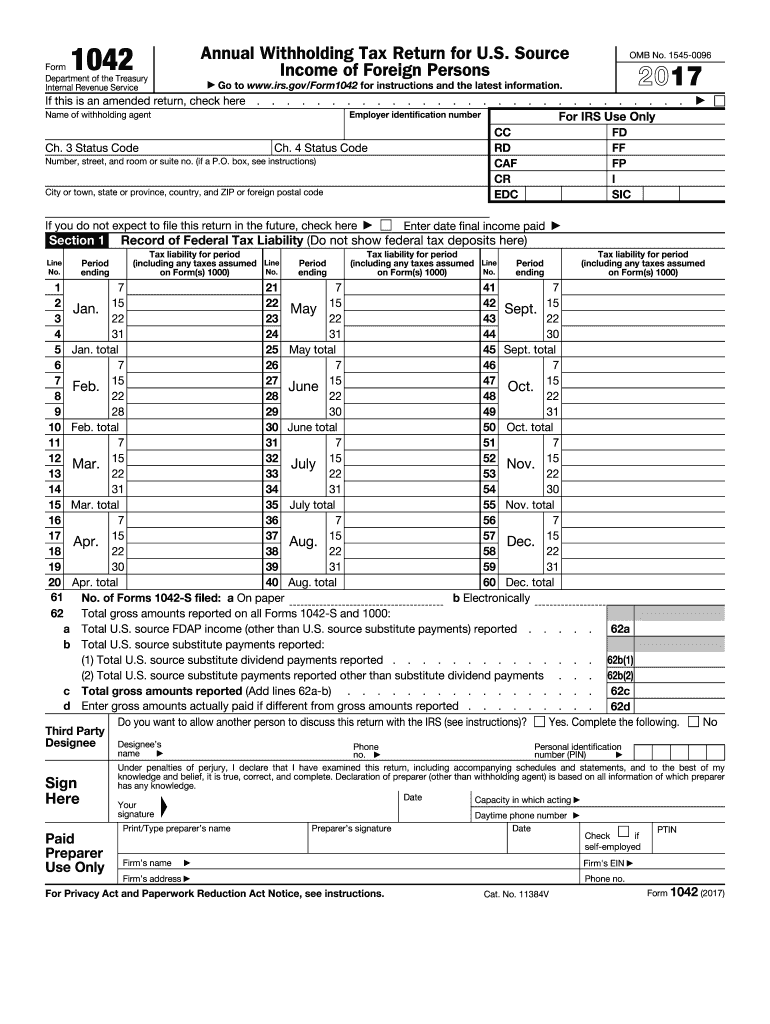

Form 1042, titled "Annual Withholding Tax Return for U.S. Source Income of Foreign Persons," is specifically designed for withholding agents—those who make payments to foreign individuals and entities. This form is crucial for reporting and paying taxes on income categorized as U.S. source Fixed, Determinable, Annual, or Periodical (FDAP) income. It provides a structured approach to disclose tax liabilities, adjustments, and reconciliations pertinent to income that foreign persons receive from U.S. sources, ensuring compliance with U.S. tax law.

Key Aspects of Form 1042 Include:

- Reporting details about the income paid to foreign individuals or entities.

- Calculating the amounts withheld for tax purposes.

- Reconciling income paid and taxes withheld throughout the year.

- Ensuring proper documentation is maintained for compliance audits by the IRS.

Importance of Compliance:

By accurately completing Form 1042, withholding agents fulfill their legal obligations, thus avoiding potential penalties or interest on unpaid taxes. Additionally, this form helps foreign payees understand their tax obligations and facilitates proper reporting of their income on their respective tax returns in their home countries.

How to Use Form 1042

Using Form 1042 involves several important steps that every withholding agent should follow. Understanding how to effectively complete this form ensures compliance with IRS regulations and accurate reporting of taxes withheld.

-

Gather Necessary Information: Before filling out the form, collect all relevant information regarding the payments made to foreign individuals or entities, including names, addresses, and taxpayer identification numbers.

-

Complete the Form: Follow the designated sections of the form, carefully inputting income amounts, deductions, and taxes withheld. Each section must be completed accurately to reflect the true nature of the payments made.

-

Calculate Taxes: Determine the total amount of tax liability, as well as any adjustments or credits that may apply to the payments reported.

-

Review for Accuracy: Before submission, review the form thoroughly to ensure that all information is accurate and that no errors are present.

-

Maintain Records: Keep copies of the form and all supporting documentation for at least three years. This is vital in case of an IRS audit or request for information.

How to Obtain Form 1042

Form 1042 can be obtained through several reliable avenues. Withholding agents have the option to download the form directly from the IRS website or request a physical copy.

Available Formats:

- Downloadable PDF: The IRS provides the form as a PDF file that can be filled out electronically or printed for manual completion.

- Official IRS Website: Access the most recent version of the form along with instructions directly from the IRS website, ensuring compliance with current tax standards.

Additional Resources:

- Instructions: Along with the form, detailed instructions are also available, guiding users in filling it out accurately.

- Local IRS Office: Withholding agents can visit their nearest IRS office to obtain a physical copy of the form and receive assistance.

Steps to Complete Form 1042

Completing Form 1042 requires careful attention to detail and adherence to IRS guidelines. Here are the structured steps to ensure successful completion:

-

Identify and Collect Relevant Information

- Obtain payment details, including payer information and the nature of income.

- Gather documentation for any tax treaty benefits applicable to foreign payees.

-

Fill Out the Form Sections

- Enter identifying information for both the withholding agent and the foreign recipient.

- Provide a detailed account of all payments made, specifying any exempt amounts under applicable tax treaties.

-

Calculate Total Withholding

- Accurately compute the tax amount withheld based on the IRS withholding rates and treaty provisions.

- Ensure that all entries are clear and concise, preventing potential misunderstandings.

-

Review and Finalize

- After completing the form, cross-check all data entries to minimize errors.

- Validate that all applicable forms and supporting schedules are attached.

-

Submit the Form

- Decide on the submission method, whether electronically or via mail.

- Keep a copy of the completed form for personal records along with any confirmations of submission.

Important Terms Related to Form 1042

Understanding the terminology associated with Form 1042 is crucial for accurate completion and compliance with IRS guidelines. The following terms are essential:

- Withholding Agent: An individual or entity responsible for withholding taxes on payments to foreign individuals or businesses.

- U.S. Source Income: Income derived from sources within the United States, obligated to U.S. tax requirements regardless of the recipient's location.

- FDAP Income: Fixed, Determinable, Annual, or Periodical income that is subject to U.S. withholding tax, such as interest, dividends, and rents.

- Tax Treaty: An agreement between the U.S. and another country that may reduce or eliminate withholding taxes on certain types of income.

These definitions provide clarity and context, enhancing the user's ability to complete the form correctly and understand its implications fully.

IRS Guidelines for Form 1042

The IRS stipulates specific guidelines related to the use and filing of Form 1042. Adhering to these guidelines is critical for compliance and accurate reporting.

Key Points of the IRS Guidelines:

- Filing Deadline: Form 1042 must be filed annually by March 15 of the following tax year.

- Payment Requirements: Taxes withheld must be deposited with the IRS using Electronic Federal Tax Payment System (EFTPS) to meet payment obligations.

- Documentation: Retain all backup documentation related to payments and withholding to be used in the event of an IRS audit.

- Penalties for Non-Compliance: The IRS imposes penalties for late payments, inaccurate information, and failure to file the form.

By following these guidelines, withholding agents can navigate the complexities of U.S. tax obligations, mitigating risks associated with penalties and audits.