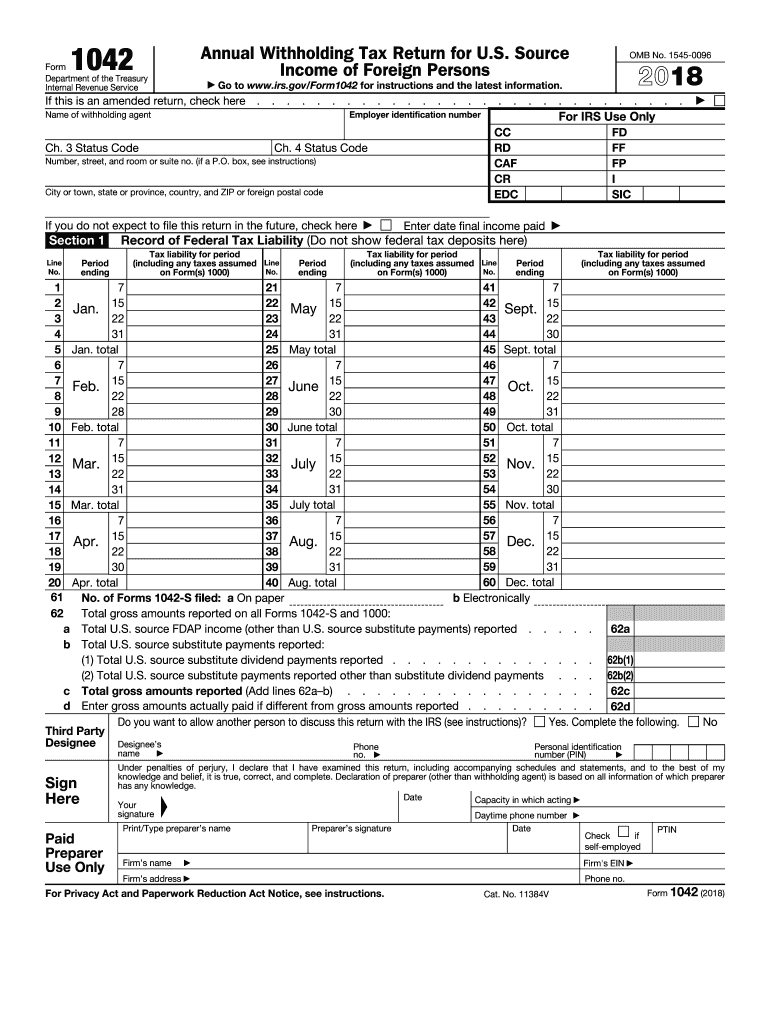

Definition and Purpose of the 1042 S Form Fillable Print Template

The 1042 S form fillable print template is utilized for reporting U.S. source income that is paid to foreign persons. Primarily crafted for withholding agents, this form is crucial for ensuring compliance with U.S. tax regulations. The income reported can encompass various categories, such as dividends, interest, rents, and royalties. By using the fillable template, individuals and organizations can electronically complete and print the form, streamlining the submission process.

Key features of the template include:

- Ease of use: The fillable nature allows users to enter data directly into the document, minimizing the possibility of errors.

- Clarity: Sections are clearly defined, making it easier to provide accurate information.

- Efficiency: The ability to print the completed form allows for a straightforward filing process.

Misreporting income or failing to file can result in significant penalties, emphasizing the template's importance in maintaining accurate records of taxation for foreign income.

Steps to Complete the 1042 S Form Fillable Print Template

Completing the 1042 S form fillable print template involves several precise steps. It is essential to follow these steps diligently to ensure the accuracy and compliance of the reported information.

- Download the Template: Access the form from a trusted source, ensuring that it is the most recent version.

- Enter Information: Input the appropriate details in each section of the form, including:

- Recipient Information: Full name, address, and taxpayer identification number.

- Withholding Agent Details: Name, address, and identification number of the paying entity.

- Income Details: Specify the type and amount of income paid, along with any tax withholding amounts.

- Review for Accuracy: Double-check entered information for any discrepancies or errors to avoid penalties.

- Add Signature: Upon reviewing, the responsible party must sign the document to attest to its accuracy.

- Print the Form: Once completed, print a hard copy for submission.

- File the Form: Submit the form either electronically or via traditional mail to the appropriate authority.

Taking these steps not only aids in correct completion but also positions individuals for compliance with IRS regulations.

Important Terms Related to the 1042 S Form Fillable Print Template

Understanding key terms associated with the 1042 S form fillable print template is vital for effective completion and compliance. Here are notable terms and their meanings:

- Withholding Agent: The individual or entity responsible for deducting and remitting tax on payments made to foreign persons.

- FDAP Income: Fixed, Determinable, Annual, or Periodical income, which includes various types of income such as interest and dividends that require tax withholding.

- Taxpayer Identification Number (TIN): A unique number assigned to individuals or organizations for tax purposes in the United States.

- Form 1042: This form encompasses annual reports related to withholding tax but does not include annual income details as the 1042 S form does.

Familiarity with these terms ensures that users are better prepared when handling the form and navigating the related tax implications.

Who Typically Uses the 1042 S Form Fillable Print Template

Several entities utilize the 1042 S form fillable print template, highlighting its significance in various sectors. Key users include:

- Withholding Agents: Organizations such as banks, brokerage firms, and other financial institutions required to report payments made to foreign parties.

- Foreign Investors: Non-U.S. residents receiving income from U.S. sources leverage this form to report and comply with tax requirements.

- Tax Professionals: Accountants and tax advisors commonly assist clients in accurately completing this form to ensure adherence to tax regulations.

- Businesses with Foreign Engagements: Companies that have foreign personnel or make payments to foreign contractors or partners must use this form for accurate reporting.

Recognizing the primary users aids in understanding the document's key role in both corporate and individual tax reporting.

IRS Guidelines for Using the 1042 S Form Fillable Print Template

The IRS provides comprehensive guidelines for using the 1042 S form fillable print template effectively, focusing on compliance and accuracy. Important aspects of these guidelines include:

- Eligibility: Ensure that the income reported qualifies under the definitions provided by the IRS for FDAP income.

- Submission Format: The form may be filed electronically or through paper submissions, but electronic filing is encouraged for efficiency.

- Accuracy Standards: Detailed instructions emphasize the significance of accurate information, including TINs and income amounts, to avoid discrepancies during tax processing.

- Penalty Structures: Familiarize oneself with potential penalties related to failure to file or inaccurately reported information, which can include financial fines and delayed processing of tax obligations.

Following IRS guidelines is crucial not only for compliance but also for maintaining a transparent relationship with tax authorities.