Definition & Meaning

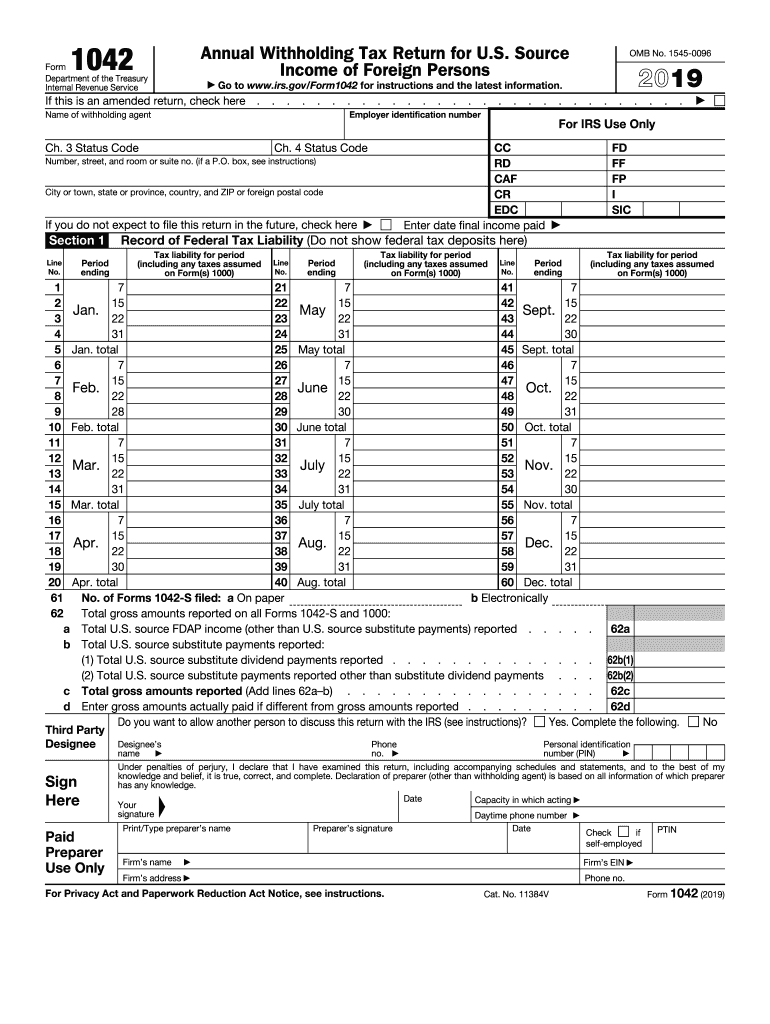

Form 1042 is an annual withholding tax return required by the IRS to report the tax withheld on U.S. source income paid to foreign individuals or entities. The form is essential for withholding agents, such as financial institutions and other payers of interest, dividends, or other types of income. It ensures compliance with the U.S. tax regime by detailing the tax liabilities, adjustments, and the reconciliation of payments associated with U.S. source Fixed, Determinable, Annual, or Periodical (FDAP) income.

How to Use Form 1042

Using Form 1042 involves several key steps. First, withholding agents must gather details about the income amounts subject to withholding, as well as any exemptions or reductions based on tax treaties. Next, they must calculate the appropriate amount of U.S. withholding tax. Form 1042 requires reporting the gross income, any deductions applied, and the net amount subject to tax. A reconciliation section helps verify that the total tax withheld matches what was actually deposited with the IRS.

Steps to Complete Form 1042

- Identify all payees: Ensure all income recipients are foreign persons or entities.

- Gather income data: Compile data for all payments made, such as interest and dividends.

- Calculate tax amounts: Use IRS guidelines to determine the tax to be withheld.

- Complete form sections: Fill in details on total income paid, taxed, and any deductions.

- Reconciliation: Double-check that the tax withheld equates to the payments deposited.

Why Should You Use Form 1042

Compliance with U.S. tax reporting obligations is imperative for withholding agents. Form 1042 ensures that the correct tax amounts are withheld from payments to foreign entities and individuals, thus maintaining adherence to IRS guidelines. This form also serves a crucial function by facilitating international transparency and cooperation in taxation, which can prevent double taxation and tax evasion.

Who Typically Uses Form 1042

Form 1042 is generally used by withholding agents responsible for making payments to foreign recipients. This includes banks, insurance companies, and any organization paying interest, dividends, or royalties. Entities that have FDAP income obligations must file this form to report their tax responsibilities accurately. It is also applicable to U.S. partnerships and trusts that distribute U.S. source income to foreign beneficiaries.

Key Elements of Form 1042

Form 1042 includes several critical elements. It features sections for reporting total gross income, the amount subject to withholding, and any exemptions claimed under tax treaties. It also includes a reconciliation statement to ensure that the reported amounts align with what has been withheld and deposited with the IRS. Additionally, various information fields are provided to capture data about both the payer and the payee, aiding in accurate report submission.

IRS Guidelines

IRS guidelines on Form 1042 specify detailed instructions on how to calculate the withholding tax and report the amount to be submitted. They outline the requirements for filing and the relevant due dates. These guidelines also highlight potential exemptions and reductions in withholding tax, such as those applicable under international tax treaties. These rules are crucial to adhere to, as they directly impact the accuracy of the form submission.

Filing Deadlines / Important Dates

The deadline for submitting Form 1042 is generally March 15 of the year following the calendar year in which the payments were made. It is essential for filers to ensure the form is postmarked or electronically submitted by this date to avoid penalties. Any additional taxes owed or discrepancies must be resolved promptly.

Penalties for Non-Compliance

Failing to file Form 1042 accurately and in a timely manner can result in significant penalties. These penalties may include fines for late submission, as well as interest on any underpaid taxes. If withholding agents do not comply correctly, they also risk audits or additional scrutiny from the IRS. Ensuring timely and accurate filing mitigates these risks and promotes compliance.

Examples of Using Form 1042

Consider a U.S.-based bank paying interest to its account holders who are foreign nationals. The bank must calculate the appropriate withholding tax on the interest paid according to IRS regulations and report it on Form 1042. Another example involves a U.S. corporation that pays royalties to a foreign entity for intellectual property use. The corporation is responsible for withholding the correct amount of tax and reporting this on Form 1042, adhering to any applicable treaty benefits.

Digital vs. Paper Version

Form 1042 can be filed either digitally or via paper submission. The IRS encourages electronic filing as it simplifies the process and allows for faster processing and confirmation. Electronic filing platforms can integrate seamlessly with existing accounting software, making it easier for agents to compile and submit data efficiently. In contrast, paper filing involves mailing the completed form by the deadline, which requires early preparation to ensure timely receipt by the IRS.