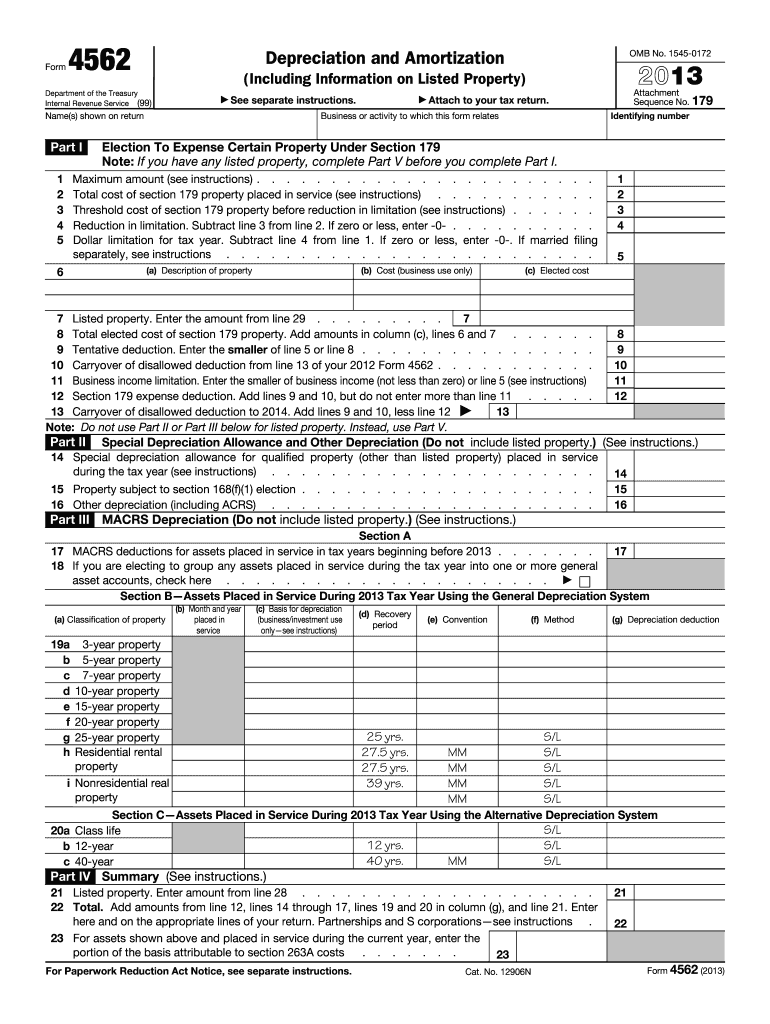

Definition and Purpose of IRS Form 4562

Form 4562, titled Depreciation and Amortization, is utilized to calculate the depreciation of property placed in service during the tax year and to report amortization. This form is integral for businesses and individuals as it helps reduce taxable income through depreciation deductions. Key sections include options for electing to expense certain property under Section 179 and recording special depreciation allowances provided by the IRS.

Sections of the Form

- Part I - Section 179 Election: Allows businesses to deduct the cost of qualifying property rather than capitalizing it.

- Part II - Special Depreciation Allowance: Covers bonus depreciation available for certain types of property.

- Part III - MACRS Depreciation: Provides calculations for Modified Accelerated Cost Recovery System.

- Part IV - Other Depreciation: For non-MACRS and other specific depreciation categories.

- Part V - Listed Property: Details on vehicles and other property that may require special reporting.

How to Use the 2013 IRS Form 4562

Step-by-Step Process

- Gather Necessary Documentation: Collect all business expenditure records, purchase receipts of property, and previous tax returns to verify depreciation carryover.

- Section 179 Deduction: Determine if qualifying for immediate expense deductions under Section 179 is beneficial.

- Calculate Bonus Depreciation: Use Part II to calculate if eligible for the special depreciation allowance.

- Fill Out MACRS Schedule: In Part III, establish guidelines for depreciating property using MACRS.

- Review Listed Property Section: Any vehicles or property listed must be detailed in Part V with proper documentation for business use percentages.

Common Errors to Avoid

- Misclassifying property types, leading to incorrect MACRS calculations.

- Forgetting to account for Section 179 deduction limits, which can alter available deductions.

Obtaining the 2013 IRS Form 4562

Access Methods

- Online Download: Form 4562 is available on the IRS website as a PDF file for easy download and printing.

- Tax Preparation Software: Programs like TurboTax or QuickBooks provide the form digitally, often integrated with additional guidance.

- Physical Copies: Request a paper copy by contacting IRS directly or visiting local IRS offices.

Filing Deadlines and Submission Methods

Important Deadlines

- Filing Date: Typically due by April 15th of each year, aligning with the individual income tax return deadline.

- Extensions: If you file for an extension, Form 4562 should be submitted with your amended return by October 15th.

Methods of Submission

- Electronic Filing: Highly recommended for speed and confirmation of receipt.

- Mail-in Submission: Paper returns can be mailed to the IRS, ensuring you utilize certified mail for tracking.

- Professional Tax Services: A CPA or tax professional can facilitate submission, particularly for complex taxes.

IRS Guidelines for Completing the Form

Detailed Instructions

- Adhere strictly to IRS instructions in the Form 4562 guide, which provides line-by-line guidance.

- Follow official IRS calculation methods for accuracy in reporting depreciation and amortization.

- Consult IRS Publication 946 for deeper insights into property classifications and special allowances.

Key Elements of the 2013 IRS Form 4562

Critical Components to Understand

- Asset Cost Basis: Required for calculating depreciation, including purchase price, installation costs, and related expenses.

- Depreciation Methods: Various methods such as MACRS and straight-line need to be understood for proper implementation.

- Listed Property Limitations: Special constraints on vehicles and other high-value items used for personal and business use.

Taxpayer Scenarios for Form 4562 Usage

Common User Profiles

- Small Businesses and Startups: Often use Section 179 to maximize immediate tax benefits.

- Self-Employed Professionals: For claimable assets and business-related expenditures.

- Corporations and LLCs: For structured depreciation schedules investing in large-scale assets or machinery.

Penalties for Non-Compliance

Potential Consequences

- Financial Penalties: Failure to properly complete and submit Form 4562 may result in fines and interest on unpaid tax.

- Denial of Deductions: Incorrectly claimed depreciation or expenses can lead to the revocation of benefits.

- Audit Risks: Increased scrutiny from IRS audits if discrepancies or inconsistencies are identified in submissions.

By understanding these aspects of filling out the 2013 IRS Form 4562, taxpayers can optimize their tax returns, minimize liabilities, and ensure compliance with guidelines.