Definition and Meaning

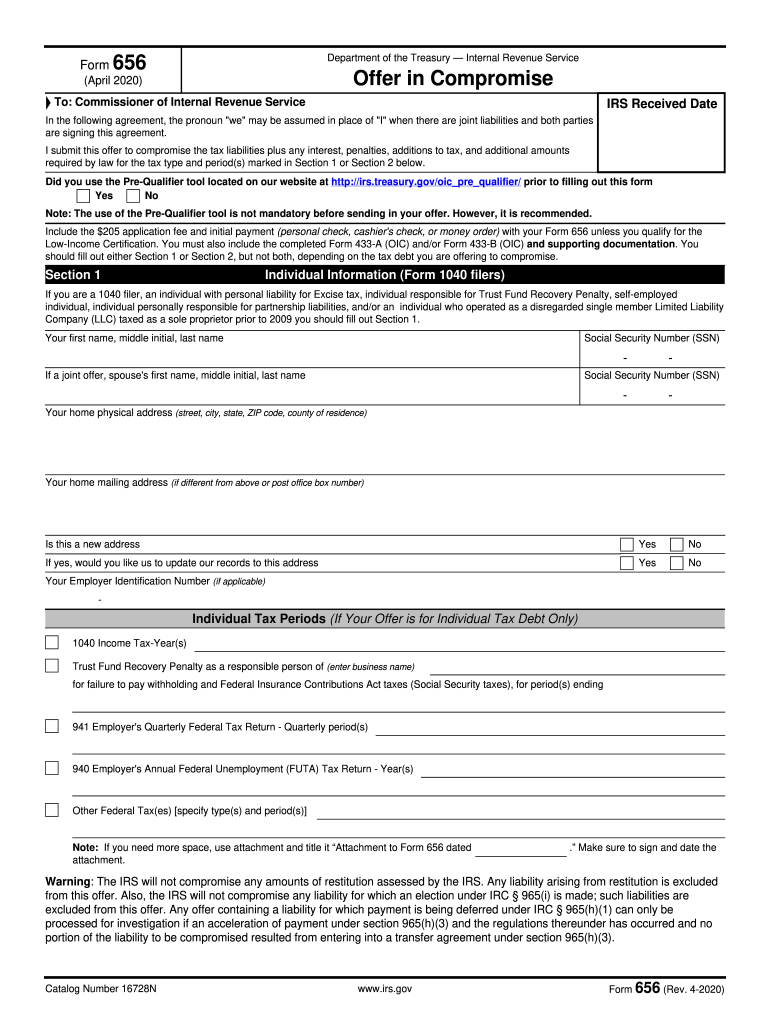

Form 656, also known as the Offer in Compromise (OIC), is a critical document used by both individuals and businesses in the United States to present an offer to the IRS to settle outstanding tax debts for less than the full amount owed. This form signifies an understanding between the taxpayer and the IRS where the taxpayer can negotiate a reduced tax burden under specific conditions. By submitting Form 656, taxpayers aim to establish a payment that they can reasonably handle based on their financial circumstances. The form is part of an administrative process and not a legal right, meaning approval depends on a thorough evaluation of the taxpayer’s situation by the IRS.

How to Use Form 656

Using Form 656 requires a clear understanding of one's financial standing and an honest presentation of this information to the IRS. The form enables taxpayers to propose a compromise amount that reflects their ability to pay, calculated from their income, assets, and overall financial situation. It is essential to support your offer with comprehensive documentation, including income verification, asset valuations, and existing liabilities. The IRS will assess these documents to ensure the offer is fair and in line with what the taxpayer can afford. Users of this form should also be prepared to justify their offer convincingly, often with the help of a tax professional.

Examples

- A self-employed individual experiencing a decline in business revenue may use Form 656 to offer a lesser amount to clear their previous tax liabilities.

- A retiree on a fixed income, unable to pay the full amount of taxes owed, might apply for an Offer in Compromise to alleviate financial stress.

Steps to Complete Form 656

Completing Form 656 involves several vital steps to ensure accuracy and completeness:

- Collect Financial Data: Gather all necessary financial information, including income, expenses, asset values, and liabilities.

- Calculate Offer Amount: Using the IRS worksheet, determine a reasonable offer amount based on your financial data.

- Fill Out the Form: Carefully enter the required information on Form 656, ensuring all sections are completed accurately.

- Attach Documentation: Include supporting documents that verify your financial claims, such as pay stubs and bank statements.

- Choose a Payment Option: Select a payment method for the offer, whether lump-sum or periodic payments.

- Submit the Form: Send the completed form with the offer payment to the appropriate IRS processing center.

Important Considerations

- Make sure the financial summary reflects your true ability to pay to avoid rejection and future complications.

- A preliminary payment is usually required when submitting Form 656, except for those who qualify for Low-Income Certification.

Eligibility Criteria

Eligibility for filing Form 656 is a critical aspect that determines whether the IRS will consider your offer. The primary criteria include:

- Demonstrating an inability to pay the full tax liability due to financial hardship.

- Filing of all required tax returns and making all necessary estimated payments.

- Not currently being in an open bankruptcy proceeding.

- Providing detailed financial information indicating that the offer is the maximum amount the taxpayer can pay over a reasonable time.

Nuances

- Taxpayers under audit or currently facing legal procedures concerning their liabilities should resolve these issues before applying for an Offer in Compromise.

- The IRS considers offers based on doubt as to collectibility, doubt as to liability, or exceptional circumstances.

Required Documents

Comprehensive documentation is required to support Form 656, aiming to verify your financial claims and argue your case effectively. These documents include:

- Proof of income (e.g., pay stubs, profit and loss statements).

- Asset valuations, including real estate and personal property documentation.

- Bank statements and transaction histories.

- Statements of personal living expenses.

Variations

Different financial situations might necessitate additional documentation, such as loan agreements, lease contracts, or divorce decrees, when applicable to the financial profile presented.

IRS Guidelines

The IRS provides specific guidelines to assess Offer in Compromise applications submitted via Form 656. According to these rules:

- All financial information should be truthful and complete.

- Arguments should fall within the categories accepted by the IRS, which are based on inability to pay more than the offered amount.

- A 20% deposit is required for lump-sum offers unless the applicant qualifies as low-income.

Case Studies

- In cases where taxpayers have over-leveraged resources, the IRS has shown lenience, provided that the offer is within the parameters of what they consider collectible.

- Offers with structured periodic payments often benefit those with variable or seasonal income.

Key Elements of Form 656

Form 656 encompasses crucial sections that the taxpayer must navigate:

- Personal Information: Detailed identification for individuals or entities offering the compromise.

- Offer Terms: This section outlines the proposed payment terms and associated conditions, like lump sum or short-term periodic payments.

- Financial Disclosures: Comprehensive financial information that the IRS will evaluate to determine the feasibility of the offer.

- Refund Waivers: Acceptance of the offer can result in the taxpayer forfeiting any potential tax refunds during the offer review period.

Important Terms Related to Form 656

Understanding the terminology associated with Form 656 is vital for accurately navigating and completing the form:

- Doubt as to Collectibility: A basis for filing Form 656 when the taxpayer can prove they can't pay the full amount due.

- Doubt as to Liability: Used when there is legitimate doubt that the assessed tax should indeed be owed.

- Low-Income Certification: A qualification that waives the application fee and pre-payment requirements for those who meet certain income thresholds.

- Offer in Compromise Pre-Qualifier Tool: An online tool provided by the IRS to help taxpayers assess their potential eligibility for an Offer in Compromise before submitting Form 656.

Clarifications

- Taxpayers may not simultaneously dispute the assessed tax amount and ability to pay through the OIC process; separate applications or processes are encouraged based on distinct issues.