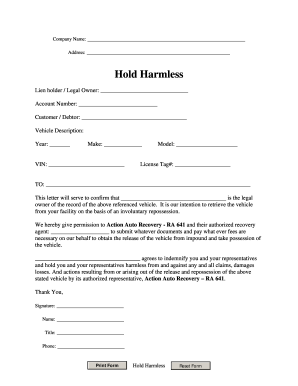

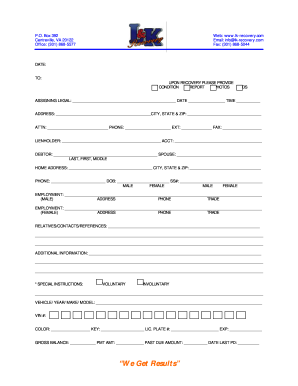

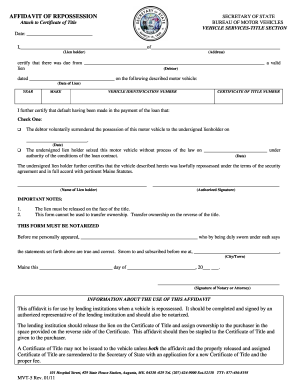

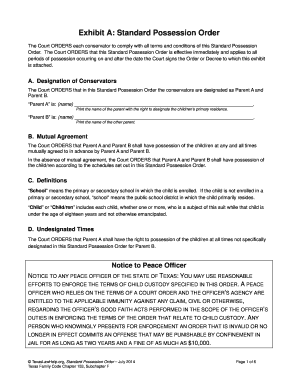

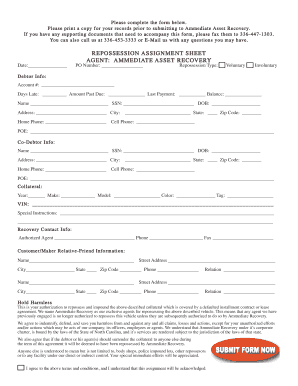

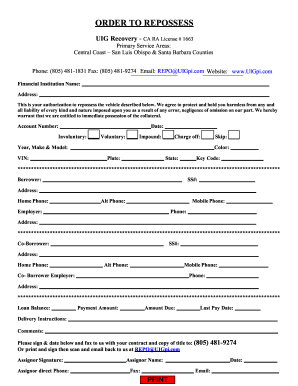

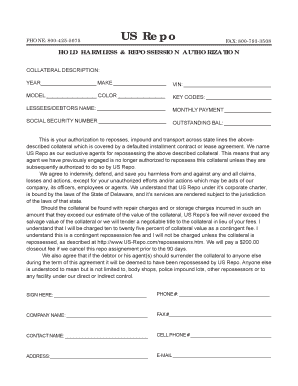

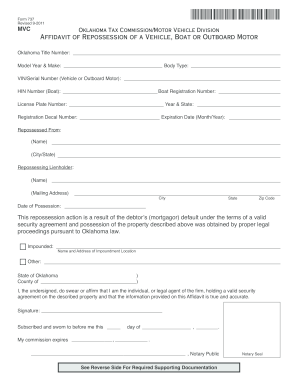

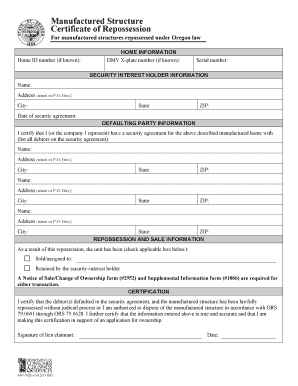

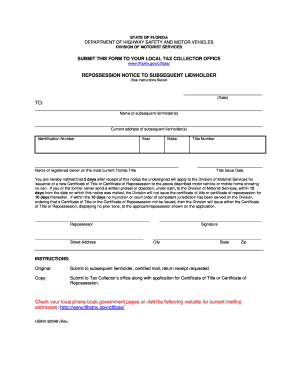

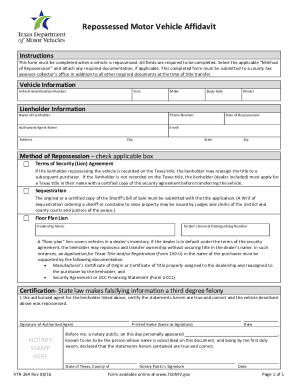

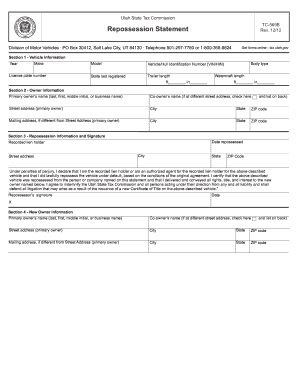

Ensure your company's performance with Repossession Order Forms templates. Choose order forms, edit and share them with your customers in a few clicks.

Boost your file operations using our Repossession Order Forms category with ready-made form templates that meet your requirements. Get the document, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with your forms.

The best way to use our Repossession Order Forms:

Explore all the opportunities for your online document administration with the Repossession Order Forms. Get your totally free DocHub account today!