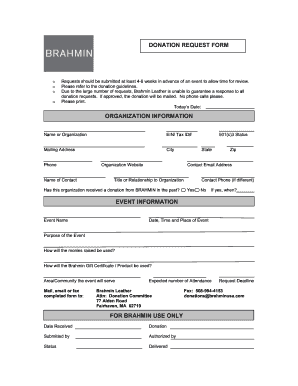

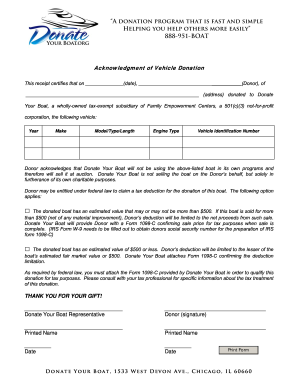

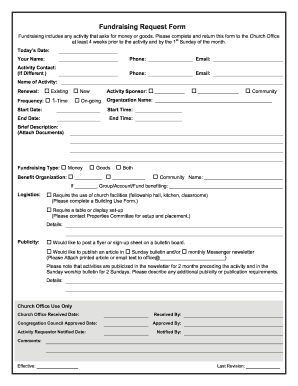

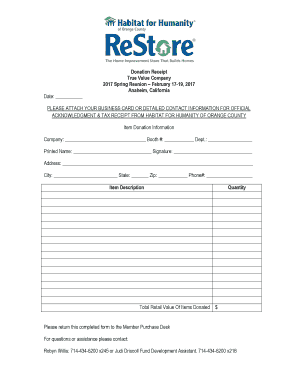

Remove the difficulty from fundraising documents with DocHub's online Receipt email Donation Forms collection. Effortlessly edit, fill out, and safely distribute forms with your contributors.

Record management occupies to half of your business hours. With DocHub, it is possible to reclaim your time and effort and boost your team's productivity. Get Receipt email Donation Forms collection and discover all templates relevant to your everyday workflows.

Effortlessly use Receipt email Donation Forms:

Improve your everyday file management with our Receipt email Donation Forms. Get your free DocHub profile right now to discover all templates.