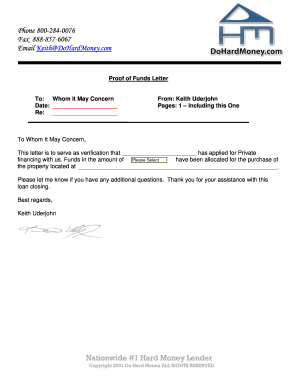

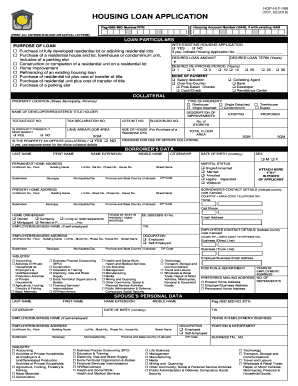

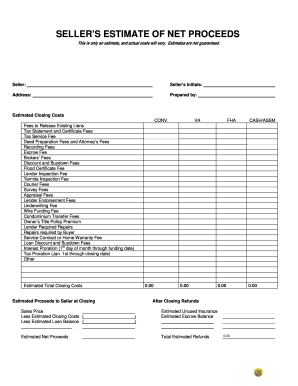

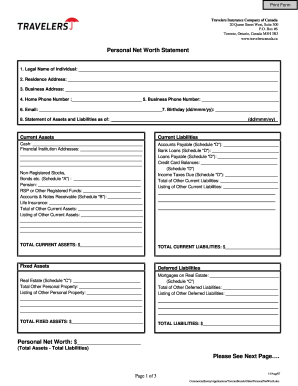

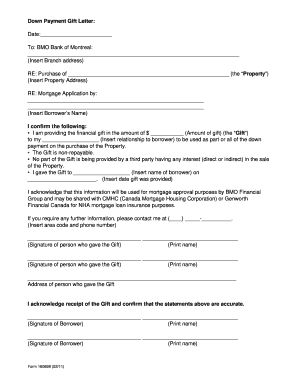

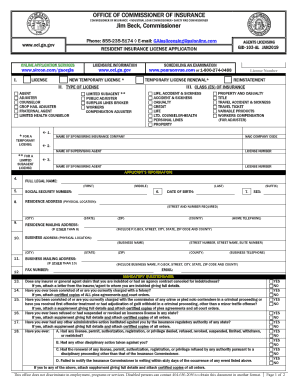

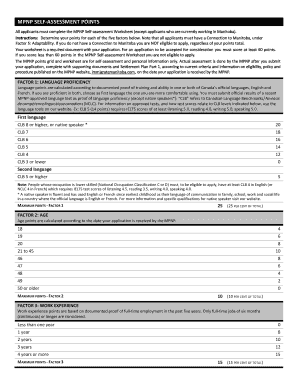

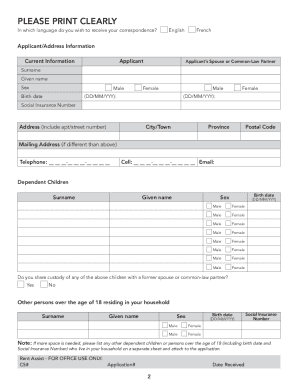

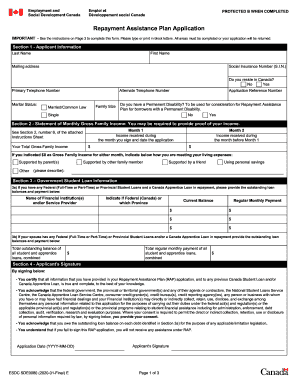

Obtain relevant Mortgage calculator Canada Forms and easily control them according to your needs. Adjust, fill out, and securely send your forms with local authorities.

Your workflows always benefit when you can easily find all of the forms and files you will need at your fingertips. DocHub offers a a large collection forms to ease your day-to-day pains. Get hold of Mortgage calculator Canada Forms category and easily discover your document.

Start working with Mortgage calculator Canada Forms in several clicks:

Enjoy easy document administration with DocHub. Explore our Mortgage calculator Canada Forms online library and get your form right now!