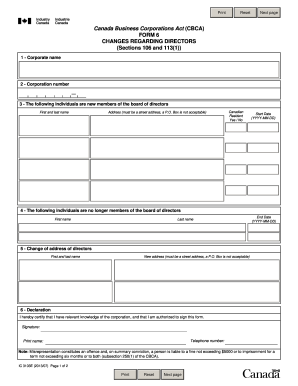

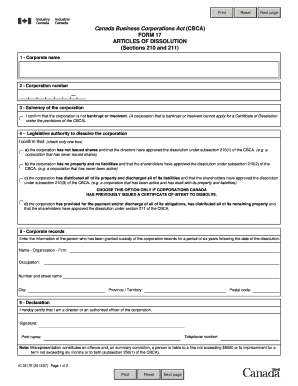

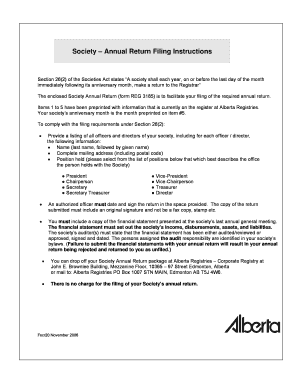

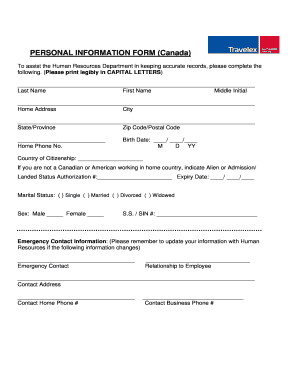

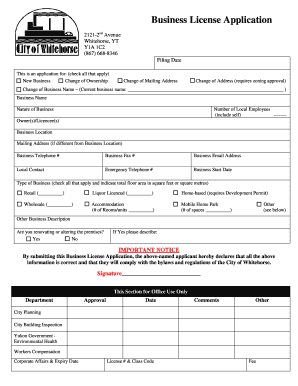

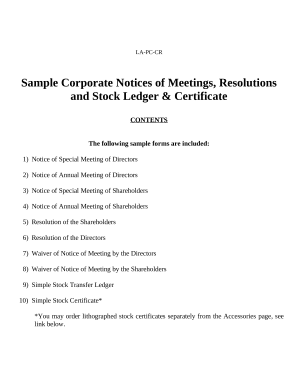

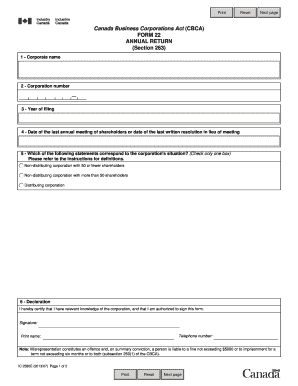

Effortlessly browse Business Canada Forms and manage your documents within your DocHub profile. Simplify your frequent document processes, modify and fill out documents online, and securely share them with others.

Your workflows always benefit when you can obtain all the forms and documents you may need at your fingertips. DocHub supplies a a huge library of form templates to relieve your day-to-day pains. Get hold of Business Canada Forms category and easily discover your document.

Start working with Business Canada Forms in a few clicks:

Enjoy easy file managing with DocHub. Discover our Business Canada Forms category and find your form right now!