Definition and Purpose of the RC1 Form

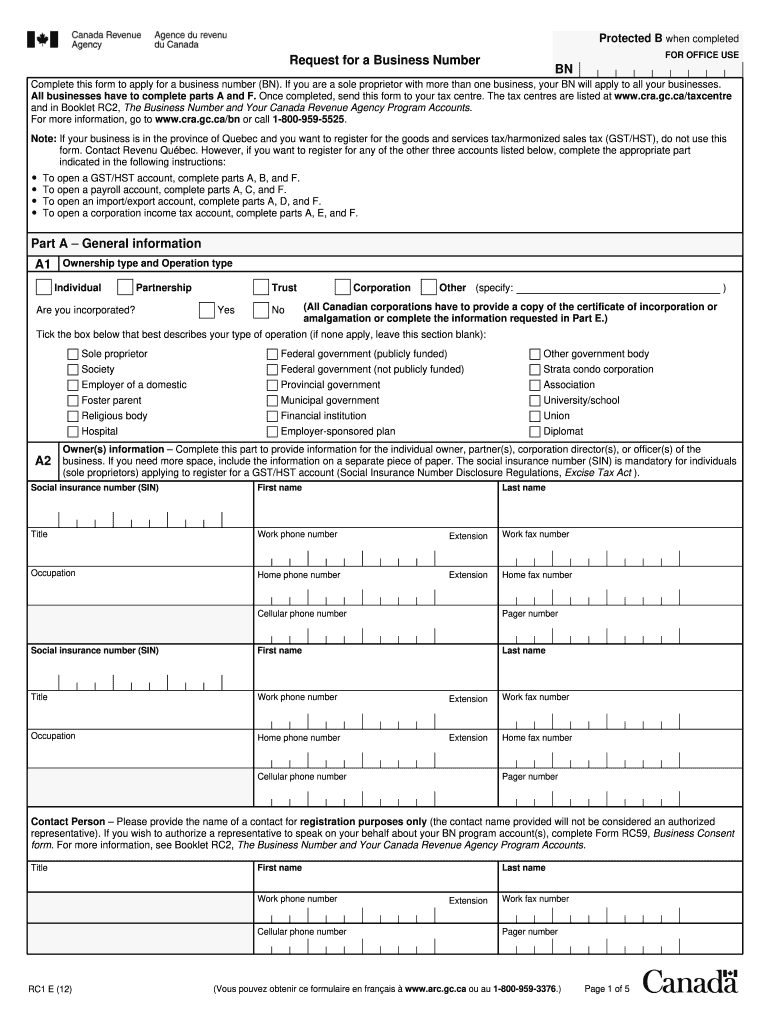

The Canada RC1 form is an essential document used for applying for a Business Number (BN) in Canada. This number is vital for various business operations, such as registering for Goods and Services Tax (GST)/Harmonized Sales Tax (HST), payroll deductions, import/export activities, and corporation income tax accounts. The form is administered by the Canada Revenue Agency (CRA) and serves as an official request for the designation necessary for businesses to conduct operations legally within the country.

The RC1 form captures critical information about the business, including ownership details, major business activities, and contact information. It is designed to streamline the registration process, simplistically guiding individuals and entities through the requirements for formal business registration.

How to Obtain the Canada RC1 Form

Acquiring the Canada RC1 form is straightforward and can be done through several methods.

-

Online Download:

- Visit the Canada Revenue Agency's official website, where the RC1 form is available for download in PDF format.

-

Order by Mail:

- Individuals can also request a physical copy of the RC1 form through the CRA by phone or mail.

-

Tax Professionals:

- Engaging with accountants or tax service providers can also ensure that you receive the correct form and guidance on its completion.

This ease of access facilitates timely business registration, ensuring compliance with Canadian business regulations.

Steps to Complete the RC1 Form

Completing the Canada RC1 form requires several steps to ensure all required information is accurately filled out. Here’s a breakdown of the process:

-

Identify the Type of Business:

- Determine if you are registering as a sole proprietor, partnership, corporation, or other business entity types.

-

Provide Ownership Information:

- Include personal information for all owners, such as name, address, and date of birth.

-

Detail Your Business Activities:

- Clearly describe the nature of your business activities. This may include services offered, products sold, or intended operational scope.

-

Choose the Taxation Options:

- Decide whether you will be registering for GST/HST, payroll, or corporate income taxes, as applicable.

-

Submit the Form:

- After accurately completing the RC1 form, it can be submitted through the CRA’s online services, or you can mail it to the provided address.

-

Await Confirmation:

- After submission, you will receive a confirmation from the CRA, which will provide your Business Number.

Following these steps carefully can prevent common mistakes and ensue a smooth registration process.

Key Elements of the RC1 Form

Understanding the key elements of the RC1 form is crucial for accurate completion:

-

Identification Section:

- This section requires detailed identification of the business owners or authorized representatives.

-

Business Description:

- Clear articulation of the primary business activities is essential for accurate classification by the CRA.

-

Choice of Business Structure:

- Options in this section determine how the business will be taxed, which affects overall operations and compliance responsibilities.

-

Contact Information:

- Accurate contact details are necessary for the CRA to communicate any important updates or requests.

Each section should be filled out with precision, as incorrect or incomplete information may lead to delays or complications in the business registration process.

Important Terms Related to the RC1 Form

Familiarizing yourself with specific terminology related to the RC1 form can facilitate a smoother application process:

- Business Number (BN): A unique identifier assigned by the CRA for tax purposes.

- Goods and Services Tax (GST): A federal tax applied to most goods and services sold in Canada.

- Harmonized Sales Tax (HST): A combination of federal and provincial sales taxes that apply in certain jurisdictions.

- Sole Proprietorship: A business structure where one individual operates the business and is personally responsible for its debts.

- Partnership: A business arrangement where two or more individuals manage and operate a business together.

- Corporation: A legal entity separate from its owners, designed for business activities.

Understanding these terms is essential for navigating the requirements and implications of the Canada RC1 form.

Common Use Cases for the RC1 Form

The RC1 form is predominantly used in various scenarios, including:

- New Business Startups: Entrepreneurs initiating new business ventures require a BN for compliance from the outset.

- Businesses Expanding Operations: Existing businesses may need to register for additional tax accounts if they diversify their operations.

- Specific Tax Elections: Businesses registering for the first time may elect to collect GST/HST, necessitating the completion of the RC1 form.

By recognizing these common use cases, applicants can better understand how the RC1 form applies to their specific business circumstances.

Filing Deadlines and Important Dates

Understanding filing deadlines is crucial for maintaining compliance with CRA regulations. Typically, business registration should occur prior to commencing business operations or collecting taxes.

- New Registrations: New businesses must file the RC1 form promptly to avoid delays in obtaining their Business Number.

- GST/HST Registration: Businesses that expect to surpass the small supplier threshold must register for GST/HST within the specified timelines to avoid penalties.

- Payroll Registration: For those intending to employ individuals, registration for payroll deductions must be completed before the first payroll is run.

Adhering to these deadlines ensures that businesses operate legally and are equipped to manage tax obligations.

Submission Methods for the RC1 Form

The RC1 form can be submitted through multiple avenues, supporting both traditional and digital preferences:

- Online Submission: Utilizing the CRA's online portal is the most efficient method, allowing immediate processing and validation.

- Mail Submission: For those who prefer paper filings, completed forms can be sent via postal service to designated CRA offices.

- In-Person Submission: Certain local CRA offices may accept submissions directly, providing an opportunity for immediate assistance if needed.

Each submission method has its benefits, and choosing the appropriate channel will depend on individual preferences and needs.