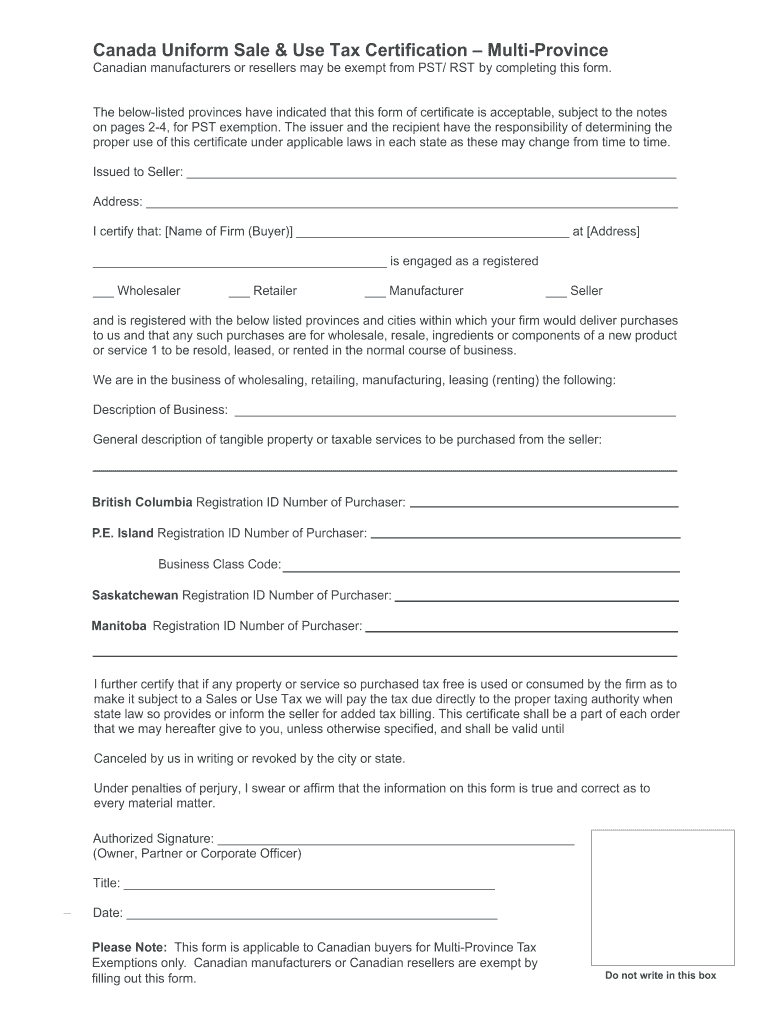

Definition & Meaning of Canada Uniform Sale & Use Tax Certification

The Canada Uniform Sale & Use Tax Certification form allows businesses to claim exemptions from certain sales taxes. This certification is often utilized by manufacturers or resellers who wish to buy goods without paying sales tax, provided they certify their business status. By completing this form, a reseller asserts that they will only use the products purchased for resale, thus qualifying for the exemption. It is crucial for businesses operating in multiple provinces to obtain this certification as it standardizes the process and facilitates compliance with tax regulations.

Importance in Canadian Taxation

The certification holds significant weight in the Canadian tax landscape for several reasons:

- Sales Tax Exemption: It enables businesses to purchase inventory without incurring sales tax, which can significantly lower operational costs.

- Provincial Compliance: The form aids in adhering to provincial sales tax laws, ensuring that businesses are not penalized for tax infractions.

- Verification Process: Issuers and recipients of the certificate have set responsibilities to verify the accuracy of the information provided, thereby maintaining accountability within the certification process.

How to Obtain a Canada Resale Certificate

Obtaining a Canada resale certificate involves a systematic process that can vary by province. Generally, this is how the process unfolds:

-

Determine Eligibility: Ensure that your business qualifies as a reseller. This typically requires a valid business number and proof of sales tax registration.

-

Acquire the Correct Form: The specific form for the Canada Uniform Sale & Use Tax Certification may vary by province. Check provincial revenue websites to obtain the applicable form.

-

Complete the Application: Fill out the application by providing essential business information, including:

- Business name and address

- Registration number

- Nature of goods being purchased

-

Submission: Some provinces allow for electronic submissions, while others may require physical copies sent through the mail.

-

Retention of Records: Keep a copy of the certification on file, as you may need to present it for audits or compliance checks.

Example: Ontario Reseller Certificate

In Ontario, the process may include additional requirements like obtaining a specific Ontario Resale Certificate to facilitate sales tax exemptions on goods sold in the province. Businesses should verify specifics to ensure compliance.

Key Elements of the Canada Uniform Sale & Use Tax Certification

The certification form comprises several key components that are critical for both issuers and recipients:

- Business Information: Complete details must be provided, including the business name, address, and contact information.

- Tax Identification: A legitimate tax identification number should be listed to validate the business's registration.

- Nature of Goods: Clearly specify the types of goods or services intended for resale to justify the exemption.

- Certification Statement: A statement affirming the accuracy of the provided information is a standard requirement, which may involve signatures from authorized personnel.

Responsibilities of Issuers and Recipients

Both the issuer of the certificate and the recipient have defined responsibilities:

- Issuer Responsibility: The issuer must ensure that the business applying for resale is valid and operates under the legally defined purpose for resale.

- Recipient Responsibility: The party receiving the certificate must use the exemption properly and take responsibility for repaying taxes if used incorrectly.

Filing Deadlines & Important Dates

Businesses must be attentive to specific deadlines associated with the Canada Uniform Sale & Use Tax Certification. These deadlines can include:

- Quarterly / Annual Filing Deadlines: Most provinces have set schedules for filing applicable tax documents that align with the certification.

- Registration Renewal: Certain provinces may require renewal of the resale certificate periodically; missing deadlines can result in penalties or revocation of the exemption.

Example: British Columbia

In British Columbia, businesses must be aware of the quarterly filing deadlines related to the Provincial Sales Tax (PST) and how these coincide with resale certificate renewals.

Taxpayer Scenarios and Resale Certificate Utilization

Understanding how different types of taxpayers can utilize the Canada Uniform Sale & Use Tax Certification is crucial:

- Self-Employed Individuals: They may use the certificate to purchase inventory for resale without incurring tax, impacting their overall profitability.

- Limited Liability Companies (LLC): The form allows LLCs to buy merchandise necessary for their operations at a reduced tax rate, enhancing cash flow management.

Specific Scenarios

- A self-employed artist purchasing art supplies intended for resale at public shows may leverage the resale certificate to avoid upfront sales tax costs.

- A retail shop owner stocking seasonal items can use the certificate to preserve margins while managing inventory effectively.

Legal Use of the Canada Uniform Sale & Use Tax Certification

Legally, the use of the Canada Uniform Sale & Use Tax Certification is bound by several principles:

- Compliance with Tax Laws: Misuse of the certificate can lead to legal penalties, including back taxes due and potential fines.

- Issuing the Certificate: Only registered businesses conducting legitimate sales can issue the certificate, and its misuse can jeopardize a business’s tax status.

- Verification Procedures: Businesses must maintain proper documentation and records as part of their tax compliance efforts to validate the use of the resale certificate.

Potential Legal Consequences

For example, if a business claims an exemption but ultimately uses the purchased items for personal use, they may face significant legal repercussions including fines and assessment for unpaid taxes.