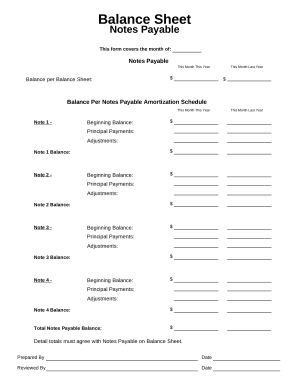

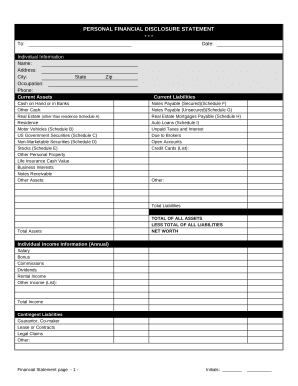

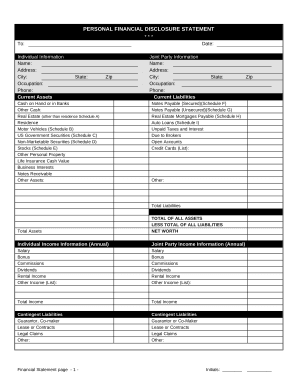

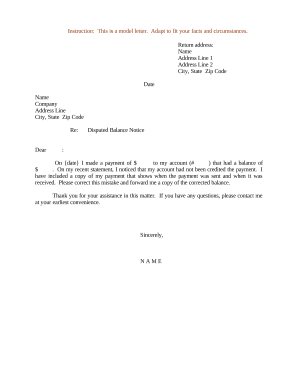

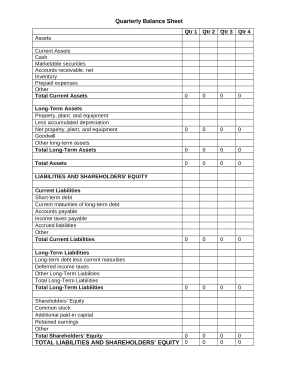

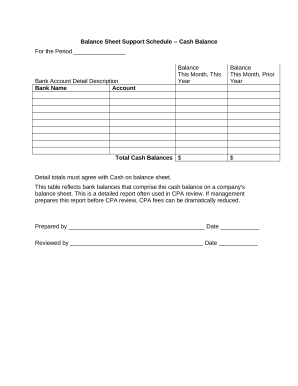

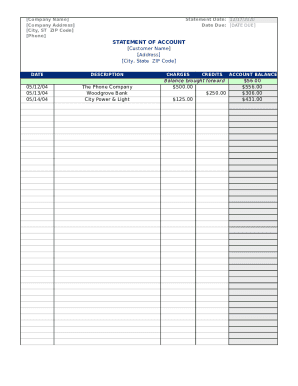

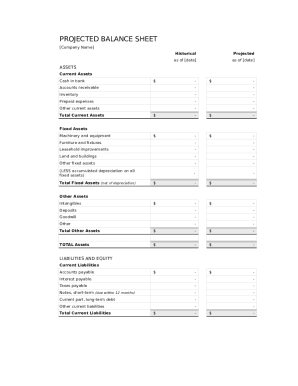

Gain access to The next 3 years Balance Sheet Templates and ensure that your financial reports are transparent, compliant, and correct. Edit, complete, or work together with your team on the form before sharing it.

Document administration can overwhelm you when you can’t find all of the forms you require. Fortunately, with DocHub's considerable form categories, you can get all you need and swiftly manage it without changing among programs. Get our The next 3 years Balance Sheet Templates and start utilizing them.

How to use our The next 3 years Balance Sheet Templates using these easy steps:

Try out DocHub and browse our The next 3 years Balance Sheet Templates category without trouble. Get a free account right now!