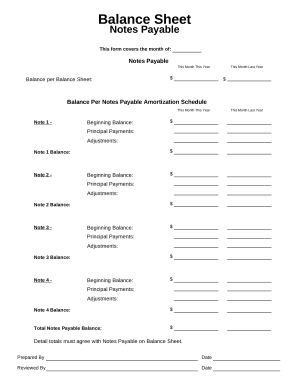

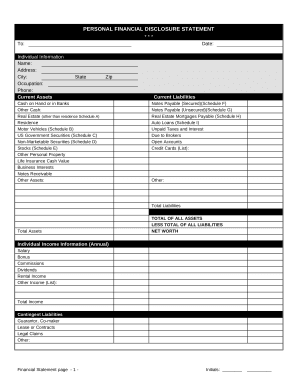

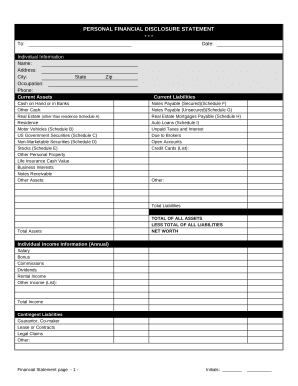

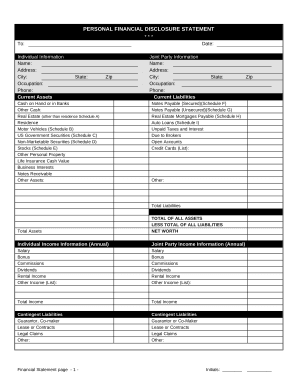

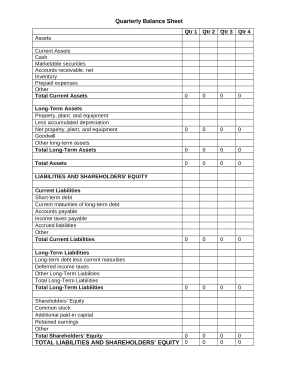

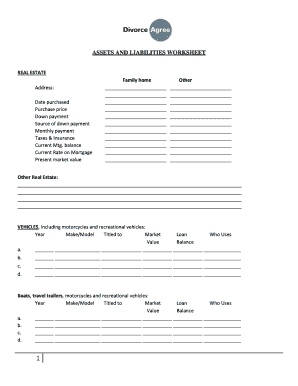

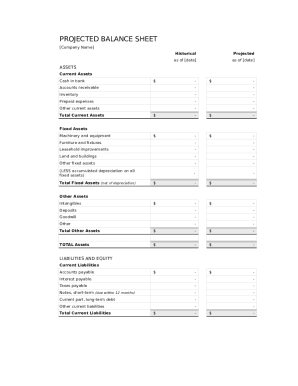

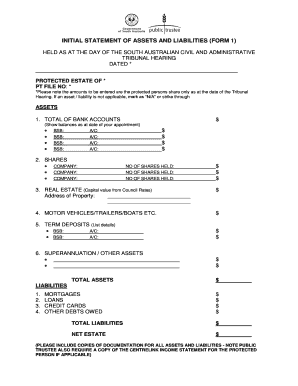

Discover Simple of assets and liabilities Balance Sheet Templates and effortlessly organize them online without switching from your DocHub profile. Edit and customize your financial documents, share them with your collaborators, and securely store complete documents in your profile.

Form management takes up to half of your business hours. With DocHub, it is easy to reclaim your time and effort and enhance your team's productivity. Access Simple of assets and liabilities Balance Sheet Templates online library and discover all document templates relevant to your daily workflows.

Easily use Simple of assets and liabilities Balance Sheet Templates:

Boost your daily file management with the Simple of assets and liabilities Balance Sheet Templates. Get your free DocHub profile today to explore all forms.