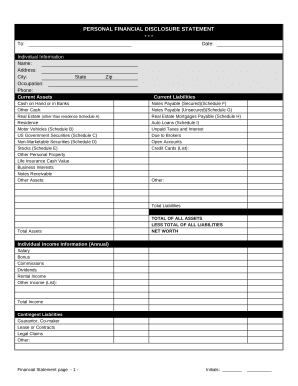

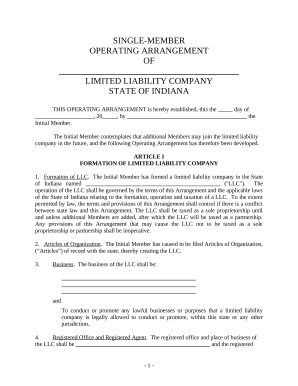

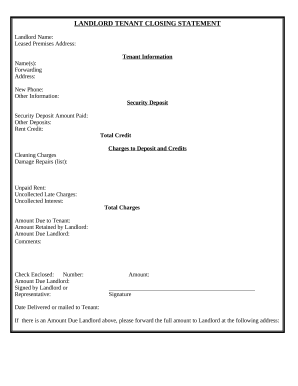

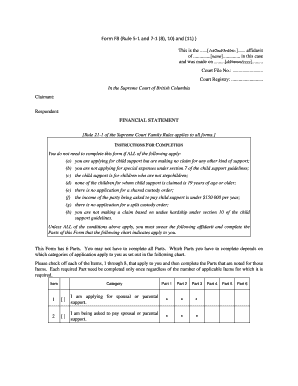

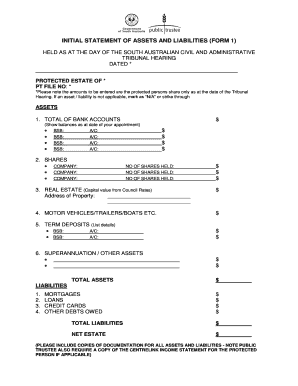

Personalize Multiple year Balance Sheet Templates online with DocHub flexible modification tools. Generate and organize your financial records all in one place without compromising your information and security.

Your workflows always benefit when you are able to get all the forms and documents you may need at your fingertips. DocHub delivers a vast array of document templates to relieve your daily pains. Get hold of Multiple year Balance Sheet Templates category and quickly browse for your document.

Begin working with Multiple year Balance Sheet Templates in a few clicks:

Enjoy fast and easy document administration with DocHub. Discover our Multiple year Balance Sheet Templates online library and get your form right now!