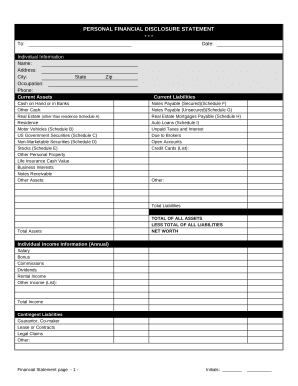

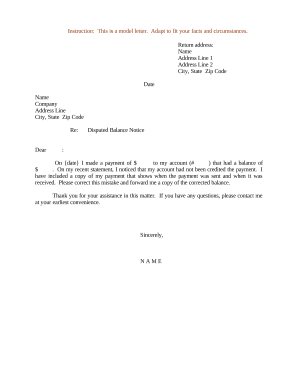

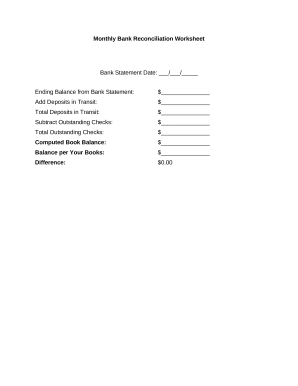

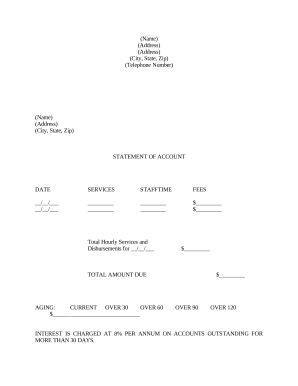

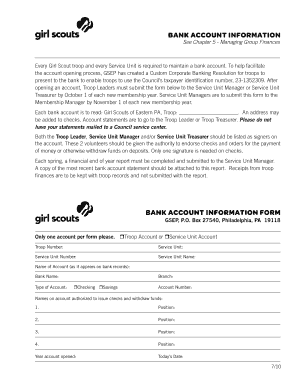

Get the best up-to-date Bank account Balance Sheet Templates with DocHub online library. Personalize and collaborate on your financial statements with your team in real-time without losing important details.

Your workflows always benefit when you are able to locate all of the forms and documents you may need at your fingertips. DocHub supplies a huge selection of form templates to relieve your day-to-day pains. Get hold of Bank account Balance Sheet Templates category and easily discover your form.

Start working with Bank account Balance Sheet Templates in a few clicks:

Enjoy seamless file management with DocHub. Check out our Bank account Balance Sheet Templates online library and locate your form right now!