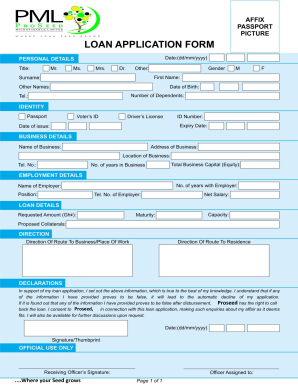

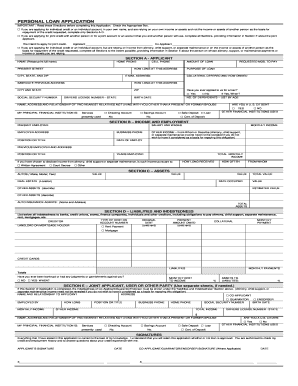

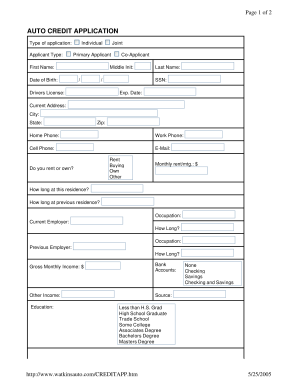

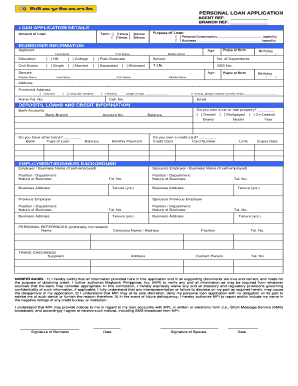

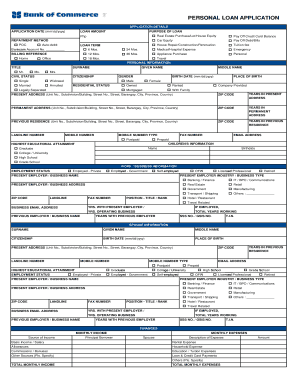

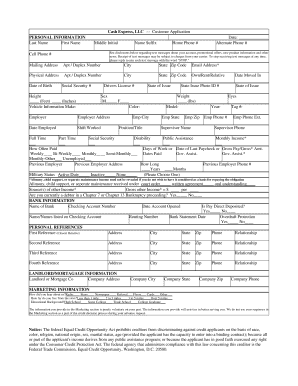

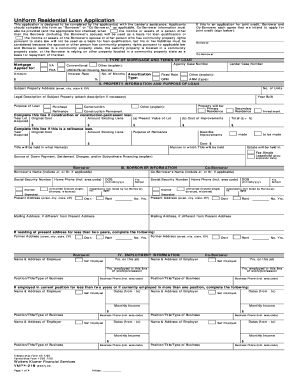

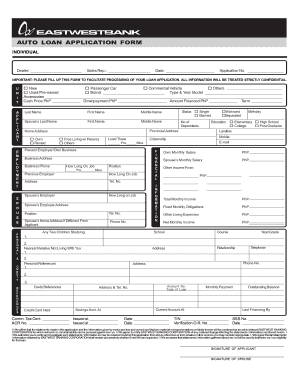

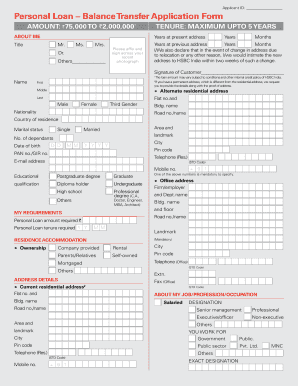

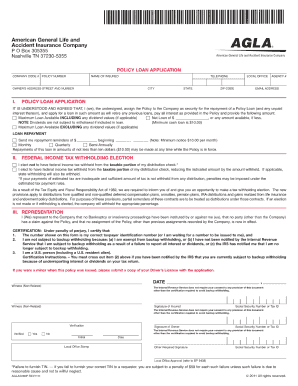

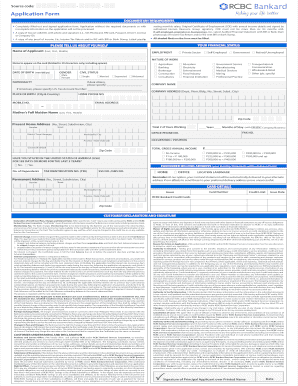

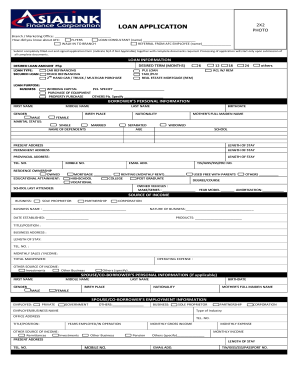

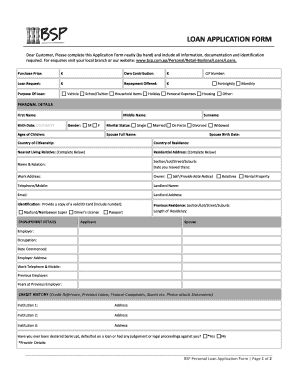

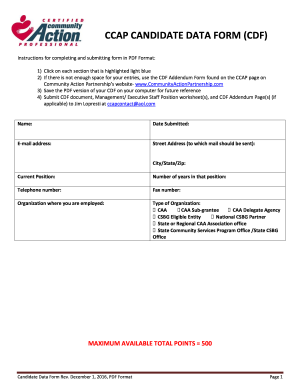

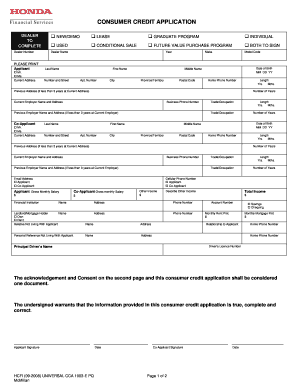

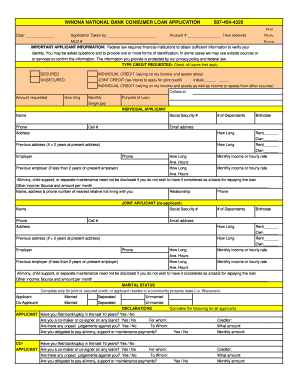

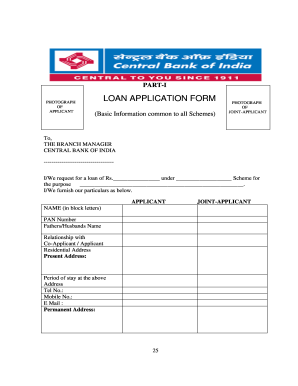

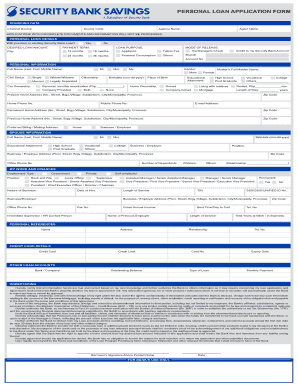

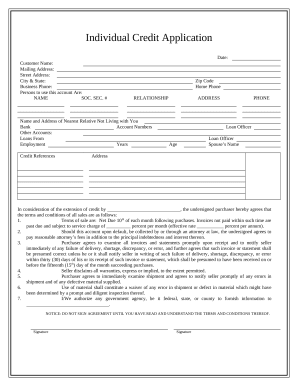

Boost your customer experience with Personal loans Application Forms. get, edit, and provide forms for other collaborators to complete in just a few clicks.

Document management can overpower you when you can’t locate all of the documents you require. Fortunately, with DocHub's vast form collection, you can find all you need and quickly take care of it without the need of switching among software. Get our Personal loans Application Forms and begin utilizing them.

Using our Personal loans Application Forms using these simple steps:

Try out DocHub and browse our Personal loans Application Forms category with ease. Get your free profile today!