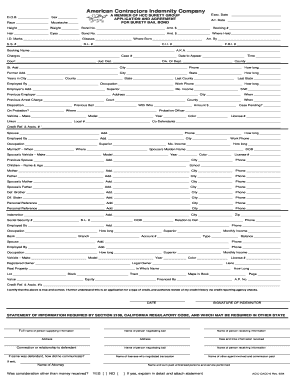

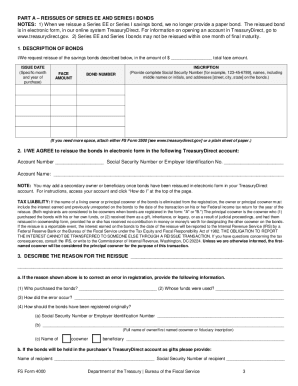

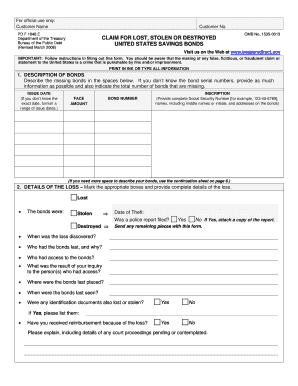

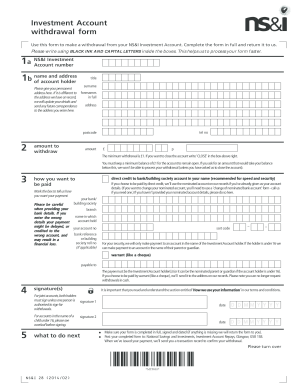

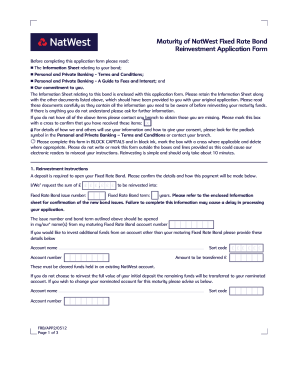

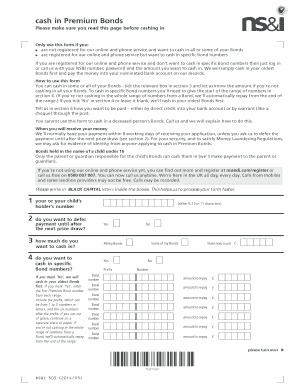

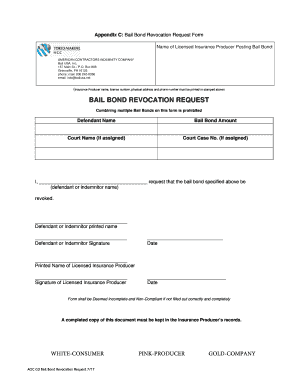

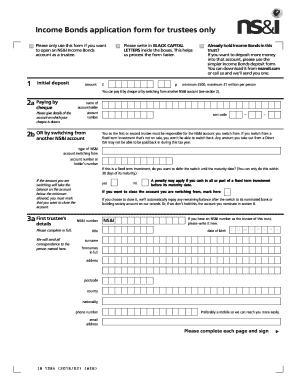

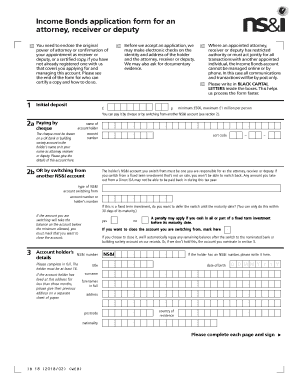

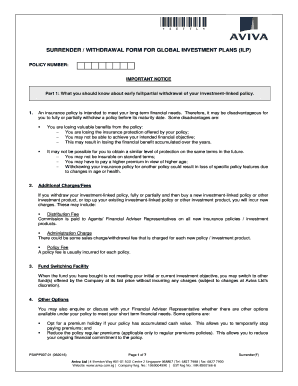

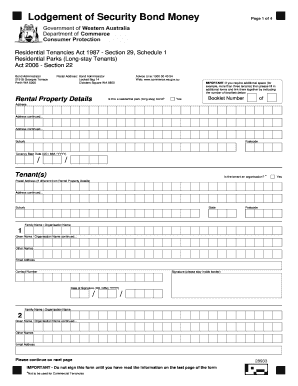

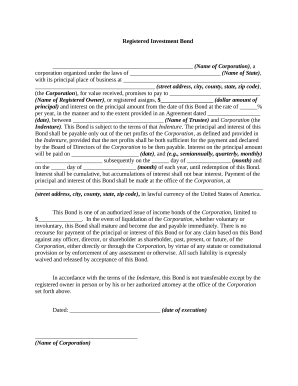

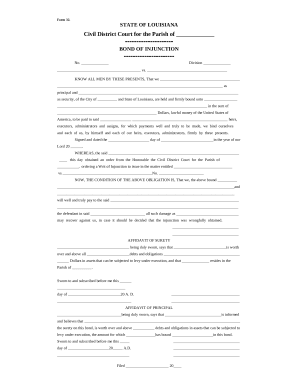

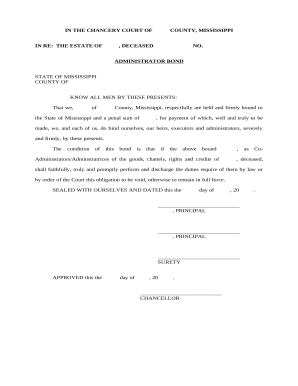

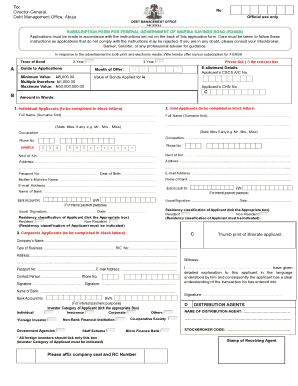

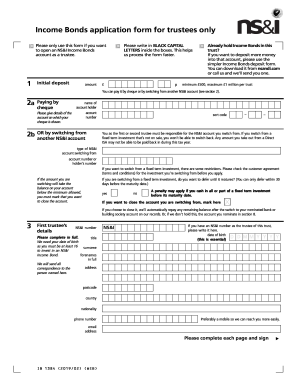

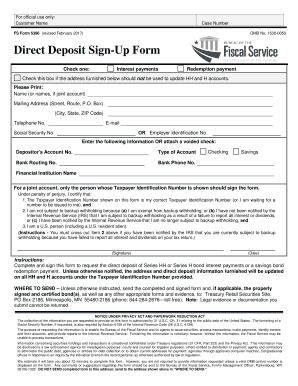

Obtain and retrieve I bond Application Forms to streamline your application submission procedure. Pick from a selection of different ready-made documents and easily edit them in DocHub online editor.

Document management can overpower you when you can’t locate all the documents you need. Fortunately, with DocHub's considerable form collection, you can discover everything you need and easily handle it without the need of switching between apps. Get our I bond Application Forms and start utilizing them.

The best way to manage our I bond Application Forms using these basic steps:

Try out DocHub and browse our I bond Application Forms category easily. Get your free profile today!