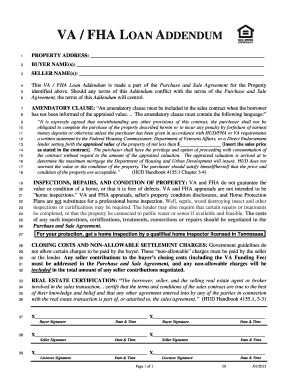

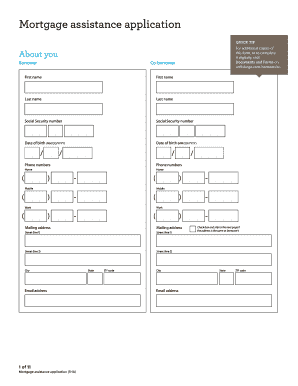

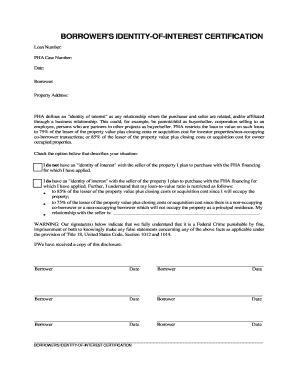

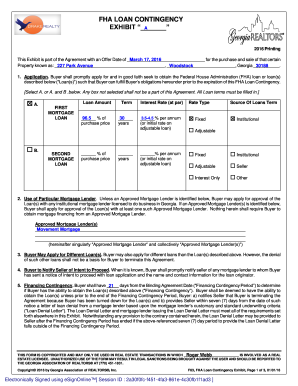

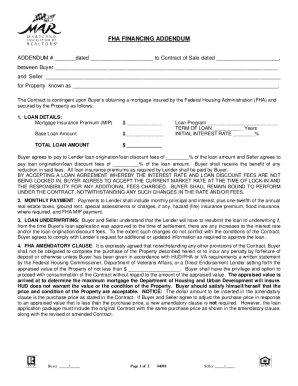

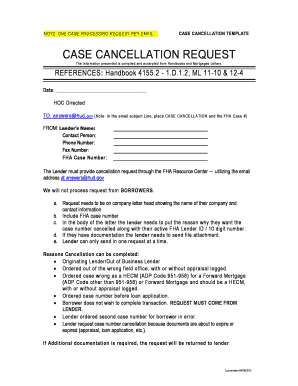

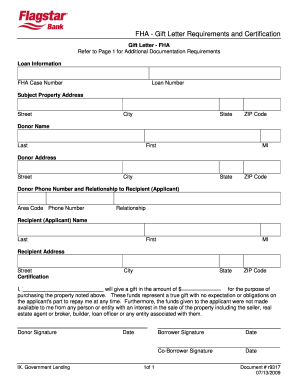

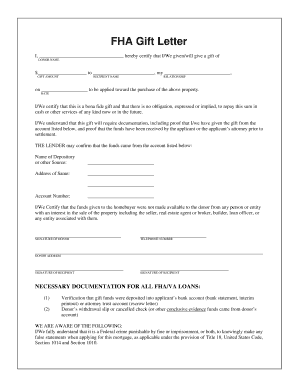

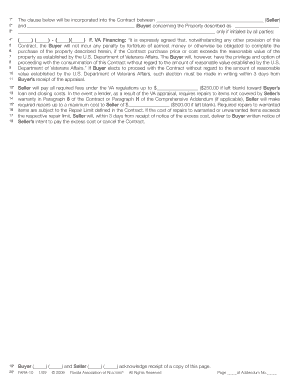

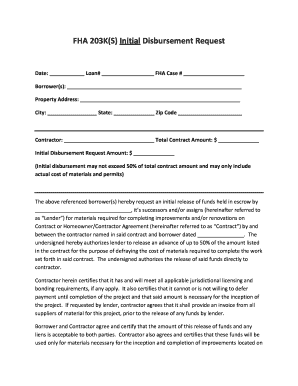

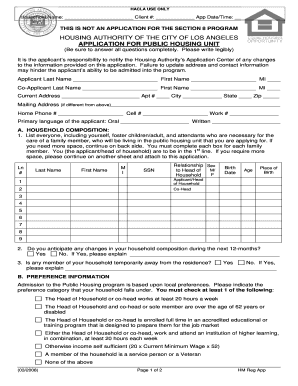

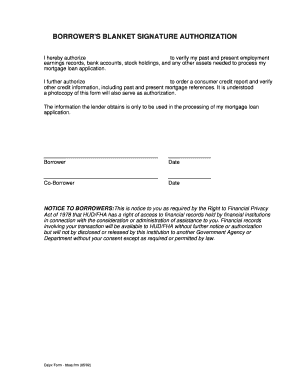

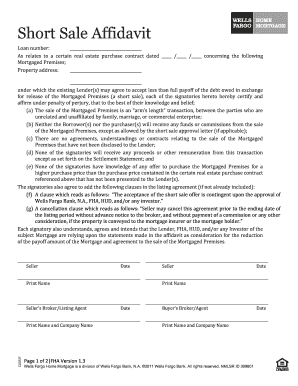

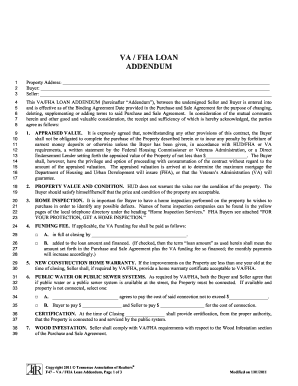

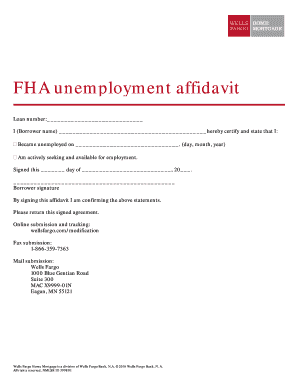

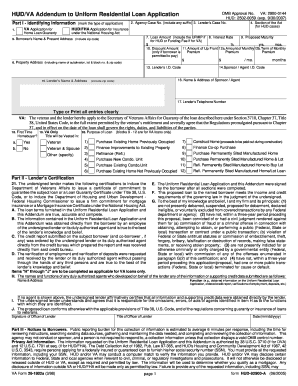

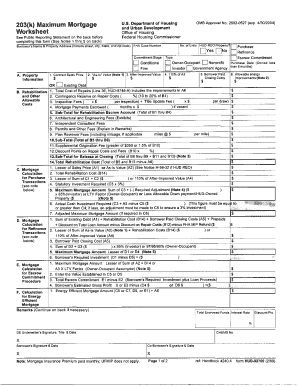

Choose from dozens of ready-made Fha Application Forms documents and enhance your procedures with a few clicks. Obtain, load, and fill out your template wherever you are with DocHub.

Your workflows always benefit when you are able to obtain all the forms and files you will need on hand. DocHub supplies a a large collection templates to relieve your everyday pains. Get a hold of Fha Application Forms category and quickly browse for your document.

Start working with Fha Application Forms in several clicks:

Enjoy effortless form administration with DocHub. Explore our Fha Application Forms online library and discover your form right now!