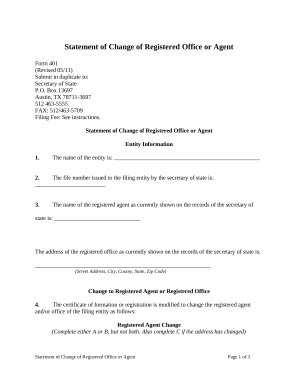

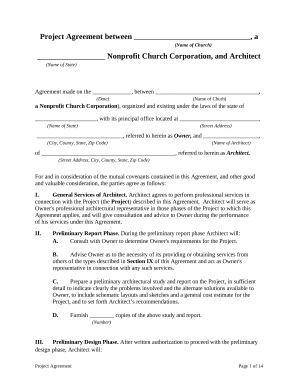

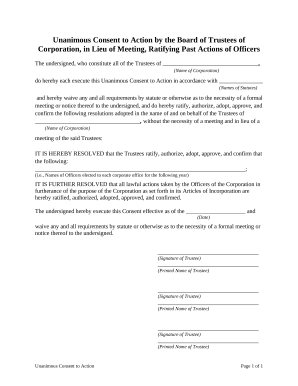

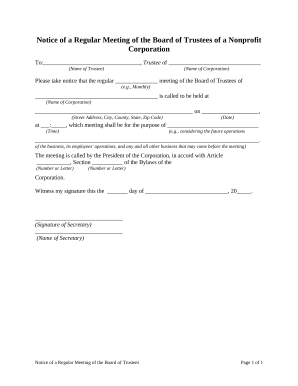

Document managing can overpower you when you can’t discover all the forms you need. Luckily, with DocHub's substantial form categories, you can discover everything you need and easily take care of it without the need of switching between apps. Get our Nonprofit Legal Forms and begin working with them.

Using our Nonprofit Legal Forms using these easy steps:

Try out DocHub and browse our Nonprofit Legal Forms category easily. Get a free account today!