Definition and Purpose of the Colorado Payment Voucher Form

The Colorado Payment Voucher Form, also known as the Colorado Tax Payment Voucher, is a document used by taxpayers to remit payments for their state income tax liabilities. This form serves as a convenient way for individuals and businesses to ensure that their payments are properly credited to their accounts.

- The primary purpose of the voucher is to accompany payments made to the Colorado Department of Revenue.

- It allows taxpayers to indicate their account details, the amount being paid, and the applicable tax year.

- By using a payment voucher, taxpayers can help avoid potential payment misattributions.

How to Obtain the Colorado Payment Voucher Form

Obtaining the Colorado Payment Voucher Form is straightforward. Taxpayers can access it through various channels, ensuring they have the correct version specific to their needs.

- Online Access: The form is available for download from the Colorado Department of Revenue’s official website. It can be printed and filled out manually or completed electronically.

- Physical Copies: Taxpayers can request a physical copy by contacting the Colorado Department of Revenue directly or visiting local government offices.

- Tax Preparation Software: Many tax preparation software programs offer the Colorado Payment Voucher as part of their features, enabling users to complete it as they prepare their tax returns.

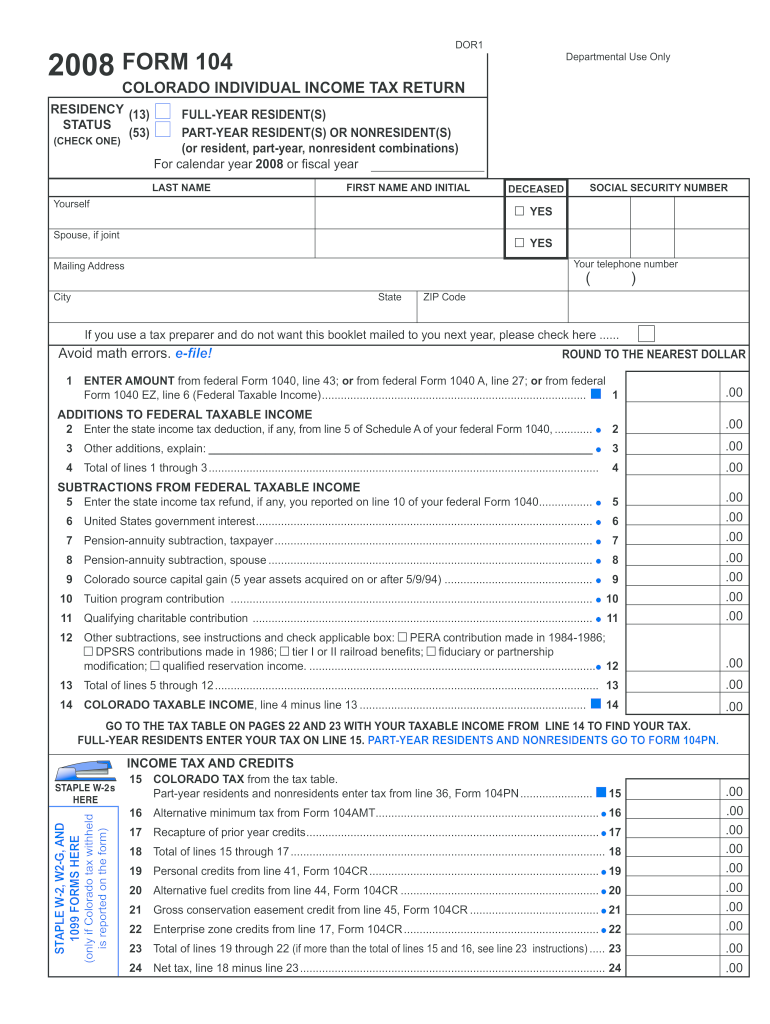

Steps to Complete the Colorado Payment Voucher Form

Completing the Colorado Payment Voucher Form involves several key steps. Following these steps ensures the voucher is filled out accurately for processing.

-

Personal Information:

- Enter your name and Social Security number or Employer Identification Number (EIN).

- Include your mailing address to ensure any correspondence is directed to your location.

-

Payment Details:

- Specify the amount being submitted with the voucher.

- Insert the tax period for which the payment is being made.

-

Signature and Date:

- The form requires your signature to confirm the information is accurate and the payment is intended for the stated tax obligation.

- Date the form to indicate when the payment is being made.

-

Submission Instructions:

- Review the payment methods available—whether mailing the voucher with a check or making an electronic payment.

- Follow any additional instructions specific to your payment method.

By meticulously following these steps, taxpayers can minimize errors and ensure prompt processing of their payments.

Key Elements of the Colorado Payment Voucher Form

Understanding the key elements of the Colorado Payment Voucher Form is essential for effective use and compliance with state tax regulations.

- Identification Section: This includes fields for personal and business identifiers, allowing the state to tie payments to the correct taxpayer.

- Payment Amount: Clearly indicates the payment being made, which is critical for accurate account management.

- Tax Year: Specifies for which tax year the payment is being made, ensuring that the payment is processed against the correct liabilities.

- Signature Line: Authenticates the document, confirming that the taxpayer is aware of and responsible for the payment.

Each of these elements plays a pivotal role in the proper submission and processing of tax payments within Colorado.

Filing Deadlines and Important Dates

Being aware of filing deadlines and important dates associated with the Colorado Payment Voucher Form is critical for effective tax planning and compliance.

- Quarterly Payment Deadlines: Taxpayers making estimated payments should adhere to designated quarterly deadlines, typically due on April 15, June 15, September 15, and January 15 of the following year.

- Annual Filing Deadline: The annual income tax return is usually due on April 15, coinciding with the federal tax deadline.

Missing these deadlines may result in penalties and interest on unpaid balances, making timely submissions essential for avoiding extra costs.

Digital vs. Paper Version of the Colorado Payment Voucher Form

Taxpayers have the option to file their Colorado Payment Voucher Form either digitally or using a paper version, with each method having its advantages and considerations.

-

Digital Version:

- Often more convenient as it allows for quick completion and immediate submission.

- Can be processed faster by the state, leading to quicker payment acknowledgments.

- Reduces the risk of lost paperwork.

-

Paper Version:

- Some taxpayers may prefer physical documents for their records.

- Paper submissions may take longer for processing, which could delay confirmation of payment.

- In some cases, the mail may be less reliable, increasing the risk of delayed or missed payments.

Each taxpayer must evaluate their preferences and resources when choosing between these options, considering their comfort with technology and the resources available to them.